by Calculated Risk on 5/15/2014 10:55:00 AM

Thursday, May 15, 2014

NAHB: Builder Confidence decreased slightly in May to 45

Catching up: The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45 in May, down from 46 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Remains in Holding Pattern

Builder confidence in the market for newly built, single-family homes in May fell one point to 45 from a downwardly revised April reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

...

“Builders are waiting for consumers to feel more secure about their financial situation,” said NAHB Chief Economist David Crowe. “Once job growth becomes more consistent, consumers will return to the market in larger numbers and that will boost builder confidence.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The index’s components were mixed in May. The component gauging sales expectations in the next six months rose one point to 57 and the component measuring buyer traffic increased two points to 33. The component gauging current sales conditions fell two points to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose one point to 48 while the Midwest fell a single point to 47 and the West posted a four-point drop to 47. The Northeast held steady at 33.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the fourth consecutive reading below 50.

MBA: "Delinquency and Foreclosure Rates Continue to Improve" in Q1

by Calculated Risk on 5/15/2014 10:00:00 AM

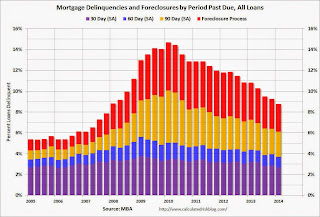

From the MBA: Delinquency and Foreclosure Rates Continue to Improve

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.11 percent of all loans outstanding at the end of the first quarter of 2014, the lowest level since the fourth quarter of 2007. The delinquency rate decreased 28 basis points from the previous quarter, and 114 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.65 percent, down 21 basis points from the fourth quarter and 90 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the first quarter of 2008.

The percentage of loans on which foreclosure actions were started during the first quarter fell to 0.45 percent from 0.54 percent, a decrease of nine basis points, and the lowest level since the second quarter of 2006.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.04 percent, a decrease of 37 basis points from last quarter, and a decrease of 135 basis points from the first quarter of last year. Similar to the previous quarter, 75 percent of seriously delinquent loans were originated in 2007 and earlier, with another 20 percent originated between 2008 and 2010. Loans originated in 2011 and later only accounted for five percent of all seriously delinquent loans.

“We are seeing sustained and significant improvement in overall mortgage performance,” said Mike Fratantoni, MBA’s Chief Economist. “A more stable and stronger job market, coupled with strong credit standards on new loans, has kept delinquency rates on recent vintages low, while the portfolio of loans made pre-crisis is steadily being resolved. Increasing home prices, caused by tight inventories of homes for sale, have helped build an equity cushion for many new borrowers and have helped some homeowners who had been underwater regain positive equity in their properties. The increase in values also helps to facilitate sales of distressed properties, which may further expedite the pace of resolution of pre-crisis loans.”

“Judicial states continue to account for the majority of loans in foreclosure, making up almost 70 percent of loans in foreclosure, while only representing about 40 percent of loans serviced. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 of those were judicial states. While the percentages of loans in foreclosure dropped in both judicial and non-judicial states, the average rate for judicial states was 4.6 percent compared to the average rate of 1.4 percent for non-judicial states.

“New Jersey, a state with a judicial foreclosure system, was the only state in the nation to see an increase in loans in foreclosure over the previous quarter and now has the highest percentage of loans in foreclosure in the nation with eight percent of its loans in the foreclosure process. New Jersey also had the highest percentage of new foreclosures started in the first quarter of 2014, but also had a significant drop in its loans that were 90+ days delinquent, a sign that a large portion of loans previously held in the 90+ day delinquency category entered the foreclosure process during the quarter. emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 2.70% from 2.89% in Q4. This is a normal level.

Delinquent loans in the 60 day bucket decreased to 1.00% in Q1, from 1.06% in Q4. This is slightly above normal.

The 90 day bucket decreased to 2.41% from 2.45%. This is still way above normal (just under 1.0% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 2.65% from 2.86% and is now at the lowest level since Q1 2008.

This survey has shown steady improvement in delinquency and foreclosure rates, but it will take a few more years to work through the backlog - especially in judicial foreclosure states.

Note 1: Most of the remaining problems are with loans made in 2007 or earlier: "75 percent of seriously delinquent loans were originated in 2007 and earlier" and are in judicial foreclosure states.

Note 2: This survey includes all mortgage loans (including terrible lending via Wall Street). The total serious delinquency rate is 5.04% compared to 2.2% for Fannie and Freddie.

Fed: Industrial Production decreased 0.6% in April

by Calculated Risk on 5/15/2014 09:27:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.6 percent in April 2014 after having risen about 1 percent in both February and March. In April, manufacturing output fell 0.4 percent. The index had increased substantially in February and March following a decrease in January; severe weather had restrained production early in the quarter. The output of utilities dropped 5.3 percent in April, as demand for heating returned toward normal levels. The production at mines increased 1.4 percent following a gain of 2.0 percent in March. At 102.7 percent of its 2007 average, total industrial production in April was 3.5 percent above its level of a year earlier. The capacity utilization rate for total industry decreased 0.7 percentage point in April to 78.6 percent, a rate that is 1.5 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.6% is 1.5 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.6% in April to 102.7. This is 23% above the recession low, and 2.0% above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations.

Weekly Initial Unemployment Claims decrease to 297,000, CPI increases 0.3%

by Calculated Risk on 5/15/2014 08:30:00 AM

From the BLS on CPI:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ....The consensus was for a 0.3% increase in CPI in April and for core CPI to increase 0.1%. I'll have more later on inflation.

The index for all items less food and energy rose 0.2 percent in April ... The all items index increased 2.0 percent over the last 12 months; this compares to a 1.5 percent increase for the 12 months ending March, and is the largest 12-month increase since July. The index for all items less food and energy has increased 1.8 percent over the last 12 months.

The DOL reports:

In the week ending May 10, the advance figure for seasonally adjusted initial claims was 297,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since May 12, 2007 when they were 297,000. The previous week's level was revised up by 2,000 from 319,000 to 321,000. The 4-week moving average was 323,250, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 324,750 to 325,250.The previous week was revised up from 319,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 323,250.

This was below the consensus forecast of 317,000. The 4-week average is close to normal levels for an expansion.

Wednesday, May 14, 2014

Thursday: CPI, Unemployment Claims, Industrial Production, Yellen and Much More; Plus San Diego Fire Photo

by Calculated Risk on 5/14/2014 07:17:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 317 thousand from 319 thousand.

• Also at 8:30 AM, the Consumer Price Index for April. The consensus is for a 0.3% increase in CPI in April and for core CPI to increase 0.1%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 5.0, up from 1.3 in April (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for April. The consensus is for no change in Industrial Production, and for Capacity Utilization to decrease to 79.1%.

• At 10:00 AM, the May NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

• Also at 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 12.5, down from 16.6 last month (above zero indicates expansion).

• Also at 10:00 AM, the Mortgage Bankers Association (MBA) Q1 2014 National Delinquency Survey (NDS).

• At 6:10 PM, Speech by Fed Chair Janet Yellen, Small Businesses and the Economy, National Small Business Week 2014, Washington, D.C

Click on photo for larger image.

Click on photo for larger image.

The San Diego fire today from Color Spot's nursery in Fallbrook.

Photo from a friend at Color Spot Nurseries.