by Calculated Risk on 7/04/2014 09:25:00 AM

Friday, July 04, 2014

Mid-Year Review: Ten Economic Questions for 2014

At the end of last year, I posted Ten Economic Questions for 2014. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2014 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and then try to understand why I was wrong).

By request, here is a mid-year review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...There are international risks - China remains a downside risk, and the situations in the Ukraine and Iraq are serious, but overall it appears that downside risks have diminished.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.Right now, through June 30th, inventory is up 14.0% compared to last year according to Housing Tracker. The NAR reported inventory was up 6.0% year-over-year in May. It looks like a 10% to 15% increase this year might be right based on the NAR reports - but this might be too low based on Housing Tracker.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.Mel Watt's comments in May suggest some easing this year, but so far there is little evidence of looser lending standards.

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data through April (10.8% year-over-year gain for Composite 20), and it appears price increases are slowing, see: The Slow Down in the House Price Indexes. My prediction still seems OK, but if anything, house prices might slow more than I expected.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through May, new home sales were up slightly over 2013, and housing starts were only up 6.5% year-over-year. There was a slow start to 2014 mostly due to higher mortgage rates, higher prices and supply constraints in some areas - and a little bit due to the weather. I still think fundamentals support a higher level of starts, and the comparisons to 2013 are easier going forward, so I still expect starts and new home sales to pick up this year (but not as much as I initially expected).

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.So far right on schedule.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.Inflation has picked up a little, but it is still not a concern.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The unemployment rate was 6.1% in June and it looks like I was too pessimistic.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through June 2014, the economy has added 1,385,000 jobs, or 231,000 per month. So far this is on pace just above the top end of my prediction.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%The first quarter was very disappointing, but I expect economic activity to pick up in the last three quarters of the year. Unless there is a significant upward revision to Q1, growth will probably be closer to 2% again this year. Oh well - but Q1 GDP does seem to be out of step with most other data.

Thursday, July 03, 2014

Correcting WSJ Graph Error on Wages

by Calculated Risk on 7/03/2014 09:42:00 PM

For fun, here is an incorrect graph on wages from the WSJ today: U.S. Jobs Report: 288,000 Positions Added

Click on graph for larger image.

This graph just looked wrong (one on the right). If wages had to increase from $22.15 per hour to $26.99 per hour to track inflation over the last 5 years, then inflation must of been 4% per year! That isn't correct.

So I pulled up the actual wage and CPI data.

| Month | Total Private Average Hourly Earnings of All Employees | CPI | Inflation Adjusted |

|---|---|---|---|

| June 2009 | $22.15 | 214.79 | |

| June 2014 | $24.45 | 237.0831 | $24.45 |

| 1CPI is for May 2014 (per WSJ). | |||

The wage data is from the BLS and is correct on the graph. But instead of multiplying $22.15 times the increase in inflation, they must have multiplied the June 2014 wages times inflation. Oops!

The correct story is that real wages have gone nowhere for 5 years (the BLS has a series on real hourly wages, and of course the series shows essentially no change from June 2009 to May 2014). The article actually had the story correct: "The average hourly wage for private-sector workers rose six cents to $24.45. That's up just 2% from a year earlier, basically in line with consumer-price inflation."

Black Knight releases Mortgage Monitor for May

by Calculated Risk on 7/03/2014 05:54:00 PM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for May today. According to BKFS, 5.62% of mortgages were delinquent in May, unchanged from April. BKFS reports that 1.91% of mortgages were in the foreclosure process, down from 3.05% in May 2013.

This gives a total of 7.53% delinquent or in foreclosure. It breaks down as:

• 1,670,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,169,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 966,000 loans in foreclosure process.

For a total of 3,805,000 loans delinquent or in foreclosure in May. This is down from 4,569,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

Though refinance activity is still down significantly from the levels seen in 2012 and early last year, it has increased 21 percent since January 2014. Black Knight also found that seasonal purchase activity has picked up, with approximately 897,000 purchase originations through April, a level on par with 2013 (898,000 over the same period), and better than 2012 (847,000). Overall, credit standards do not seem to be easing, as both average loan-to-value (LTV) ratios and credit scores on both purchase and refinance originations remain relatively strict and essentially unchanged.This fits with the NAR data showing standard equity purchases up slightly this year even as distressed sales decline sharply (many distressed sales are cash buyers). However this doesn't fit with the MBA purchase index.

emphasis added

There is much more in the mortgage monitor.

Trade Deficit decreased in May to $44.4 Billion

by Calculated Risk on 7/03/2014 03:35:00 PM

Catching up ... the Department of Commerce reported this morning:

[T]otal May exports of $195.5 billion and imports of $239.8 billion resulted in a goods and services deficit of $44.4 billion, down from $47.0 billion in April, revised. May exports were $2.0 billion more than April exports of $193.5 billion. May imports were $0.7 billion less than April imports of $240.5 billion.The trade deficit was smaller than the consensus forecast of $45.1 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2014.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in May.

Exports are 18% above the pre-recession peak and up 4% compared to May 2013; imports are about 4% above the pre-recession peak, and up about 3% compared to May 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $96.12 in May, up from $95.48 in April, and down from $96.74 in May 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $28.8 billion in May, from $27.9 billion in May 2013.

Reis: Strip Mall Vacancy Rate declined slightly in Q2, Regional Malls Unchanged

by Calculated Risk on 7/03/2014 01:03:00 PM

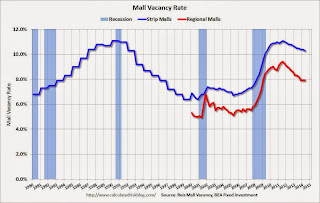

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q2 2014. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.3% from 10.4% in Q1. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points to 10.3% during the second quarter. This was a marginal improvement over the first quarter when the national vacancy rate did not change. The national vacancy is now down 80 basis points from its historical peak during the third quarter of 2011. However, that translates into a less than 10 basis points per quarter compression in the vacancy rate.

...

[Regional] Vacancy during the second quarter was 7.9%, unchanged from the first quarter and down 40 basis points from the second quarter of 2013. Vacancy is also down 150 basis points from the historical‐high level of 9.4% reached during the third quarter of 2011. Asking rents grew by 0.4% in the second quarter and 1.8% during the last twelve months. This is the thirteenth consecutive quarter of rent increases at the national level for regional malls. While the mood surrounding malls at industry events continues to brighten, the data in recent quarters has become a bit less optimistic. The vacancy rate for malls has been unchanged over the last three quarters, although rent growth continues to accelerate. Even though the economy is recovering, the mall sector is grappling with the fallout surrounding store closures and retailers going out of business. This is putting upward pressure on vacancy at a time when improvement in the economy and labor market is gradually translating into slow increases in demand and net absorption.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.