by Calculated Risk on 7/05/2014 05:29:00 PM

Saturday, July 05, 2014

Unofficial Problem Bank list declines to 465 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 3, 2014.

Changes and comments from surferdude808:

Generally a quiet week for the Unofficial Problem Bank List with three removals but none from failure as no one expected the FDIC to close on bank on the July 4th weekend. After the removals, the list count drops to 465 institutions with assets of $147.6 billion. The list is down significantly from a year ago when it included 743 institutions with assets of $271.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 465.

The FDIC terminated the action against Monroe Bank & Trust, Monroe, MI ($1.2 billion Ticker: MBTF). The other two banks removed -- Harrington Bank, FSB, Chapel Hill, NC ($225 million) and Community Bank of San Joaquin, Stockton, CA ($125 million Ticker: BKOT) -- found their way off the list through a merger with a healthier bank.

Next week is expected to see few changes as the OCC likely will not be providing an update on it enforcement actions until July 18th. Enjoy the holiday weekend.

Schedule for Week of July 6th

by Calculated Risk on 7/05/2014 08:37:00 AM

This will be a very light week for economic data.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for June.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In April, the number of job openings (yellow) were up 17% year-over-year compared to April 2013, and Quits were up 11% year-over-year.

3:00 PM: Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $17.5 billion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for the Meeting of June 17-18, 2014.

Early: Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 316 thousand from 315 thousand.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.6% increase in inventories.

At 4:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Financial Sector Reform, At the Martin Feldstein Lecture, hosted by the National Bureau of Economic Research, Cambridge, Massachusetts

2:00 PM ET: The Monthly Treasury Budget Statement for June.

Friday, July 04, 2014

The Kids are Alright: Living in Dorms counted as Living in Parents' Home

by Calculated Risk on 7/04/2014 08:53:00 PM

An interesting point from Derek Thompson at the Atlantic: The Misguided Freakout About Basement-Dwelling Millennials

More than 15.3 million twentysomethings—and half of young people under 25—live "in their parents’ home," according to official Census statistics..

There's just one problem with those official statistics. They're criminally misleading. When you read the full Census reports, you often come upon this crucial sentence:

It is important to note that the Current Population Survey counts students living in dormitories as living in their parents' home

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 7/04/2014 03:01:00 PM

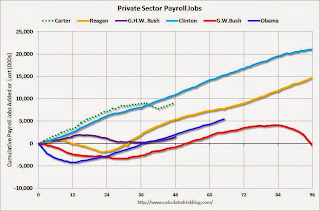

By request, here is an update on an earlier post through the June employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 21 | 3,477 |

| 1Seventeen months into 2nd term | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Seventeen months into Mr. Obama's second term, there are now 5,475,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 671,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 21 | 42 |

| 1Seventeen months into 2nd term | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are over at the state and local levels in the aggregate, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014, but nothing like what happened during Reagan's second term.

Mid-Year Review: Ten Economic Questions for 2014

by Calculated Risk on 7/04/2014 09:25:00 AM

At the end of last year, I posted Ten Economic Questions for 2014. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2014 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and then try to understand why I was wrong).

By request, here is a mid-year review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...There are international risks - China remains a downside risk, and the situations in the Ukraine and Iraq are serious, but overall it appears that downside risks have diminished.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.Right now, through June 30th, inventory is up 14.0% compared to last year according to Housing Tracker. The NAR reported inventory was up 6.0% year-over-year in May. It looks like a 10% to 15% increase this year might be right based on the NAR reports - but this might be too low based on Housing Tracker.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.Mel Watt's comments in May suggest some easing this year, but so far there is little evidence of looser lending standards.

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data through April (10.8% year-over-year gain for Composite 20), and it appears price increases are slowing, see: The Slow Down in the House Price Indexes. My prediction still seems OK, but if anything, house prices might slow more than I expected.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through May, new home sales were up slightly over 2013, and housing starts were only up 6.5% year-over-year. There was a slow start to 2014 mostly due to higher mortgage rates, higher prices and supply constraints in some areas - and a little bit due to the weather. I still think fundamentals support a higher level of starts, and the comparisons to 2013 are easier going forward, so I still expect starts and new home sales to pick up this year (but not as much as I initially expected).

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.So far right on schedule.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.Inflation has picked up a little, but it is still not a concern.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The unemployment rate was 6.1% in June and it looks like I was too pessimistic.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through June 2014, the economy has added 1,385,000 jobs, or 231,000 per month. So far this is on pace just above the top end of my prediction.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%The first quarter was very disappointing, but I expect economic activity to pick up in the last three quarters of the year. Unless there is a significant upward revision to Q1, growth will probably be closer to 2% again this year. Oh well - but Q1 GDP does seem to be out of step with most other data.