by Calculated Risk on 7/19/2014 01:11:00 PM

Saturday, July 19, 2014

Schedule for Week of July 20th

The key reports this week are New and Existing home sales for June.

For manufacturing, the July Richmond and Kansas City Fed surveys will be released.

For prices, CPI will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

8:30 AM: Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

9:00 AM: FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

10:00 AM: New Home Sales for June from the Census Bureau.

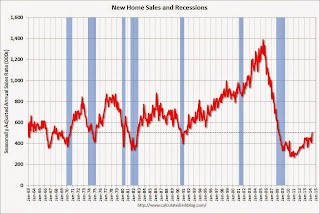

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

Unofficial Problem Bank list declines to 463 Institutions

by Calculated Risk on 7/19/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 18, 2014.

Changes and comments from surferdude808:

Surprisingly there were few changes to the Unofficial Problem Bank List this week given that the OCC released an update of its enforcement action activity this Friday. There were two removals this week that push the list count down to 463 institutions with assets of $147.4 billion. A year ago, the list held 734 institutions with assets of $267.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 463.

Removals this week include the OCC terminating an action against Commerce National Bank & Trust, Winter Park, FL ($77 billion). The other removal was the failed Eastside Commercial Bank, Conyers, GA ($169 million), which was the 13th failure this year. This is the first failure in Georgia since Sunrise Bank failed more than a year ago on May 10, 2013. Still, there have now been an astonishing 88 failures of Georgia-based institutions with aggregate assets of $33.4 billion since the on-set of the Great Recession. So 17.5 percent of the 503 institutions that have failed in this crisis were headquartered in Georgia.

Next week we anticipate the FDIC will provide an update on its enforcement action activity.

Friday, July 18, 2014

Bank Failure #13 in 2014: Eastside Commercial Bank, Conyers, Georgia

by Calculated Risk on 7/18/2014 05:17:00 PM

From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of Eastside Commercial Bank, Conyers, Georgia

As of March 31, 2014, Eastside Commercial Bank had approximately $169.0 million in total assets and $161.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... Eastside Commercial Bank is the 13th FDIC-insured institution to fail in the nation this year, and the first in Georgia.There hasn't been a failure in Georgia since May 2013, but this is the 88th failure in Georgia since the crisis started - the most of any state.

The Recovery for U.S. Heavy Truck Sales

by Calculated Risk on 7/18/2014 01:52:00 PM

Just a quick graph ... heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR) from a peak of 555 thousand in February 2006.

Sales were above 382 thousand (SAAR) in June (after increasing to over 400 thousand SAAR in April for the first time since 2007).

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

The recovery for heavy truck has slowed, but as construction for both residential and commercial picks up, heavy truck sales will probably increase further.

BLS: No State with Unemployment Rate at or above 8% in June, First Time since mid-2008

by Calculated Risk on 7/18/2014 10:45:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in June. Twenty-two states and the District of Columbia had unemployment rate decreases from May, 14 states had increases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi and Rhode Island had the highest unemployment rates among the states in June, 7.9 percent each. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Rhode Island and Mississippi had the highest unemployment rates in June at 7.9%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).For the first time since mid-2008, no state has an unemployment rate at or above 8% (light blue), although 9 states are still at or above 7% (dark blue).