by Calculated Risk on 4/30/2014 08:30:00 AM

Wednesday, April 30, 2014

BEA: Real GDP increased at 0.1% Annualized Rate in Q1

From the BEA: Gross Domestic Product: First Quarter 2014 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the first quarter (that is, from the fourth quarter of 2013 to the first quarter of 2014), according to the "advance" estimate released by the Bureau of Economic Analysis.The advance Q1 GDP report, with 0.1% annualized growth, was below expectations of a 1.1% increase. Personal consumption expenditures (PCE) increased at a 3.0% annualized rate - a solid pace.

...

The increase in real GDP in the first quarter primarily reflected a positive contribution from personal consumption expenditures (PCE) that was partly offset by negative contributions from exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

However the the change in inventories subtracted 0.57 percentage points from growth in Q1, exports subtracted 0.83 percentage points, and both non-residential and residential investment were negative.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The drag from state and local governments (red) appeared to have ended last year after an unprecedented period of state and local austerity (not seen since the Depression). However State and local governments subtracted from GDP in Q1.

Overall I expect state and local governments to continue to make a small positive contributions to GDP in 2014.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4 2013 and Q1 2014. However since RI is still very low, I expect RI to make a positive contribution to GDP in 2014.

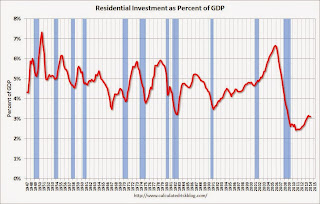

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".I'll add details for investment in offices, malls and hotels next week.

Overall this was a weak report, although PCE growth was decent. Private investment (even excluding the change in inventories) was negative, and that is the key to more growth going forward.

ADP: Private Employment increased 220,000 in April

by Calculated Risk on 4/30/2014 08:19:00 AM

Private sector employment increased by 220,000 jobs from March to April according to the April ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 210,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market is gaining strength. After a tough winter employers are expanding payrolls across nearly all industries and company sizes. The recent pickup in job growth at mid-sized companies may signal better business confidence. Job market prospects are steadily improving.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for April will be released on Friday.

MBA: Mortgage Applications Decrease in Latest Survey, Refinance Activity Lowest Since 2008

by Calculated Risk on 4/30/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 25, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

“Both purchase and refinance application activity fell last week, and the market composite index is at its lowest level since December 2000,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase applications decreased 4 percent over the week, and were 21 percent lower than a year ago. Refinance activity also continued to slide despite a 30-year fixed rate that was unchanged from the previous week. The refinance index dropped 7 percent to the lowest level since 2008, continuing the declining trend that we have seen since May 2013.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.49 percent, with points decreasing to 0.38 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 (almost one year ago).

With the mortgage rate increases, refinance activity will be very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 29, 2014

Wednesday: FOMC Announcement, Q1 GDP and more

by Calculated Risk on 4/29/2014 06:54:00 PM

From Goldman Sachs economist Kris Dawsey: FOMC Preview: A Bit Brighter

The April FOMC meeting will probably be a quiet one compared with the March meeting, with no press conference or Summary of Economic Projections (SEP) to be released. We anticipate that the Fed will want to make relatively few changes to the statement, especially in the monetary policy paragraphs. The largest changes will probably occur in the first paragraph on economic activity, reflecting the passing drag from adverse weather.Wednesday:

...

Regarding the FOMC's policy decision, a further $10bn/month tapering of asset purchases is almost a foregone conclusion, split equally between Treasuries and MBS. This would bring the monthly purchase amount down to $45bn ($25bn Treasuries and $20bn MBS), to take effect in May. ...

It appears likely that Minneapolis Fed President Kocherlakota—who lodged a dovish dissent at the March meeting—will not dissent to the April statement, based on a recent interview.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in April, up from 191,000 in March.

• At 8:30 AM, Q1 GDP (advance estimate). This is the advance estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 1.1% annualized in Q1.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for an increase to 56.9, up from 55.9 in March.

• At 2:00 PM, the FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

An exciting time for the Data Tribe

by Calculated Risk on 4/29/2014 03:12:00 PM

This is an exciting time to be a member of the "data tribe" (those who follow data closely and are willing to change their views based on the data). There are two new internet sites worth following: The Upshot at the NY Times, and Vox (both feeds added to right sidebar).

Here is fun piece from Neil Irwin at The Upshot: No One Cares About Economic Data Anymore. That’s Good News.

If people in your office seem to be tingling with excitement this week, it is probably because of all the big economic news on the way. The two biggest regular United States economic reports are scheduled to come out, with first-quarter gross domestic product on tap for Wednesday and April jobs numbers out on Friday. Federal Reserve policy makers are meeting Tuesday and Wednesday for one of their regular sessions to set the nation’s monetary policy. And a variety of other important data releases are coming, including personal income and spending, manufacturing and home prices.Personally I'm excited about all the data to be released this week, but Irwin makes an excellent point. Most people don't feel the need to pay close attention any more.

What, no tingling? You’re not alone. Because as important as all that stuff is, it is substantially less important, and less interesting, than it has been any time in the last seven years. The economy has gotten boring, and that’s fantastic news — even if it would be even better news if that underlying growth path were a bit stronger.

P.S. A suggestion for The Upshot - drop the "The", just Upshot, it is cleaner.