by Calculated Risk on 5/19/2014 11:08:00 AM

Monday, May 19, 2014

LA area Port Traffic: Up year-over-year in April

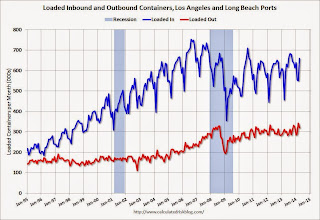

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for April since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in March. Outbound traffic was up 0.6% compared to 12 months ending in March.

Inbound traffic has generally been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports and exports were up solidly year-over-year in April, and this was an all time high for exports for the month of April.

Imports were close to the all time high for April (set in April 2006), and it is possible that imports will be at a record high later this year.

Congratulations to Breanna Grow, the 2014 recipient of the Doris "Tanta" Dungey scholarship!

by Calculated Risk on 5/19/2014 09:34:00 AM

Congratulations to Breanna Grow, the 2014 recipient of the Doris "Tanta" Dungey scholarship!

Here is a picture of Ms. Grow with Tanta's mother (via Tanta's sister Cathy).

A happy day for Tanta's family!

Note: For new readers, Tanta was my co-blogger from from Dec 2006 through November 2008. Please see: Sad News: Tanta Passes Away, NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47 and much more at In Memoriam: Doris "Tanta" Dungey and on the scholarship.

You can make an additional contribution to the Doris Dungey Endowed Scholarship.

Sunday, May 18, 2014

Sunday Night Futures

by Calculated Risk on 5/18/2014 10:01:00 PM

From Jon Hilsenrath at the WSJ: Fed's Rate-Change System Up for Revamp

In the past, the Fed changed its benchmark interest rate—the fed funds rate—by increasing or decreasing ... reserves. ...Weekend:

...

Since the crisis, the Fed has paid banks interest on the reserves they deposit with the central bank at a rate of 0.25%. When it comes time to raise rates across the economy, the Fed will lift this rate rather than altering the fed funds rate by changing the supply of reserves.

...

The Fed could shed light on the subject Wednesday when it releases minutes of an April meeting at which discussions of the issue intensified. And New York Fed President William Dudley may address the matter in a speech Tuesday.

• Schedule for Week of May 18th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 7and DOW futures are up 48 (fair value).

Oil prices were up over the last week with WTI futures at $102.05 per barrel and Brent at $109.85 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.62 per gallon (might have peaked, and slightly below the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Quarterly Housing Starts by Intent, and compared to New Home Sales

by Calculated Risk on 5/18/2014 04:27:00 PM

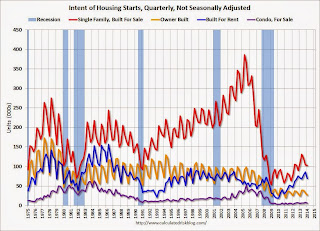

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report last week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released last week showed there were 103,000 single family starts, built for sale, in Q1 2014, and that was below the 107,000 new homes sold for the same quarter, so inventory decreased slightly in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April).

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April). Owner built starts were up 8% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly, and were up 20% year-over-year in Q1.

CoStar: Commercial Real Estate prices increased in Q1, Distress Sales just 10% of all sales

by Calculated Risk on 5/18/2014 09:07:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Major Commercial Real Estate Price Indices Advance In First Quarter

BROAD PRICING INDICES MOVE UPWARD IN FIRST QUARTER: The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — each finished the first quarter of 2014 on a positive note. The U.S. equal-weighted index, which represents lower-value properties, has the most momentum in early 2014, with pricing up 4.2% for the first quarter of 2014 and 17.1% year-over-year. Meanwhile the U.S. value-weighted index, which is more heavily weighted toward larger, higher-value properties, has already recovered to within 5% of its prior peak levels. As a result, pricing gains in the value-weighted Composite Index have slowed, advancing by a more modest 0.5% for the first quarter and 10.1% for the year ending in March 2014.

...

The percentage of commercial property selling at distressed prices has also fallen by more than two-thirds from the peak levels reached in 2011, to just 10% of all composite pair trades in the first quarter of 2014.

...

The Multifamily Index continued to post steady growth, advancing by 7.8% for the 12 months ended March 2014, even though pricing in the Prime Metros Index has surpassed its previous peak set in 2007 by 10%. Pricing in the overall Multifamily Index is now within 8% of its pre-recession peak.Given the steep competition and pricing for Class A assets in prime metro areas, recent pricing gains likely reflect shifting investor interest to Class B properties in primary markets and higher quality properties in secondary and tertiary markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Primary Property Type Quarterly indexes. Multi-family has recovered the most, and offices the least.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.