by Calculated Risk on 5/09/2014 12:03:00 PM

Friday, May 09, 2014

Hotels: On track for Strongest Year since 2000

From HotelNewsNow.com: STR: US hotel results for week ending 3 May

In year-over-year measurements, the industry’s occupancy increased 7.5 percent to 67.4 percent. Average daily rate increased 5.6 percent to finish the week at US$116.41. Revenue per available room for the week was up 13.6 percent to finish at US$78.42.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

BLS: Jobs Openings at 4.0 million in March

by Calculated Risk on 5/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.0 million job openings on the last business day of March, little changed from 4.1 million in February, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in March for total nonfarm and total private. The quits level was little changed in government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.014 million from 4.125 million in February.

The number of job openings (yellow) are up 3.5% year-over-year compared to March 2013.

Quits increased in March and are up sharply year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million for the second consecutive month, and that quits are increasing.

Thursday, May 08, 2014

Friday: Job Openings

by Calculated Risk on 5/08/2014 08:01:00 PM

Q1 GDP looks worse. Q2 GDP looks better. A couple of short excerpts ...

From the WSJ on Q1: Trade Data Indicate Economy Contracted

J.P. Morgan Chase economists now estimate GDP contracted at a 0.8% pace in the first three months of 2014. Macroeconomic Advisers pegged the decline at 0.6%. Even some of the more optimistic estimates point to slight output shrinkage in the first quarter. Barclays Capital economists see a 0.2% decline and BNP Paribas put the GDP drop at a 0.1% pace.And on Q2 from the WSJ: Economists See Growth Rebound

According to The Wall Street Journal's May survey of 48 economists, the consensus forecast is for annualized real growth in gross domestic product of 3.3%, better than the 3% pace projected in the April survey. ... Nine in the Journal's survey are forecasting second-quarter growth of 4% or better.Q2 should be solid.

Friday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for March from the BLS. In February, the number of job openings were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 5/08/2014 05:48:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in late June.

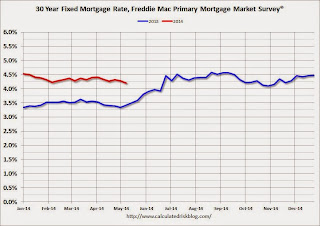

From Freddie Mac: 30-Year Fixed-Rate Mortgage Hits Low for the Year

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down further and following the decline in Treasury yields as the economic growth for the first quarter came in well below market expectations. At 4.21 percent, the 30-year fixed-rate mortgage is at its lowest since the week of November 7, 2013.

30-year fixed-rate mortgage (FRM) averaged 4.21 percent with an average 0.6 point for the week ending May 8, 2014, down from last week when it averaged 4.29 percent. A year ago at this time, the 30-year FRM averaged 3.42 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.21%).

Las Vegas Real Estate in April: Year-over-year Non-contingent Inventory Doubles, Median Price declines

by Calculated Risk on 5/08/2014 03:31:00 PM

Note: Usually I ignore the median price because it can be skewed by the mix of homes sold. I mention the median in this post because I'm looking for price increases to flatten out in Las Vegas because of the rapid increase in inventory - and the median might be an early indicator.

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports slight dip in Southern Nevada home prices

GLVAR reported the median price of existing single-family homes sold in Southern Nevada during April was $192,000, down 1.5 percent from $195,000 in March, but still up 15.0 percent from $167,000 in April of 2013.There are several key trends that we've been following:

...

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,215, up from 3,094 in March, but down from 3,789 one year ago.

GLVAR said 41.4 percent of all existing local homes sold in April were purchased with cash. That’s down from 43.1 percent in March, and well short of the February 2013 peak of 59.5 percent.

...

GLVAR continued to track the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. In April, 12.4 percent of all existing local home sales were short sales, down from 12.9 percent in March. Another 11.4 percent of all April sales were bank-owned properties, down from 11.9 in March.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in April was 13,833. That’s down 0.8 percent from 13,944 in March and down 0.3 percent from one year ago. GLVAR reported a total of 3,697 condos and townhomes listed for sale on its MLS in April, down 0.1 percent from 3,701 listed in March, but up 6.1 percent from one year ago.

By the end of April, GLVAR reported 6,420 single-family homes listed without any sort of offer. That’s down 0.8 percent from 6,470 such homes listed in March, but a 103.1 percent jump from one year ago. For condos and townhomes, the 2,264 properties listed without offers in April represented a 1.4 percent decrease from 2,295 such properties listed in March, but a 79.5 percent increase from one year ago.

emphasis added

1) Overall sales were down about 15% year-over-year.

2) Conventional (equity, not distressed) sales were up 12% year-over-year. In April 2013, only 57.5% of all sales were conventional. This year, in April 2014, 76.2% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) Non-contingent inventory (year-over-year) continues to increase, but the year-over-year rate of increase is slowing. Non-contingent inventory is up 103.1% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014), and this might be showing up in the median price.