by Calculated Risk on 5/16/2014 03:47:00 PM

Friday, May 16, 2014

Sacramento Housing in April: Total Sales down 5% Year-over-year, Equity (Conventional) Sales up 17%, Active Inventory increases 46%

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April 2014, 16.3% of all resales (single family homes) were distressed sales. This was unchanged from last month, and down from 31.9% in April 2013.

The percentage of REOs was at 7.2%, and the percentage of short sales was 9.1%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 46.3% year-over-year in April.

Cash buyers accounted for 21.9% of all sales, down from 37.2% in April 2013, and down from 22.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 4.8% from April 2013, but conventional equity sales were up 17.0% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas.

A few comments on Housing Starts

by Calculated Risk on 5/16/2014 12:46:00 PM

The Census Bureau reported that housing starts increased 26.4 percent year-over-year in April to a 1.072 million seasonally adjusted annual rate (SAAR). A few points:

1) This is just one month of data (the usual caveat).

2) Most of the month-to-month increase was due to multi-family starts (Multi-family is volatile month-to-month).

3) Some of the increase appears to be payback from the severe weather earlier this year.

4) This was an easy year-over-year comparison since starts in April last year were near the low for 2013 (see first graph below).

Most of the commentary today is focused on the increase in multi-family starts - and that single family starts have stalled. Yes, but going forward I expect multi-family starts to mostly move sideways and for single family starts to pickup (the opposite of most of the commentary).

There were 301 thousand total housing starts during the first four months of 2014 (not seasonally adjusted, NSA), up 6% from the 284 thousand during the same period of 2013. Single family starts are up close to 2%, and multi-family starts up 17%. The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that Q1 was a difficult year-over-year comparison for housing starts. There was a huge surge for housing starts in Q1 2013 (up 34% over Q1 2012). Then starts softened a little over the next 7 months until November.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to be stronger over the next few quarters (I expect Q1 was the weakest) - and more starts combined with an easier comparison means starts will be up solidly year-over-year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up (but the increase has slowed recently), and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: "State unemployment rates were generally lower in April"

by Calculated Risk on 5/16/2014 10:57:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in April. Forty-three states had unemployment rate decreases, two states had increases, and five states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in April, 8.3 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. No state has double digit or even a 9% unemployment rate. Only Rhode Island (8.3%) and Nevada are at or above 8%.

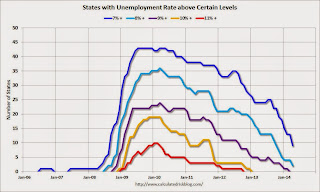

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 9% (purple), 2 states are at or above 8% (light blue), and 9 states are at or above 7% (blue).

Preliminary May Consumer Sentiment decreases to 81.8

by Calculated Risk on 5/16/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May was at 81.8, down from 84.1 in April.

This was below the consensus forecast of 84.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Housing Starts at 1.072 Million Annual Rate in April

by Calculated Risk on 5/16/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,072,000. This is 13.2 percent above the revised March estimate of 947,000 and is 26.4 percent above the April 2013 rate of 848,000.

Single-family housing starts in April were at a rate of 649,000; this is 0.8 percent above the revised March figure of 644,000. The April rate for units in buildings with five units or more was 413,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,080,000. This is 8.0 percent above the revised March rate of 1,000,000 and is 3.8 percent above the April 2013 estimate of

Single-family authorizations in April were at a rate of 602,000; this is 0.3 percent above the revised March figure of 600,000. Authorizations of units in buildings with five units or more were at a rate of 453,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in April (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased in April.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was above expectations of 980 thousand starts in April. Note: Starts for February and March were revised up slightly. I'll have more later.