by Calculated Risk on 8/01/2014 08:26:00 PM

Friday, August 01, 2014

Lawler: More Builder Results and Summary Table

From housing economist Tom Lawler:

The Ryland Group reported that net home orders in the quarter ended June 30, 2014 totaled 2,228, up 1.7% from the comparable quarter of 2013. Sales per community last quarter were down 13.8% from a year ago. Home deliveries last quarter totaled 1,700, up 2.5% from the comparable quarter of 2013, at an average sales price of $333,000, up 15.0% from last year. The company’s order backlog at the end of June was 3,860, up 5.5% from last June, at an average order price of $336,000, up 11.3% from a year ago. Ryland owned or controlled 40,966 lots at the end of June, up 11.5% from last June and up 58.3% from two years ago. The company said that concessions averaged 6.7% of sales prices last quarter, down from 7.3% a year earlier but up from 6.4% in the previous quarter.

Beazer Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,290, down 6.6% from the comparable quarter of 2013. Sales per community were off 3.9% from a year ago. Home deliveries totaled 1,241 last quarter, up 0.6% from the comparable quarter of 2013, at an average sales price of $284,600, up 12.1% from a year ago. The company’s order backlog at the end of June was 2,212, down 6.2% from last June. Beazer owned or controlled 29,783 lots at the end of June, up 10.4% from last June and up 18.7% from two years ago.

Standard Pacific Corporation reported that net home orders in the quarter ended June 30, 2014 totaled 1,524, up 0.5% from the comparable quarter of 2013. Sales per community were down 9.9% from a year ago. Home deliveries last quarter totaled 1,236, up 12.9% from the comparable quarter of 2013, at an average sales price of $479,000, up 20.7% from a year ago. The company’s order backlog at the end of June was 2,304, up 1.4% from the comparable quarter of 2013. The company owned or controlled 35,948 lots at the end of June, up 30.7% from last June and up 68.2% from two years ago.

Below are some summary stats for nine large publicly-traded home builders. Net home orders per community for these combined home builders were unchanged from a year ago.

Last week Census estimated that new SF home sales last quarter were down about 6% from the comparable quarter of 2013 (not seasonally adjusted). Comparing large builder orders to Census data can be tricky, as (1) Census treats sales cancellations differently from reported builder numbers; (2) there appears to be a difference in the timing of the recognition of a “sale;” and (3) market shares can change. Normally the above large builder results would lead me to conclude that there is a good chance Census will revise its home sales estimates for last quarter upward in the next report. Given D.R. Horton’s move last quarter to increase its sales pace by materially increasing sales incentives in many markets, however, it seems likely that the overall market share of these builders increased last quarter. (In addition, Horton’s orders last quarter were boosted by about 290 from an acquisition.). As a result, it’s not clear if the builder results below point to a likely upward revision in Census sales numbers.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg |

| D.R. Horton | 8,551 | 6,822 | 25.3% | 7,676 | 6,464 | 18.8% | $272,316 | 252,290 | 7.9% |

| PulteGroup | 4,778 | 4,885 | -2.2% | 3,798 | 4,152 | -8.5% | $328,000 | 294,000 | 11.6% |

| NVR | 3,415 | 3,278 | 4.2% | 2,943 | 2,878 | 2.3% | $368,200 | 344,700 | 6.8% |

| The Ryland Group | 2,228 | 2,191 | 1.7% | 1,700 | 1,659 | 2.5% | $333,000 | 287,000 | 16.0% |

| Beazer Homes | 1,290 | 1,381 | -6.6% | 1,241 | 1,234 | 0.6% | $284,600 | 253,800 | 12.1% |

| Standard Pacific | 1,524 | 1,516 | 0.5% | 1,236 | 1,095 | 12.9% | $479,000 | 397,000 | 20.7% |

| Meritage Homes | 1,647 | 1,637 | 0.6% | 1,368 | 1,321 | 3.6% | $368,000 | 330,000 | 11.5% |

| MDC Holdings | 1,419 | 1,351 | 5.0% | 1,158 | 1,183 | -2.1% | $372,000 | 338,400 | 9.9% |

| M/I Homes | 1,016 | 1,078 | -5.8% | 894 | 788 | 13.5% | $306,000 | 281,000 | 8.9% |

| Total | 25,868 | 24,139 | 7.2% | 22,014 | 20,774 | 6.0% | $324,282 | $294,852 | 10.0% |

U.S. Light Vehicle Sales decline to 16.4 million annual rate in July

by Calculated Risk on 8/01/2014 02:45:00 PM

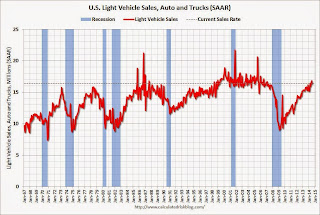

Based on an WardsAuto estimate, light vehicle sales were at a 16.4 million SAAR in July. That is up 5% from July 2013, and down 2.5% from the 16.9 million annual sales rate last month.

This was below the consensus forecast of 16.7 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.4 million SAAR from WardsAuto).

Note: AutoData estimates sales at 16.48 million SAAR for July.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery - although sales growth will slow this year.

Sales have average close to 16.5 million over the last five months following a weak winter due to severe weather.

Construction Spending decreased in June

by Calculated Risk on 8/01/2014 02:19:00 PM

Earlier the Census Bureau reported that overall construction spending decreased in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2014 was estimated at a seasonally adjusted annual rate of $950.2 billion, 1.8 percent below the revised May estimate of $967.8 billion. The June figure is 5.5 percent above the June 2013 estimate of $900.3 billion.Both private and public spending declined in June:

Spending on private construction was at a seasonally adjusted annual rate of $685.5 billion, 1.0 percent below the revised May estimate of $692.0 billion. Residential construction was at a seasonally adjusted annual rate of $355.9 billion in June, 0.3 percent below the revised May estimate of $357.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $329.5 billion in June, 1.6 percent below the revised May estimate of $335.0 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $264.7 billion, 4.0 percent below the revised May estimate of $275.7 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 47% below the peak in early 2006, and up 56% from the post-bubble low.

Non-residential spending is 20% below the peak in January 2008, and up about 46% from the recent low.

Public construction spending is now 19% below the peak in March 2009 and about 1.6% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 7%. Non-residential spending is up 11% year-over-year. Public spending is down 3% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom.

Comments on Employment Report

by Calculated Risk on 8/01/2014 11:04:00 AM

Earlier: July Employment Report: 209,000 Jobs, 6.2% Unemployment Rate

A few key points:

• At the current pace (through July), the economy will add 2.75 million jobs this year (2.64 million private sector jobs). Right now 2014 is on pace to be the best year for both total and private job growth since 1999.

• Wage growth is still subdued, from the BLS: "In July, average hourly earnings for all employees on private nonfarm payrolls edged up by 1 cent to $24.45. Over the past 12 months, average hourly earnings have risen by 2.0 percent."

• Inflation is not a concern this year. The BEA reported this morning that the PCE price index is up 1.6% year-over-year, and core PCE prices are up 1.5%.

• With the unemployment rate at 6.2%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but currently with low inflation and little wage pressure, the Fed can and will be patient.

A few numbers:

Total employment increased 209,000 from June to July, and is now 639,000 above the previous peak. Total employment is up 9.349 million from the employment recession low.

Private payroll employment increased 198,000 from June to July, and private employment is now 1,105,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 9.895 million from the low.

Through the first seven months of 2014, the economy has added 1,609,000 payroll jobs - up from 1,370,000 added during the same period in 2013 - even with the severe weather early this year. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. I might have been too low!

Overall this was another solid employment report.

Employment-Population Ratio, 25 to 54 years old

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate declined recently due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate has mostly moved sideways (with a downward drift started around '00) - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in July to 80.8%, and the 25 to 54 employment population ratio decreased to 76.6% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase - although the participation rate has been trending down for this group since the '90s.

Year-over-year Change in Employment

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.

In July, the year-over-year change was 2.570 million jobs, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 7.5 million, was unchanged in July. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased slightly in July to 7.511 million from 7.544 million in June. This suggests significantly slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that increased to 12.2% in July from 12.1% in June.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.155 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 3.081 in June. This is generally trending down, but is still very high.

Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In July 2014, state and local governments added 11,000 jobs. State and local government employment is now up 151,000 from the bottom, but still 593,000 below the peak.

It is pretty clear that state and local employment is now increasing. Federal government layoffs have slowed (unchanged in July), but Federal employment is still down 22,000 for the year.

ISM Manufacturing index increased in July to 57.1

by Calculated Risk on 8/01/2014 10:00:00 AM

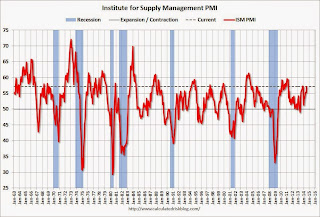

The ISM manufacturing index suggests faster expansion in July than in June. The PMI was at 57.1% in July, up from 55.3% in June. The employment index was at 58.2%, up from 52.8% in June, and the new orders index was at 63.4%, up from 58.9% in June.

From the Institute for Supply Management: July 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July for the 14th consecutive month, and the overall economy grew for the 62nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The July PMI® registered 57.1 percent, an increase of 1.8 percentage points from June's reading of 55.3 percent, indicating expansion in manufacturing for the 14th consecutive month. The New Orders Index registered 63.4 percent, an increase of 4.5 percentage points from the 58.9 percent reading in June, indicating growth in new orders for the 14th consecutive month. The Production Index registered 61.2 percent, 1.2 percentage points above the June reading of 60 percent. Employment grew for the 13th consecutive month, registering 58.2 percent, an increase of 5.4 percentage points over the June reading of 52.8 percent. Inventories of raw materials registered 48.5 percent, a decrease of 4.5 percentage points from the June reading of 53 percent, contracting after five months of consecutive growth. Comments from the panel are generally positive, while some indicate concern over global geopolitical situations."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was just solidly above expectations of 55.9%. The employment and new orders indexes were strong.