by Calculated Risk on 6/08/2014 12:00:00 PM

Sunday, June 08, 2014

41-Year-Olds and the Labor Force Participation Rate

On Friday, Dean Baker wrote: The Question on People Leaving the Labor Force is 41-Year-Olds, Not 61-Year-Olds

In his discussion of today's employment report Neil Irwin notes that the unemployment rate is considerably lower than would otherwise be the case because so many people have simply given up looking for work and are therefore not counted as being unemployed. Irwin then adds that the big question is that if the economy eventually recovers is:This brings up a few key points:

"How many of the 61-year-olds who gave up looking for a job in the last few years are going to return to the labor force when they smell opportunity, and how many have retired for good?"

Actually, the story of people leaving the labor force is not primarily one of older workers who are near retirement age, it is primarily a story of prime age workers. ...

It is difficult to envision any obvious reason why people in their prime working years would suddenly decide that they did not want to work other than the weakness of the labor market. Most of these workers will presumably come back into the labor market if they see opportunities for employment.

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old).

3) Although Dr. Baker argues that the decline in prime working age workers is due to "weakness of the labor market", this decline was happening long before the Great Recession. For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

Lets take a look at Dean Bakers "41-Year-Olds". I used the BLS data on 40 to 44 year old men (only available Not Seasonally Adjusted since 1976). I choose men only to simplify.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Just looking at this graph, I don't think there are many "missing 41-Year-Old" men that will be returning to the labor force.

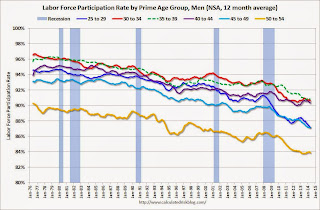

The second graph shows the trends for each prime working age men 5-year age group.

The second graph shows the trends for each prime working age men 5-year age group.Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about how many workers are "missing", we need to take these long term trends into account.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

Saturday, June 07, 2014

Schedule for Week of June 8th

by Calculated Risk on 6/07/2014 01:11:00 PM

This will be a light week for economic data.

The key report this week is May retail sales on Thursday.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for May.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In March, the number of job openings (yellow) were up 3.5% year-over-year compared to March 2013, and Quits were up sharply year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: The Monthly Treasury Budget Statement for May. Note: The CBO's estimate is the deficit through May in fiscal 2014 was $439 billion, compared to $626 billion for the same period in fiscal 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 312 thousand.

8:30 AM ET: Retail sales for May will be released.

8:30 AM ET: Retail sales for May will be released.This graph shows retail sales since 1992 through March 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.8% from April 2013.

The consensus is for retail sales to increase 0.6% in May, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.4% increase in inventories.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.1% increase in prices.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 83.0, up from 81.9 in May.

Unofficial Problem Bank list declines to 495 Institutions

by Calculated Risk on 6/07/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 6, 2014.

Changes and comments from surferdude808:

It was a very quiet week for the Unofficial Problem Bank List with only one removal. The list holds 495 institutions with assets of $153.9 billion. A year ago, the list had 923 institutions with assets of $355.7 billion. The OCC terminated the action against Independence National Bank, Greenville, SC ($97 million Ticker: IEBS). Next week, we anticipate for the OCC to provide an update on its enforcement action activity through mid-May 2014.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 495.

Friday, June 06, 2014

Larry Summers on "House of Debt"

by Calculated Risk on 6/06/2014 07:14:00 PM

An interesting piece from Larry Summers in the Financial Times: Lawrence Summers on ‘House of Debt’ A short excerpt:

Atif Mian and Amir Sufi’s House of Debt, despite some tough competition, looks likely to be the most important economics book of 2014; it could be the most important book to come out of the 2008 financial crisis and subsequent Great Recession. Its arguments deserve careful attention, and its publication provides an opportunity to reconsider policy choices made in 2009 and 2010 regarding mortgage debt.I have my copy of the book and will probably post a few comments soon too (thanks for nice mention of Calculated Risk on page 147).

...

Mian and Sufi ... argue that, rather than failing banks, the key culprits in the financial crisis were overly indebted households. ... Mian and Sufi highlight how harsh leverage and debt can be – for example, when the price of a house purchased with a 10 per cent downpayment goes down by 10 per cent, all of the owner’s equity is lost. They demonstrate powerfully that spending fell much more in parts of the country where house prices fell fastest and where the most mortgage debt was attached to homes. So their story of the crisis blames excessive mortgage lending, which first inflated bubbles in the housing market and then left households with unmanageable debt burdens. These burdens in turn led to spending reductions and created an adverse economic and financial spiral that ultimately led financial institutions to the brink.

emphasis added

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 6/06/2014 04:34:00 PM

By request, here is an update on an earlier post through the May employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is just starting the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Sixteen months into Mr. Obama's second term, there are now 5,197,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 710,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are over at the state and local levels in the aggregate, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014.