by Calculated Risk on 6/26/2014 11:00:00 AM

Thursday, June 26, 2014

Kansas City Fed: Regional Manufacturing "Activity Slowed Somewhat" in June

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed somewhat, while producers’ expectations for future factory activity showed little change and remained at solid levels.The last regional Fed manufacturing survey for June will be released on Monday, June 30th (Dallas Fed). In general the regional surveys have indicated growth in June at about the same pace as in May.

“We saw some moderation in factory growth in June and many contacts mentioned difficulties finding qualified workers,” said Wilkerson. “However, many respondents noted solid expectations for future months.”

The month-over-month composite index was 6 in June, down from 10 in May and 7 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index dropped from 14 to 2, and the new orders, employment, and new orders for exports indexes also declined.

emphasis added

Personal Income increased 0.4% in May, Spending increased 0.2%

by Calculated Risk on 6/26/2014 08:57:00 AM

The BEA released the Personal Income and Outlays report for May:

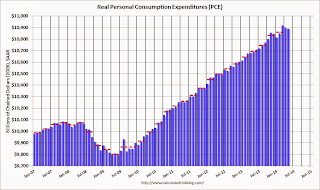

Personal income increased $58.8 billion, or 0.4 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.3 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in May, compared with a decrease of 0.2 percent in April. ... The price index for PCE increased 0.2 percent in May, the same increase as in April. The PCE price index, excluding food and energy, increased 0.2 percent in May, the same increase as in April. ... The May price index for PCE increased 1.8 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.5 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Note: Usually the two-month and mid-month methods can be used to estimate PCE growth for the quarter (using the first two months and mid-month of the quarter). However this isn't very effective if there was an "event", and in Q1 PCE was especially weak in January and February - and then surged in March.

Still, using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 2.3% annual rate in Q2 2014 (using the mid-month method, PCE was increasing less than 1.5%). Since the comparison to March will be difficult, it appears PCE growth will be below 2% in Q2 (another weak quarter).

On inflation: The PCE price index increased 1.8 percent year-over-year, and at a 2.8% annualized rate in May. The core PCE price index (excluding food and energy) increased 1.5 percent year-over-year in May, and at a 2.0% annualized rate in May.

Weekly Initial Unemployment Claims decrease to 312,000

by Calculated Risk on 6/26/2014 08:34:00 AM

The DOL reports:

In the week ending June 21, the advance figure for seasonally adjusted initial claims was 312,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 312,000 to 314,000. The 4-week moving average was 314,250, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 311,750 to 312,250.The previous week was revised up from 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 314,250.

This was close to the consensus forecast of 313,000. The 4-week average is now at normal levels for an expansion.

Wednesday, June 25, 2014

Thursday: May Personal Income and Outlays, Weekly Unemployment Claims

by Calculated Risk on 6/25/2014 08:23:00 PM

First, according to Mortgage News Daily, 30 year mortgage rates have fallen to 4.13% today, down from 4.18% yesterday, and down from 4.59% a year ago.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 312 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Merrill Lynch on Q1 GDP Revision

by Calculated Risk on 6/25/2014 02:09:00 PM

From Merrill Lynch:

In the final release of 1Q GDP, growth was revised down significantly to -2.9% qoq saar from -1.0% previously. This was a big disappointment ...

The downward revision owed to two primary factors: weaker consumer spending on healthcare and a wider trade deficit. Updated data on healthcare spending contributed to a 1.2pp downward revision to GDP growth ... The large change to healthcare spending was due to the BEA significantly overestimating the impact of the Affordable Care Act (ACA).

The other major moving part was in net exports, largely due to a wider services trade deficit. ... This equates to an additional 0.6pp drag on GDP growth.

...

We caution against reading too much into the weakness, as it is clear that special factors during the quarter distorted growth. The severe winter weather weighed heavily on consumption, fixed investment and trade. Furthermore, there was a notable inventory drawdown that amounted to a 1.7pp drag on growth, following two strong quarters of inventory build in 3Q and 4Q of 2013. Despite the deeper contraction in this final release, we are not revising 2Q GDP growth. We continue to expect a 4.0% rebound in the second quarter, and the recent data suggest that we are headed in that direction. However, uncertainty around this number remains elevated: there could continue to be special factors at play stemming from the weakness in 1Q. Moreover, benchmark GDP revisions, released with the first estimate of 2Q GDP in July, could alter the trajectory.

Assuming 4.0% growth in 2Q and solid 3.0% growth in 2H, growth will still only average 1.7% this year. It certainly was not the start of the year we were hoping for.

emphasis added