by Calculated Risk on 5/22/2014 08:19:00 PM

Thursday, May 22, 2014

Friday: New Home Sales

First, a couple of manufacturing releases earlier today for May ...

From MarkIt: Markit Flash U.S. Manufacturing PMI™, Output rises at fastest pace in over three years

Operating conditions in the US manufacturing sector continued to improve during May, with strong rises in production and output complemented by further payroll growth.From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Expanded Solidly

After accounting for seasonal factors, the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) improved to 56.2 in May, up from April’s 55.4.

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity expanded solidly, and producers’ expectations for future factory activity remained at healthy levels.Friday:

“This was the third straight month of solid growth at factories in the region, following some weather-related weakness in previous months”, said Wilkerson. “More factories than in recent surveys were also able to raise selling prices.”

The month-over-month composite index was 10 in May, up from 7 in April and equal to 10 in March

• At 10:00 AM ET, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 384 thousand in March.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/22/2014 05:45:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for selected cities in April. Lawler writes: "Note the steep YOY decline in the short-sales share, and the significant increase in the foreclosure sales share of home sales in Florida."

Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in some judicial foreclosure areas and also in Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011).

The All Cash Share (last two columns) is mostly declining year-over-year.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | |

| Las Vegas | 12.4% | 32.5% | 11.4% | 10.0% | 23.8% | 42.5% | 41.4% | 59.3% |

| Reno** | 15.0% | 33.0% | 6.0% | 8.0% | 21.0% | 41.0% | ||

| Phoenix | 4.0% | 12.7% | 6.5% | 11.3% | 10.5% | 24.1% | 32.2% | 42.0% |

| Sacramento | 7.5% | 8.8% | 9.5% | 23.1% | 17.0% | 31.9% | 21.9% | 37.2% |

| Minneapolis | 5.0% | 7.4% | 15.9% | 24.0% | 20.9% | 31.4% | ||

| Mid-Atlantic | 5.9% | 9.9% | 10.0% | 8.6% | 15.9% | 18.5% | 19.5% | 19.4% |

| Orlando | 9.1% | 21.2% | 23.7% | 20.5% | 32.9% | 41.8% | 42.4% | 54.8% |

| California * | 5.5% | 16.1% | 6.7% | 13.5% | 12.2% | 29.6% | ||

| Bay Area CA* | 3.8% | 11.8% | 3.6% | 8.4% | 7.4% | 20.2% | 22.9% | 28.3% |

| So. California* | 5.4% | 16.6% | 5.9% | 12.4% | 11.3% | 29.0% | 26.7% | 34.4% |

| Florida SF | 6.9% | 14.8% | 21.1% | 16.2% | 28.0% | 31.0% | 43.4% | 47.9% |

| Florida C/TH | 4.5% | 10.2% | 15.6% | 12.0% | 20.1% | 22.3% | 70.9% | 73.8% |

| Miami MSA SF | 10.5% | 18.5% | 16.5% | 10.8% | 27.0% | 29.3% | 44.4% | 47.1% |

| Miami MSA C/TH | 5.6% | 12.8% | 17.5% | 12.0% | 23.1% | 24.7% | 73.4% | 78.9% |

| Sarasota | 3.8% | 9.5% | 12.8% | 12.5% | 16.6% | 22.0% | ||

| Northeast Florida | 38.1% | 39.5% | ||||||

| Hampton Roads | 24.4% | 27.8% | ||||||

| Toledo | 33.4% | 40.8% | ||||||

| Des Moines | 17.1% | 19.6% | ||||||

| Peoria | 21.2% | 24.4% | ||||||

| Tucson | 30.5% | 33.5% | ||||||

| Omaha | 22.3% | 17.4% | ||||||

| Pensacola | 35.6% | 34.5% | ||||||

| Georgia*** | 34.3% | NA | ||||||

| Houston | 6.1% | 10.4% | ||||||

| Memphis* | 16.6% | 24.7% | ||||||

| Birmingham AL | 16.8% | 24.1% | ||||||

| Springfield IL** | 13.2% | 14.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Hotels: Occupancy Rate up 4.6%, RevPAR up 9.6% in Latest Survey

by Calculated Risk on 5/22/2014 04:09:00 PM

From HotelNewsNow.com: STR: US results for week ending 17 May

In year-over-year measurements, the industry’s occupancy increased 4.6 percent to 69.7 percent. Average daily rate increased 4.8 percent to finish the week at US$116.30. Revenue per available room for the week was up 9.6 percent to finish at US$81.10.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

"Employment Scars of the Housing Bust"

by Calculated Risk on 5/22/2014 03:03:00 PM

More insight from Atif Mian and Amir Sufi at House of Debt: Employment Scars of the Housing Bust

One way to see the scars of the housing bust is to look at the unemployment rate today in counties that saw the biggest decline in house prices. As we argue in the book, such an approach actually significantly underestimates the impact of the house price-driven spending collapse. This is because even people living in areas that were not hit by housing lost their jobs when people living in areas where house prices crashed stopped buying goods. But even with this under-estimation ... [t]he unemployment rate in counties hit hardest by the housing crash is more than 3% higher in 2013 relative to 2006. The rise in the unemployment rate is twice as high as the rise in counties with the smallest decline in house prices. The housing crash has led to a large and persistent increase in unemployment.This reminds me ... way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And the Inland Empire was crushed. Note: The Inland Empire unemployment rate in March 2007 was 5.3%. The rate peaked at 15.0% in 2010, and was at 9.4% in March 2014.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Freddie Mac: "Fixed Mortgage Rates Near Seven Month Low"

by Calculated Risk on 5/22/2014 12:04:00 PM

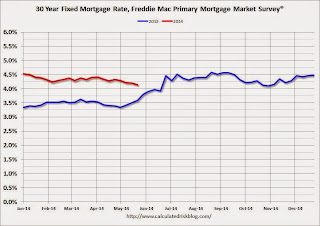

It is looking more likely that we will see a headline sometime in June: "Mortgage Rates down year-over-year"!

From Freddie Mac: Fixed Mortgage Rates Near Seven Month Low Heading Into Memorial Day Weekend

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing showing average fixed mortgage rates moving lower for the fourth consecutive week with fixed mortgage rates hitting new lows for this year.

30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.6 point for the week ending May 22, 2014, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 3.59 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.14%).

Note: The lowest rate in the PMMS® since June 2013 was 4.10% last October.