by Calculated Risk on 6/03/2014 02:42:00 PM

Tuesday, June 03, 2014

U.S. Light Vehicle Sales increase to 16.7 million annual rate in May, Highest Rate since 2007

Based on an AutoData estimate, light vehicle sales were at a 16.77 million SAAR in May. That is up 9% from May 2013, and up 5% from the sales rate last month.

This is the highest sales rate since February 2007.

Note: WardsAuto is currently estimating 16.70 million SAAR (updated final), see: May 2014 Sales Thread: Late-Month Sales Send SAAR Soaring

This was above the consensus forecast of 16.1 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 16.77 million SAAR from AutoData).

Severe weather clearly impacted sales in January and February. Since then vehicle sales have been solid.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales.

Vehicle Sales in May: Solid Early Reports

by Calculated Risk on 6/03/2014 12:15:00 PM

I'll post a graph of monthly vehicle sales when after all the automakers report (usually between 3 and 4 PM ET). The consensus is for light vehicle sales to increase to 16.1 million SAAR in May from just under 16.0 million in April (Seasonally Adjusted Annual Rate).

Here are a few articles that suggest sales were solid in May (there was one more selling day in May 2014 compared to May 2013).

From MarketWatch: General Motors U.S. sales jump 13% in May

GM said it sold 284,694 total vehicles in May, up from 252,894 a year earlier. ... GM called the results its best total monthly sales figure since August 2008.From MarketWatch: Chrysler's U.S. sales jump 17% in May

Chrysler, a unit of Fiat Chrysler Automobiles, sold 194,421 vehicles in May, up from 166,596 a year earlier. The company said it enjoyed its best May sales since 2007.From MarketWatch: Ford sales rise 3% in May

Ford Motor Co. reported Tuesday it sold 254,084 cars and pickup-truck in the United States in May, up 3% from a year ago. ... It was Ford's best May in 10 years

CoreLogic: House Prices up 10.5% Year-over-year in April

by Calculated Risk on 6/03/2014 09:14:00 AM

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 10.5 Percent Year Over Year in April

Home prices nationwide, including distressed sales, increased 10.5 percent in April 2014 compared to April 2013. This change represents 26 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 2.1 percent in April 2014 compared to March 2014.

Excluding distressed sales, home prices nationally increased 8.3 percent in April 2014 compared to April 2013 and 1.1 percent month over month compared to March 2014. Distressed sales include short sales and real estate owned (REO) transactions.

“The weakness in home sales that began a few months ago is clearly signaling a slowdown in price appreciation,” said Sam Khater, deputy chief economist for CoreLogic. “The 10.5 percent increase in April, compared to a year earlier, was the slowest rate of appreciation in 14 months.”

emphasis added

Click on graph for larger image.

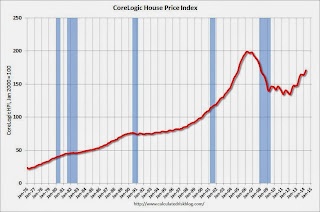

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.1% in April, and is up 10.5% over the last year.

This index is not seasonally adjusted, so a strong month-to-month gain was expected for April.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to continue to slow.

Monday, June 02, 2014

Tuesday: Vehicle Sales

by Calculated Risk on 6/02/2014 08:25:00 PM

From Emily Badger at the WaPo:

Census data released Monday on the characteristics of new single-family housing construction confirms that the median size of a new pad in America is bigger than it's ever been ... In 2013, the median size of a new single-family home completed in the United States was 2,384 square feet (the average, not surprisingly, was tugged even higher by the mega-mega home: 2,598 square feet). That median is above the pre-crash peak of 2,277 square feet in 2007, and it dwarfs the size of homes we were building back in 1973 (median size then: 1,525 square feet)....Looks like extra bathrooms are very popular.

What, then, do we want all of this room for? What's particularly striking in the Census Bureau's historic data on new housing characteristics is the growth of what would be luxuries for many households: fourth bedrooms, third bathrooms, three-car garages.

Tuesday:

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 16.1 million SAAR in May from 16.0 million in April (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 0.5% increase in April orders.

Weekly Update: Housing Tracker Existing Home Inventory up 10.5% year-over-year on June 2nd

by Calculated Risk on 6/02/2014 06:23:00 PM

Here is another weekly update on housing inventory ...

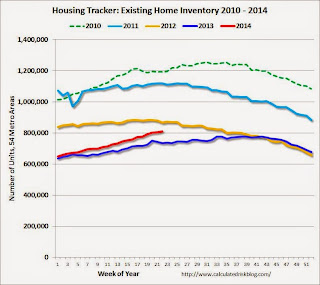

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 10.5% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory will be up 10% to 15% year-over-year at the end of 2014. Inventory may increase a little more than I expected!