by Calculated Risk on 8/03/2014 12:09:00 PM

Sunday, August 03, 2014

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the July employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 21 | 3,687 |

| 1Eighteen months into 2nd term | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Eighteen months into Mr. Obama's second term, there are now 5,685,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 657,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 21 | 56 |

| 1Seventeen months into 2nd term | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are over at the state and local levels in the aggregate, but it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment in 2014, but nothing like what happened during Reagan's second term.

Saturday, August 02, 2014

Schedule for Week of August 3rd

by Calculated Risk on 8/02/2014 01:01:00 PM

This will be a very light week for economic data.

Early: Black Knight Mortgage Monitor report for June.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a reading of 56.5, up from 56.0 in June. Note: Above 50 indicates expansion.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is for a 0.6% increase in June orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. Imports decreased and exports increased in May.

The consensus is for the U.S. trade deficit to be at $45.0 billion in June from $44.4 billion in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 302 thousand.

Early: Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $18.3 billion.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for a 0.6% increase in inventories.

Unofficial Problem Bank list declines to 451 Institutions

by Calculated Risk on 8/02/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 1, 2014.

Changes and comments from surferdude808:

Actions by the Federal Reserve were responsible for the two changes to the Unofficial Problem Bank List this week. There was one removal lowering the list count to 451 institutions with assets of $145.7 billion. A year ago, the list held 726 institutions with assets of $260.9 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 451.

The Federal Reserve terminated the Written Agreement against Peoples Bank & Trust Co., Troy, MO ($424 million) and they issued a Prompt Corrective Action order against Premier Bank, Denver, CO ($44 million), which has been under a Written Agreement since April 2010.

We expect few changes to the list over the next week and it will not be until August 15th until the OCC provides an update on its enforcement action activity.

Friday, August 01, 2014

Lawler: More Builder Results and Summary Table

by Calculated Risk on 8/01/2014 08:26:00 PM

From housing economist Tom Lawler:

The Ryland Group reported that net home orders in the quarter ended June 30, 2014 totaled 2,228, up 1.7% from the comparable quarter of 2013. Sales per community last quarter were down 13.8% from a year ago. Home deliveries last quarter totaled 1,700, up 2.5% from the comparable quarter of 2013, at an average sales price of $333,000, up 15.0% from last year. The company’s order backlog at the end of June was 3,860, up 5.5% from last June, at an average order price of $336,000, up 11.3% from a year ago. Ryland owned or controlled 40,966 lots at the end of June, up 11.5% from last June and up 58.3% from two years ago. The company said that concessions averaged 6.7% of sales prices last quarter, down from 7.3% a year earlier but up from 6.4% in the previous quarter.

Beazer Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,290, down 6.6% from the comparable quarter of 2013. Sales per community were off 3.9% from a year ago. Home deliveries totaled 1,241 last quarter, up 0.6% from the comparable quarter of 2013, at an average sales price of $284,600, up 12.1% from a year ago. The company’s order backlog at the end of June was 2,212, down 6.2% from last June. Beazer owned or controlled 29,783 lots at the end of June, up 10.4% from last June and up 18.7% from two years ago.

Standard Pacific Corporation reported that net home orders in the quarter ended June 30, 2014 totaled 1,524, up 0.5% from the comparable quarter of 2013. Sales per community were down 9.9% from a year ago. Home deliveries last quarter totaled 1,236, up 12.9% from the comparable quarter of 2013, at an average sales price of $479,000, up 20.7% from a year ago. The company’s order backlog at the end of June was 2,304, up 1.4% from the comparable quarter of 2013. The company owned or controlled 35,948 lots at the end of June, up 30.7% from last June and up 68.2% from two years ago.

Below are some summary stats for nine large publicly-traded home builders. Net home orders per community for these combined home builders were unchanged from a year ago.

Last week Census estimated that new SF home sales last quarter were down about 6% from the comparable quarter of 2013 (not seasonally adjusted). Comparing large builder orders to Census data can be tricky, as (1) Census treats sales cancellations differently from reported builder numbers; (2) there appears to be a difference in the timing of the recognition of a “sale;” and (3) market shares can change. Normally the above large builder results would lead me to conclude that there is a good chance Census will revise its home sales estimates for last quarter upward in the next report. Given D.R. Horton’s move last quarter to increase its sales pace by materially increasing sales incentives in many markets, however, it seems likely that the overall market share of these builders increased last quarter. (In addition, Horton’s orders last quarter were boosted by about 290 from an acquisition.). As a result, it’s not clear if the builder results below point to a likely upward revision in Census sales numbers.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg |

| D.R. Horton | 8,551 | 6,822 | 25.3% | 7,676 | 6,464 | 18.8% | $272,316 | 252,290 | 7.9% |

| PulteGroup | 4,778 | 4,885 | -2.2% | 3,798 | 4,152 | -8.5% | $328,000 | 294,000 | 11.6% |

| NVR | 3,415 | 3,278 | 4.2% | 2,943 | 2,878 | 2.3% | $368,200 | 344,700 | 6.8% |

| The Ryland Group | 2,228 | 2,191 | 1.7% | 1,700 | 1,659 | 2.5% | $333,000 | 287,000 | 16.0% |

| Beazer Homes | 1,290 | 1,381 | -6.6% | 1,241 | 1,234 | 0.6% | $284,600 | 253,800 | 12.1% |

| Standard Pacific | 1,524 | 1,516 | 0.5% | 1,236 | 1,095 | 12.9% | $479,000 | 397,000 | 20.7% |

| Meritage Homes | 1,647 | 1,637 | 0.6% | 1,368 | 1,321 | 3.6% | $368,000 | 330,000 | 11.5% |

| MDC Holdings | 1,419 | 1,351 | 5.0% | 1,158 | 1,183 | -2.1% | $372,000 | 338,400 | 9.9% |

| M/I Homes | 1,016 | 1,078 | -5.8% | 894 | 788 | 13.5% | $306,000 | 281,000 | 8.9% |

| Total | 25,868 | 24,139 | 7.2% | 22,014 | 20,774 | 6.0% | $324,282 | $294,852 | 10.0% |

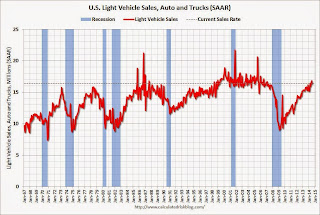

U.S. Light Vehicle Sales decline to 16.4 million annual rate in July

by Calculated Risk on 8/01/2014 02:45:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.4 million SAAR in July. That is up 5% from July 2013, and down 2.5% from the 16.9 million annual sales rate last month.

This was below the consensus forecast of 16.7 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.4 million SAAR from WardsAuto).

Note: AutoData estimates sales at 16.48 million SAAR for July.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery - although sales growth will slow this year.

Sales have average close to 16.5 million over the last five months following a weak winter due to severe weather.