by Calculated Risk on 5/22/2014 12:04:00 PM

Thursday, May 22, 2014

Freddie Mac: "Fixed Mortgage Rates Near Seven Month Low"

It is looking more likely that we will see a headline sometime in June: "Mortgage Rates down year-over-year"!

From Freddie Mac: Fixed Mortgage Rates Near Seven Month Low Heading Into Memorial Day Weekend

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing showing average fixed mortgage rates moving lower for the fourth consecutive week with fixed mortgage rates hitting new lows for this year.

30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.6 point for the week ending May 22, 2014, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 3.59 percent.

Click on graph for larger image.

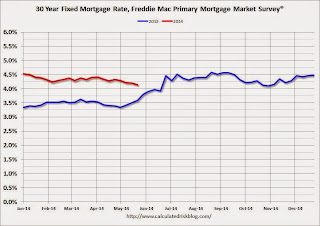

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.14%).

Note: The lowest rate in the PMMS® since June 2013 was 4.10% last October.

Existing Home Sales in April: 4.65 million SAAR, Inventory up 6.5% Year-over-year

by Calculated Risk on 5/22/2014 10:00:00 AM

The NAR reports: April Existing-Home Sales Show Modest Improvement Behind Gaining Inventory

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.3 percent to a seasonally adjusted annual rate of 4.65 million in April from 4.59 million in March, but are 6.8 percent below the 4.99 million-unit level in April 2013.

Total housing inventory at the end of April jumped 16.8 percent to 2.29 million existing homes available for sale, which represents a 5.9-month supply at the current sales pace, up from 5.1 months in March. Unsold inventory is 6.5 percent higher than a year ago, when there was a 5.2-month supply.

Click on graph for larger image.

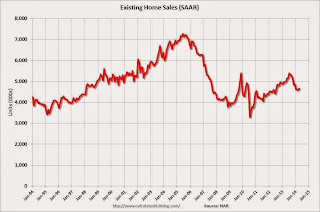

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (4.65 million SAAR) were higher than last month, but were 6.8% below the April 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.29 million in April from 1.96 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.29 million in April from 1.96 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 6.5% year-over-year in April compared to April 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.

Inventory increased 6.5% year-over-year in April compared to April 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.Months of supply was at 5.9 months in April.

This was slightly below expectations of sales of 4.67 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims increase to 326,000

by Calculated Risk on 5/22/2014 08:30:00 AM

The DOL reports:

In the week ending May 17, the advance figure for seasonally adjusted initial claims was 326,000, an increase of 28,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 297,000 to 298,000. The 4-week moving average was 322,500, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 323,250 to 323,500.The previous week was revised up from 297,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 322,500.

This was above the consensus forecast of 310,000. The 4-week average is close to normal levels for an expansion.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since September 2008

by Calculated Risk on 5/22/2014 12:02:00 AM

According to Black Knight's First Look report for April, the percent of loans delinquent increased seasonally in April compared to March, but declined by 9.5% year-over-year.

Also the percent of loans in the foreclosure process declined further in April and were down 36% over the last year. Foreclosure inventory was at the lowest level since September 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 5.62% in April from 5.52% in March. The normal rate for delinquencies is around 4.5% to 5%. The increase in delinquencies was in the 'less than 90 days' bucket.

The percent of loans in the foreclosure process declined to 2.02% in April from 2.13% in March.

The number of delinquent properties, but not in foreclosure, is down 207,000 properties year-over-year, and the number of properties in the foreclosure process is down 572,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for March in early May.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| April 2014 | March 2014 | April 2013 | |

| Delinquent | 5.62% | 5.52% | 6.21% |

| In Foreclosure | 2.02% | 2.13% | 3.17% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,634,000 | 1,571,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,187,000 | 1,199,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,016,000 | 1,070,000 | 1,588,000 |

| Total Properties | 3,837,000 | 3,840,000 | 4,699,000 |

Wednesday, May 21, 2014

Thursday: Existing Home Sales, Unemployment Claims

by Calculated Risk on 5/21/2014 07:52:00 PM

From economist Tom Lawler: Realogy: Spring Selling Season Softer than Expected: Cites Weak First-Time Homebuyers, Blames Tight Mortgage Underwriting AND FHA’s “Onerous” Premiums

Speaking of FHA and first-time home buyers, first-time home buyers came up 18 times, and FHA 17 times, in Realogy Holdings Corporation’s earnings conference call earlier this month – and not in a good way. ... Realogy’s results last quarter, of course, were well below “consensus” (RLGY is down about 17% from the day before it released earnings), and company officials gave a somewhat downbeat assessment of the spring selling season and likely home sales in Q2 – especially for first-time home buyers. Here are a few excerpts from the conference call transcript.Thursday:

“As we have moved into our spring selling season, thus far the level of open activity we expected has not materialized particularly as it relates to home sale transaction size.Realtors and home builders have noted that home purchases by first-time home buyers so far this year have fallen short of last year’s pace.

“Tight credit standards and limited inventory are factors affecting the first-time buyers but we also believe that the high costs of an FHA loan are discouraging first-time homebuyers. The FHA's unusually high mortgage insurance premium structure which was raised to help improve the overall health of the FHA, is now more than double its historic average

“Our current forecasts for 2014 are not assuming any significant increase in first-time buyer activity. But I think most people are expecting some increase principally because -- we hope -- change in credit underwriting for next year. So I don't expect to see a material change in first-time buyer activity this year but we do expect to see some change -- some improvement next year.

“I don't see anything else that has changed or impacted the market with the exception of the first-time buyer. The first-time buyer continues to be under pressure from a cost perspective. I mean the FHA loan is extraordinarily high, the insurance premiums are very high, up about twice what they have been previously. I think that is an impediment to many first-time buyers.

“This is where we have faith in the private sector so let's say FHA continues with its onerous minimum premium obligations which are very onerous by any definition, this private sector will step in and capture that market share that otherwise would not be available if FHA were more reasonable. So you can see examples of that as FICO scores are starting to decline, Wells Fargo as an example has made it clear they are going after business they haven't tackled in the past by reducing the down payment requirements. They are more I think reasonable in their underwriting. So still have a long ways to go but they are getting there.

“So if this persists, we are of the view that the private sector will jump in and be more relevant to the first-time buyer. That is not going to happen overnight but it will happen as industry shift gears. Remember the mortgage industry is trying to recover from the downturn in refinance as well so they are going to be aggressive in going after purchase money and we see that now so we just expect they will become more aggressive.”

• At 12:01 AM ET, the Black Knight “First Look” at April 2014 Mortgage Data

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 297 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.67 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.70 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.