by Calculated Risk on 6/24/2014 10:00:00 AM

Tuesday, June 24, 2014

New Home Sales increase sharply to 504,000 Annual Rate in May

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 504 thousand.

April sales were revised down from 433 thousand to 425 thousand, and March sales were revised up from 407 thousand to 410 thousand.

Sales of new single-family houses in May 2014 were at a seasonally adjusted annual rate of 504,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 18.6 percent above the revised April rate of 425,000 and is 16.9 percent above the May 2013 estimate of 431,000.

Click on graph for larger image.

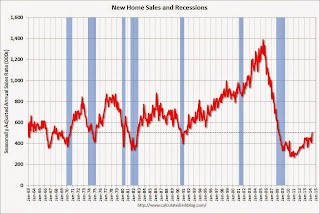

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the highest sales rate since May 2008. Even with the increase in sales over the previous two years, new home sales are still just above the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 4.5 months from 5.3 months in April.

The months of supply decreased in May to 4.5 months from 5.3 months in April. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of May was 189,000. This represents a supply of 4.5 months at the current sales rate."

On inventory, according to the Census Bureau:

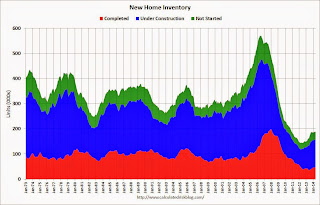

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2014 (red column), 49 thousand new homes were sold (NSA). Last year 40 thousand homes were also sold in May. The high for May was 120 thousand in 2005, and the low for May was 26 thousand in 2010.

This was well above expectations of 441,000 sales in May, and sales were up 16.9% year-over-year.

I'll have more later today .

Case-Shiller: Comp 20 House Prices increased 10.8% year-over-year in April

by Calculated Risk on 6/24/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Rate of Home Price Gains Drop Sharply, According to the S&P/Case-Shiller Home Price Indices

Data through April 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... show that the 10-City and 20-City Composites posted annual gains of 10.8%. This is a significantly lower rate when compared to last month. Nineteen of the 20 cities saw lower annual gains in April than in March.

The 10-City and 20-City Composites increased 1.0% and 1.1% in April. Seven cities – Cleveland, Las Vegas, Los Angeles, Miami, Phoenix, San Diego and San Francisco – reported lower returns than in March. ...

“Although home prices rose in April, the annual gains weakened,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Overall, prices are rising month-to-month but at a slower rate. Last year some Sunbelt cities were seeing year-over-year numbers close to 30%, now all are below 20%: Las Vegas (18.8%), Los Angeles (14.0%), Phoenix (9.8%), San Diego (15.3%) and San Francisco (18.2%). Other cities around the nation are also experiencing slower price increases."

...

In April, all cities saw prices increase with twelve cities reporting higher returns than last month. Boston gained the most with an increase of 2.9%, its highest month-over-month gain. San Francisco and Seattle trailed at +2.3%. At the bottom of the list, New York gained only 0.1%. Dallas and Denver continue to set new peaks while Detroit remains the only city below its January 2000 value.

Click on graph for larger image.

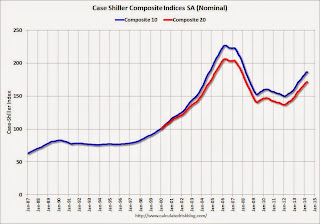

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 17.8% from the peak, and unchanged in April (SA). The Composite 10 is up 24.4% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 16.9% from the peak, and up 0.2% (SA) in April. The Composite 20 is up 25.2% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 10.8% compared to April 2013.

The Composite 20 SA is up 10.8% compared to April 2013.

Prices increased (SA) in 15 of the 20 Case-Shiller cities in April seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 43.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was lower than the consensus forecast for a 11.4% YoY increase and suggests a slowdown in price increases. I'll have more on house prices later.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since July 2008

by Calculated Risk on 6/24/2014 07:01:00 AM

According to Black Knight's First Look report for May, the percent of loans delinquent was unchanged in May compared to April, and declined by 7.6% year-over-year.

Also the percent of loans in the foreclosure process declined further in May and were down 37% over the last year. Foreclosure inventory was at the lowest level since July 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was unchanged at 5.62% in May. The normal rate for delinquencies is around 4.5% to 5%. The increase in delinquencies was in the 'less than 90 days' bucket.

The percent of loans in the foreclosure process declined to 1.91% in May from 2.02% in April.

The number of delinquent properties, but not in foreclosure, is down 204,000 properties year-over-year, and the number of properties in the foreclosure process is down 559,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for May in early June.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| May 2014 | April 2014 | May 2013 | |

| Delinquent | 5.62% | 5.62% | 6.08% |

| In Foreclosure | 1.91% | 2.02% | 3.05% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,670,000 | 1,634,000 | 1,708,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,169,000 | 1,187,000 | 1,335,000 |

| Number of properties in foreclosure pre-sale inventory: | 966,000 | 1,016,000 | 1,525,000 |

| Total Properties | 3,805,000 | 3,837,000 | 4,569,000 |

Monday, June 23, 2014

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 6/23/2014 09:01:00 PM

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April. The consensus is for a 11.4% year-over-year increase in the Composite 20 index (NSA) for April.

• Also at 9:00 AM, the FHFA House Price Index for April. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for an in increase in sales to 441 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 433 thousand in April.

• Also at 10:00 AM, the Conference Board's consumer confidence index for June. The consensus is for the index to increase to 83.7 from 83.0.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for June. The consensus is for a reading of 7, unchanged from 7 in May.

Fed's Mike Bryan: "Torturing CPI Data until They Confess"

by Calculated Risk on 6/23/2014 06:27:00 PM

Every month I post a few key measures of inflation including the Atlanta Fed's median CPI and trimmed-mean CPI, along with core CPI and core PCE. Atlanta Fed senior economist Mike Bryan and his colleagues developed these two measures.

Here is a very informative post on inflation today from Mike Bryan: Torturing CPI Data until They Confess: Observations on Alternative Measures of Inflation

Why do price change distributions have peaked centers and very elongated tails? ... absent a clear economic rationale for this unusual distribution, it presents a measurement problem and an immediate remedy. The problem is that these long tails tend to cause the CPI (and other weighted averages of prices) to fluctuate pretty widely from month to month, but they are, in a statistical sense, tethered to that large proportion of price changes that lie in the center of the distribution.

... The median CPI is immune to the obvious analyst bias that I had been guilty of, while greatly reducing the volatility in the monthly CPI report in a way that I thought gave the Federal Reserve Bank of Cleveland a clearer reading of the central tendency of price changes.

Cecchetti and I pushed the idea to a range of trimmed-mean estimators, for which the median is simply an extreme case. Trimmed-mean estimators trim some proportion of the tails from this price-change distribution and reaggregate the interior remainder. Others extended this idea to asymmetric trims for skewed price-change distributions, as Scott Roger did for New Zealand, and to other price statistics, like the Federal Reserve Bank of Dallas's trimmed-mean PCE inflation rate.

How much one should trim from the tails isn't entirely obvious. We settled on the 16 percent trimmed mean for the CPI (that is, trimming the highest and lowest 8 percent from the tails of the CPI's price-change distribution) because this is the proportion that produced the smallest monthly volatility in the statistic while preserving the same trend as the all-items CPI.