by Calculated Risk on 8/01/2014 10:00:00 AM

Friday, August 01, 2014

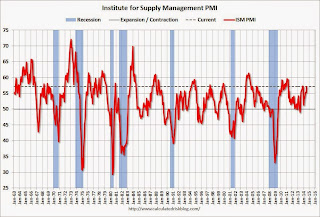

ISM Manufacturing index increased in July to 57.1

The ISM manufacturing index suggests faster expansion in July than in June. The PMI was at 57.1% in July, up from 55.3% in June. The employment index was at 58.2%, up from 52.8% in June, and the new orders index was at 63.4%, up from 58.9% in June.

From the Institute for Supply Management: July 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July for the 14th consecutive month, and the overall economy grew for the 62nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The July PMI® registered 57.1 percent, an increase of 1.8 percentage points from June's reading of 55.3 percent, indicating expansion in manufacturing for the 14th consecutive month. The New Orders Index registered 63.4 percent, an increase of 4.5 percentage points from the 58.9 percent reading in June, indicating growth in new orders for the 14th consecutive month. The Production Index registered 61.2 percent, 1.2 percentage points above the June reading of 60 percent. Employment grew for the 13th consecutive month, registering 58.2 percent, an increase of 5.4 percentage points over the June reading of 52.8 percent. Inventories of raw materials registered 48.5 percent, a decrease of 4.5 percentage points from the June reading of 53 percent, contracting after five months of consecutive growth. Comments from the panel are generally positive, while some indicate concern over global geopolitical situations."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was just solidly above expectations of 55.9%. The employment and new orders indexes were strong.

Final July Consumer Sentiment at 81.8

by Calculated Risk on 8/01/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for July was at 81.8, down from 82.5 in June, and up from the preliminary July reading of 81.3.

This was close to the consensus forecast of 81.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

July Employment Report: 209,000 Jobs, 6.2% Unemployment Rate

by Calculated Risk on 8/01/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 209,000 in July, and the unemployment rate was little changed at 6.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for May was revised from +224,000 to +229,000, and the change for June was revised from +288,000 to +298,000. With these revisions, employment gains in May and June were 15,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This was the sixth month in a row with more than 200 thousand jobs added, and employment is now up 2.57 million year-over-year.

Total employment is now 639 thousand above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was increased in July to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate increased in July to 6.2%.

Although below expectations, this was another solid employment report - including the positive revisions to prior months. 2014 is on pace to be the best year for employment gains since 1999.

I'll have much more later ...

Thursday, July 31, 2014

Friday: Jobs, Autos, ISM Manufacturing and More

by Calculated Risk on 7/31/2014 09:06:00 PM

From Goldman Sachs economist Sven Jari Stehn: July Payroll Preview

We expect a 235,000 increase in nonfarm payrolls and a one tenth drop in the unemployment rate to 6.0%. As far as payrolls are concerned, our forecast would be a solid gain but at a pace slightly below that seen over the past few months. While a number of labor market indicators improved slightly in July (including jobless claims, the business survey employment components and household job market perceptions), other considerations point to a deceleration in the pace of employment creation (including a slowdown in ADP employment growth, softer online job advertising, higher layoffs and the composition of the June payroll gain).Friday:

• At 8:30 AM ET, the Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to be unchanged at 6.1% in July.

• At 8:30 AM, Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

• All day, Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June. The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since October 2008

by Calculated Risk on 7/31/2014 03:59:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 2.05% from 2.08% in May. The serious delinquency rate is down from 2.77% in June 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in June to 2.07% from 2.10% in May. Freddie's rate is down from 2.79% in June 2013, and is at the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.72 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015 or early 2016.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in 2016.