by Calculated Risk on 5/18/2014 04:27:00 PM

Sunday, May 18, 2014

Quarterly Housing Starts by Intent, and compared to New Home Sales

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report last week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released last week showed there were 103,000 single family starts, built for sale, in Q1 2014, and that was below the 107,000 new homes sold for the same quarter, so inventory decreased slightly in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

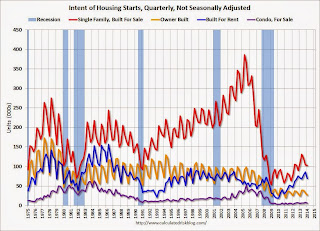

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April).

Single family starts built for sale were down about 4% compared to Q1 2013 (however starts increased sharply in April). Owner built starts were up 8% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly, and were up 20% year-over-year in Q1.

CoStar: Commercial Real Estate prices increased in Q1, Distress Sales just 10% of all sales

by Calculated Risk on 5/18/2014 09:07:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Major Commercial Real Estate Price Indices Advance In First Quarter

BROAD PRICING INDICES MOVE UPWARD IN FIRST QUARTER: The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — each finished the first quarter of 2014 on a positive note. The U.S. equal-weighted index, which represents lower-value properties, has the most momentum in early 2014, with pricing up 4.2% for the first quarter of 2014 and 17.1% year-over-year. Meanwhile the U.S. value-weighted index, which is more heavily weighted toward larger, higher-value properties, has already recovered to within 5% of its prior peak levels. As a result, pricing gains in the value-weighted Composite Index have slowed, advancing by a more modest 0.5% for the first quarter and 10.1% for the year ending in March 2014.

...

The percentage of commercial property selling at distressed prices has also fallen by more than two-thirds from the peak levels reached in 2011, to just 10% of all composite pair trades in the first quarter of 2014.

...

The Multifamily Index continued to post steady growth, advancing by 7.8% for the 12 months ended March 2014, even though pricing in the Prime Metros Index has surpassed its previous peak set in 2007 by 10%. Pricing in the overall Multifamily Index is now within 8% of its pre-recession peak.Given the steep competition and pricing for Class A assets in prime metro areas, recent pricing gains likely reflect shifting investor interest to Class B properties in primary markets and higher quality properties in secondary and tertiary markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Primary Property Type Quarterly indexes. Multi-family has recovered the most, and offices the least.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, May 17, 2014

Schedule for Week of May 18th

by Calculated Risk on 5/17/2014 01:02:00 PM

The key reports this week are April Existing Home Sales on Thursday and April New Home sales on Friday.

For manufacturing, the May Kansas City Fed survey will be released.

No economic releases scheduled.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

11:30 AM, Fed Chair Janet Yellen Speaks, Commencement Remarks, At the New York University Commencement, New York, New York

2:00 PM: FOMC Minutes for the Meeting of April 29-30, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 297 thousand.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 4.67 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.59 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.70 million SAAR.

As always, a key will be inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for May.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an in increase in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 384 thousand in March.

Unofficial Problem Bank list declines to 502 Institutions

by Calculated Risk on 5/17/2014 08:53:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 16, 2014.

Changes and comments from surferdude808:

As expected, the OCC provided an update on its recent enforcement action activity and the FDIC shuttered a bank this Friday. In all, there were seven removals from the Unofficial Problem Bank List leaving it at 502 institutions with assets of $161.2 billion. A year ago, the list held 770 institutions with assets of $284.1 billion.

Actions were terminated against Modern Bank, National Association, New York, NY ($678 million); American Bank and Trust Company, National Association, Davenport, IA ($368 million); Provident Community Bank, National Association, Rock Hill, SC ($323 million Ticker: PCBS); First Texoma National Bank, Durant, OK ($155 million); Mission Oaks National Bank, Temecula, CA ($96 million Ticker: MOKB); and Treasure State Bank, Missoula, MT ($66 million Ticker: TRSU).

AztecAmerica Bank, Berwyn, IL ($66 million) was the seventh bank failure this year. Since the on-set of the Great Recession, there have been 58 bank failures in Illinois, which only trails the 87 failures in Georgia and 70 failures in Florida.

Most likely, the FDIC will provide an update on its recent enforcement action activity in two weeks. Moreover, they will likely release industry results for the first quarter and refreshed problem bank list figures that week as well.

Friday, May 16, 2014

Bank Failure #7 in 2014: AztecAmerica Bank, Berwyn, Illinois

by Calculated Risk on 5/16/2014 07:18:00 PM

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of AztecAmerica Bank, Berwyn, Illinois

As of December 31, 2013, AztecAmerica Bank had approximately $66.3 million in total assets and $65.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $18.0 million. ... AztecAmerica Bank is the seventh FDIC-insured institution to fail in the nation this year, and the second in Illinois.The FDIC is back to work! At the current pace, the number of failures this year will be the lowest since 2007 (when 3 banks failed).