by Calculated Risk on 4/30/2014 07:00:00 AM

Wednesday, April 30, 2014

MBA: Mortgage Applications Decrease in Latest Survey, Refinance Activity Lowest Since 2008

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 25, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

“Both purchase and refinance application activity fell last week, and the market composite index is at its lowest level since December 2000,” said Mike Fratantoni, MBA’s Chief Economist. “Purchase applications decreased 4 percent over the week, and were 21 percent lower than a year ago. Refinance activity also continued to slide despite a 30-year fixed rate that was unchanged from the previous week. The refinance index dropped 7 percent to the lowest level since 2008, continuing the declining trend that we have seen since May 2013.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.49 percent, with points decreasing to 0.38 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 (almost one year ago).

With the mortgage rate increases, refinance activity will be very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 29, 2014

Wednesday: FOMC Announcement, Q1 GDP and more

by Calculated Risk on 4/29/2014 06:54:00 PM

From Goldman Sachs economist Kris Dawsey: FOMC Preview: A Bit Brighter

The April FOMC meeting will probably be a quiet one compared with the March meeting, with no press conference or Summary of Economic Projections (SEP) to be released. We anticipate that the Fed will want to make relatively few changes to the statement, especially in the monetary policy paragraphs. The largest changes will probably occur in the first paragraph on economic activity, reflecting the passing drag from adverse weather.Wednesday:

...

Regarding the FOMC's policy decision, a further $10bn/month tapering of asset purchases is almost a foregone conclusion, split equally between Treasuries and MBS. This would bring the monthly purchase amount down to $45bn ($25bn Treasuries and $20bn MBS), to take effect in May. ...

It appears likely that Minneapolis Fed President Kocherlakota—who lodged a dovish dissent at the March meeting—will not dissent to the April statement, based on a recent interview.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in April, up from 191,000 in March.

• At 8:30 AM, Q1 GDP (advance estimate). This is the advance estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 1.1% annualized in Q1.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for an increase to 56.9, up from 55.9 in March.

• At 2:00 PM, the FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

An exciting time for the Data Tribe

by Calculated Risk on 4/29/2014 03:12:00 PM

This is an exciting time to be a member of the "data tribe" (those who follow data closely and are willing to change their views based on the data). There are two new internet sites worth following: The Upshot at the NY Times, and Vox (both feeds added to right sidebar).

Here is fun piece from Neil Irwin at The Upshot: No One Cares About Economic Data Anymore. That’s Good News.

If people in your office seem to be tingling with excitement this week, it is probably because of all the big economic news on the way. The two biggest regular United States economic reports are scheduled to come out, with first-quarter gross domestic product on tap for Wednesday and April jobs numbers out on Friday. Federal Reserve policy makers are meeting Tuesday and Wednesday for one of their regular sessions to set the nation’s monetary policy. And a variety of other important data releases are coming, including personal income and spending, manufacturing and home prices.Personally I'm excited about all the data to be released this week, but Irwin makes an excellent point. Most people don't feel the need to pay close attention any more.

What, no tingling? You’re not alone. Because as important as all that stuff is, it is substantially less important, and less interesting, than it has been any time in the last seven years. The economy has gotten boring, and that’s fantastic news — even if it would be even better news if that underlying growth path were a bit stronger.

P.S. A suggestion for The Upshot - drop the "The", just Upshot, it is cleaner.

NMHC Survey: Apartment Market Conditions Tighter in April 2014

by Calculated Risk on 4/29/2014 12:04:00 PM

From the National Multi Housing Council (NMHC): Overbuilding Overblown? Apartment Markets Expand in April NMHC Quarterly Survey

Apartment markets rebounded from a soft January, with all four indexes above the breakeven level of 50 in the latest National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. Last year’s concerns of overbuilding or lack of capital have largely eased, reflected in market tightness (56), sales volume (52), equity financing (53) and debt financing (63) all above 50 for the first time since April 2013.

“Supply appears to have ramped up enough to meet approximate ongoing demand with few, if any, signs of irrational exuberance,” said NMHC Senior Vice President of Research and Chief Economist Mark Obrinsky. “A handful of submarkets are facing a temporary surge in new deliveries that may put downward pressure on occupancy rates or rent growth. However, increased development costs could well keep a lid on new supply.”

...

The Market Tightness Index rose from 41 to 56. Almost half (47 percent) of respondents reported unchanged conditions, and approximately one-third (32 percent) saw conditions as tighter than three months ago, in contrast with January’s survey, where almost one-third saw conditions as looser than three months ago. This is the first time the index has indicated overall improving conditions since July 2013.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. The quarterly increase was small, but indicates tighter market conditions.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey has been bouncing around 50 - and now suggests vacancy rates might be close to a bottom.

HVS: Q1 2014 Homeownership and Vacancy Rates

by Calculated Risk on 4/29/2014 10:17:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.8% in Q1, from 65.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

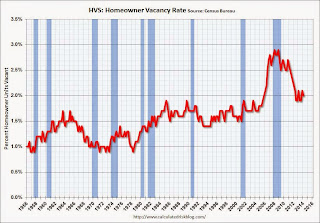

The HVS homeowner vacancy decreased to 2.0% in Q1.

The HVS homeowner vacancy decreased to 2.0% in Q1.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.