by Calculated Risk on 5/03/2014 01:02:00 PM

Saturday, May 03, 2014

Schedule for Week of May 4th

This will be a light week for economic data.

The key reports are the Trade Balance report for March, and the ISM non-manufacturing (service) survey for April.

Also Fed Chair Janet Yellen will testify to Congress on the economic outlook.

Early: the Black Knight Mortgage Monitor for March.

10:00 AM: ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, up from 53.1 in March. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. Imports increased and exports decreased in February.

The consensus is for the U.S. trade deficit to be at $40.2 billion in March from $42.3 billion in February.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for credit to increase $15.1 billion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 344 thousand.

Early: Trulia Price Rent Monitors for April. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

9:30 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Committee on the Budget, U.S. Senate

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

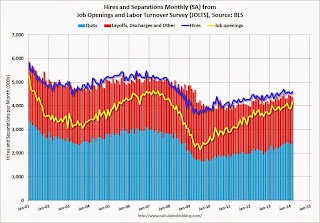

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In February, the number of job openings (yellow) were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Unofficial Problem Bank list declines to 509 Institutions

by Calculated Risk on 5/03/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2, 2014.

Changes and comments from surferdude808:

With four removals this week, the Unofficial Problem Bank List fell to 509 institutions with assets of $163.3 billion. A year ago, the list held 773 institutions with assets of $284.9 billion.

Actions were terminated against Ocean Bank, Miami, FL ($3.3 billion); TruPoint Bank, Grundy, VA ($441 million); and Liberty Bank, South San Francisco, CA ($219 million). First Federal Savings and Loan Association of Hammond, Hammond, IN ($40 million) found its way off the list through an unassisted merger. Next week should be light in terms of changes to the list as we will not receive an update from the OCC for another two weeks.

Friday, May 02, 2014

Merrill: Q1 GDP now tracking negative 0.4%

by Calculated Risk on 5/02/2014 06:30:00 PM

The data flow suggests Q1 was even weaker than the 0.1% real annualized growth rate reported earlier this week. From Merrill Lynch:

The advance 1Q GDP report revealed growth of only 0.1% qoq saar, about a full percentage point less than we had expected. After accounting for weaker-than-expected construction spending and nondurable inventories in March, 1Q GDP is now tracking -0.4%. This is clearly disappointing and pulls down estimates for annual GDP growth.

...

With all the optimism to start this year, nobody was predicting the economy would contract in 1Q. Based on the Blue Chip forecasts in December last year, the average forecast for 1Q was 2.5% with the top 10 highest forecasts of 3.2% and bottom 10 of 2.0%. Obviously, we were all taken by surprise by this brutally cold winter.

It seems that the economy cannot catch a break – each year there is some explanation for a lack of momentum. It was the European crisis in 2010, the US debt rating downgrade/Greek exit in 2011, gridlock in Washington in 2012 and fiscal tightening/government shutdown in 2013. But the shock from weather does not linger and actually reverses quite quickly. With the harsh winter weather in our rearview mirror, we can focus on the underlying healing of the economy, which we think has been significant.

We believe the economy is on track to bounce back, leading us to revise up 2Q GDP growth to 3.6% from 3.2%. However, this increase does not entirely offset the weakness in 1Q, leaving our forecast for annual GDP growth to slip to 2.5% from 2.7%.

...

Importantly, we think the strength in 2Q is not just a one-quarter bounce. We expect growth to remain strong, averaging 3.4% growth in both 3Q and 4Q.

Lawler on New Homes: Sales will probably move higher over the course of 2014, Prices will not

by Calculated Risk on 5/02/2014 03:35:00 PM

Standard Pacific Corp. reported that net home orders (ex jvs) in the quarter ended March 31, 2014 totaled 1,311, down 6.0% from the comparable quarter of 2013. Net orders per active community last quarter were down 14.6% from a year ago. The company’s sales cancellation rate, expressed as % of gross orders, was 14% last quarter, up from 10% a year earlier. Home deliveries last quarter totaled 995, up 5.1% from the comparable quarter of 2013, at an average sales price of $449,000, up 19.7% from a year ago. The company’s order backlog at the end of March was 2,016, up 8.9% from last March. The company attributed the big YOY gain in average sales price to “general price increases within a majority of the Company’s markets, a shift to more move-up product, and a decrease in the use of sales incentives.” Standard Pacific owned or controlled 35,715 lots at the end of March, up 11.2% from last March.

Here are some summary stats for nine large publicly-traded builders.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg | 3/14 | 3/13 | % Chg |

| D.R. Horton | 8,569 | 7,879 | 8.8% | 6,194 | 5,463 | 13.4% | $271,230 | $242,548 | 11.8% |

| Pulte Group | 4,863 | 5,200 | -6.5% | 3,436 | 3,833 | -10.4% | $317,000 | $287,000 | 10.5% |

| NVR | 3,325 | 3,510 | -5.3% | 2,211 | 2,272 | -2.7% | $361,400 | $330,400 | 9.4% |

| The Ryland Group | 2,186 | 2,052 | 6.5% | 1,470 | 1,315 | 11.8% | $327,000 | $277,000 | 18.1% |

| Beazer Homes | 1,390 | 1,521 | -8.6% | 977 | 1,127 | -13.3% | $272,400 | $253,300 | 7.5% |

| Standard Pacific | 1,311 | 1,394 | -6.0% | 995 | 947 | 5.1% | $449,000 | $375,000 | 19.7% |

| Meritage Homes | 1,525 | 1,547 | -1.4% | 1,109 | 1,052 | 5.4% | $365,896 | $314,363 | 16.4% |

| MDC Holdings | 1,236 | 1,300 | -4.9% | 873 | 1,018 | -14.2% | $377,000 | $339,400 | 11.1% |

| M/I Homes | 982 | 1,047 | -6.2% | 737 | 627 | 17.5% | $299,000 | $284,000 | 5.3% |

| Total | 25,387 | 25,450 | -0.2% | 18,002 | 17,654 | 2.0% | $317,582 | $285,200 | 11.4% |

For the group as a whole, net orders per active community last quarter were down about 6% from a year earlier.

The combined order backlog (in units) for these nine builders at the end of March was 36,257, up just 0.5% from last March.

While home deliveries in units for these builders last quarter were up just 2% from a year earlier, home deliveries in dollar terms were up 13.5% YOY, reflecting the sizable increases in average sales price. Most builders attributed the ASP gains to a combination of general price gains in many of their markets and a product-shift mix toward larger homes/move-up buyers. While not all builders commented on first-time buyers, comments from those that did suggest that first-time buyer purchases of new homes were down from a year ago. Operating margins on average were up significantly from a year ago, with some builders reporting their highest margins in 7-8 years.

While land/lot acquisitions varied significantly across these builders, in aggregate they increased sharply their land/lot acquisitions during the second half of 2012 through the third quarter of 2013. Longer-than-normal development timelines, however, partly related to “supply-chain” issues, limited their ability to meet the strong demand in the first half of 2013, and limited supply enabled builders to increase prices significantly last year.

Such “supply” problems should not be an issue in 2014, and in aggregate these 9 builders expect (and plan) to increase their number of active communities in 2014 at a double-digit pace. A key issue, however, will be demand: both interest rates and home prices are higher than they were in the first half of 2013, with prices up significantly in many parts of the country. As noted before, many builders hiked prices sharply because they could not meet demand in the first half of 2013. With supply issues unlikely to be an “issue” in 2014, it seems highly likely that the “pricing power” builders had in 2013 will not be evident in 2014, and in fact “effective” home prices may ease a bit as builders significantly increase their use of sales incentives from 2013’s unusually low level.

So SF home sales will probably move higher over the course of 2014, though prices will not. But the pace of increase is likely to be slower than most folks thought as the year began, and the hoped for recovery in home purchases by first-time home buyers in 2014 has not only not been seen, but it appears to have dipped somewhat from a year ago. So far the only builder to react to this trend is D.R. Horton, who is rolling out a new “express homes” product line in select markets with price targets in the $120,000 to $150,000 range. As a Horton official noted in the company’s latest conference call, the sharp price increases by builders last year had priced a “lot” of first-time buyers out of the market.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 5/02/2014 01:55:00 PM

By request, here is an update on an earlier post through the April employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is just starting the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Fifteen months into Mr. Obama's second term, there are now 4,986,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 710,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level. Right now I'm expecting some increase in public employment in 2014.