by Calculated Risk on 6/04/2014 08:21:00 AM

Wednesday, June 04, 2014

ADP: Private Employment increased 179,000 in May

Private sector employment increased by 179,000 jobs from April to May according to the May ADP National Employment Report®. ... he report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Job growth moderated in May. The slowing in growth was concentrated in Professional/Business Services and companies with 50-999 employees. The job market has yet to break out from the pace of growth that has prevailed over the last three years.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for May will be released on Friday.

MBA: Mortgage Applications Decrease in Latest Survey, Mortgage Rates "lowest levels in close to a year"

by Calculated Risk on 6/04/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2014. This week’s results include an adjustment for the Memorial Day holiday. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

...

Interest rates for most products fell to their lowest levels in close to a year.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.26 percent from 4.31 percent, with points decreasing to 0.13 from 0.15 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013 (one year ago).

As expected, refinance activity is very low this year.

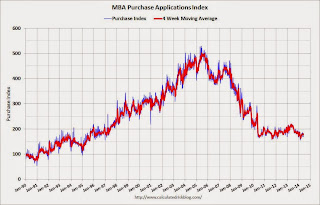

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 17% from a year ago.

Note: It appears mortgage rates will be down year-over-year in a few weeks.

Tuesday, June 03, 2014

Wednesday: ADP Employment, Trade Deficit, ISM Service, Beige Book

by Calculated Risk on 6/03/2014 06:45:00 PM

From Jon Hilsenrath at the WSJ: Fed Officials Growing Wary of Market Complacency

[M]easures of risk aversion and market volatility show an especially striking sense of investor calm. The VIX, which tracks expected stock-market fluctuations based on options trading, has gone 74 straight weeks below its long-run average—a run of steadiness not seen since 2006 and 2007."Complacency" may be a problem, but this isn't 2006 and 2007. In January 2007 I predicted a recession would start that year as a result of the housing bust (made it by one month since the recession started in December 2007!). Now - I don't see a recession any time soon.

...

New York Fed President William Dudley warned in a question-and-answer session after a speech last month that he was nervous that unusually low volatility in markets was breeding too much risk-taking.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in May, down from 220,000 in April.

• At 8:30 AM, the Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.0 billion in April from $40.4 billion in March.

• At 10:00 AM, the ISM non-Manufacturing Index for May. The consensus is for a reading of 55.3, up from 55.2 in April. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales increase to 16.7 million annual rate in May, Highest Rate since 2007

by Calculated Risk on 6/03/2014 02:42:00 PM

Based on an AutoData estimate, light vehicle sales were at a 16.77 million SAAR in May. That is up 9% from May 2013, and up 5% from the sales rate last month.

This is the highest sales rate since February 2007.

Note: WardsAuto is currently estimating 16.70 million SAAR (updated final), see: May 2014 Sales Thread: Late-Month Sales Send SAAR Soaring

This was above the consensus forecast of 16.1 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 16.77 million SAAR from AutoData).

Severe weather clearly impacted sales in January and February. Since then vehicle sales have been solid.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales.

Vehicle Sales in May: Solid Early Reports

by Calculated Risk on 6/03/2014 12:15:00 PM

I'll post a graph of monthly vehicle sales when after all the automakers report (usually between 3 and 4 PM ET). The consensus is for light vehicle sales to increase to 16.1 million SAAR in May from just under 16.0 million in April (Seasonally Adjusted Annual Rate).

Here are a few articles that suggest sales were solid in May (there was one more selling day in May 2014 compared to May 2013).

From MarketWatch: General Motors U.S. sales jump 13% in May

GM said it sold 284,694 total vehicles in May, up from 252,894 a year earlier. ... GM called the results its best total monthly sales figure since August 2008.From MarketWatch: Chrysler's U.S. sales jump 17% in May

Chrysler, a unit of Fiat Chrysler Automobiles, sold 194,421 vehicles in May, up from 166,596 a year earlier. The company said it enjoyed its best May sales since 2007.From MarketWatch: Ford sales rise 3% in May

Ford Motor Co. reported Tuesday it sold 254,084 cars and pickup-truck in the United States in May, up 3% from a year ago. ... It was Ford's best May in 10 years