by Calculated Risk on 4/15/2014 08:04:00 PM

Tuesday, April 15, 2014

Wednesday: Housing Starts, Industrial Production, Yellen Speech, Beige Book

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not quite yet).

In March 2013, starts were at a 1.005 million seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.206 million SAAR in March (not likely). For NDD to win, starts would have to fall to 905 thousand SAAR (possible). NDD could also "win" if permits fall to 790 thousand SAAR from 890 thousand SAAR in March 2013 (not likely).

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for March. Total housing starts were at 907 thousand (SAAR) in February. Single family starts were at 583 thousand SAAR in February. The consensus is for total housing starts to increase to 965 thousand (SAAR) in March.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

• At 12:25 PM, Speech by Fed Chair Janet Yellen, Monetary Policy and the Economic Recovery, At the Economic Club of New York, New York, New York

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/15/2014 04:39:00 PM

From housing economist Tom Lawler:

Based on realtor association/board/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.64 million in March, up 0.9% from February’s preliminary pace, but down 6.5% from last March’s seasonally adjusted pace. If my estimate is correct, then first-quarter existing home sales this year would be down 6.3% from the comparable quarter of 2013. Depending on the area of the country, weather, lower distressed sales, lower investor purchases, and weak demand from primary-residence purchases (especially from first-time buyers), the latter partly reflecting lower inventories of affordably-priced homes (even though overall inventories of homes for sale were higher), contributed to the “surprisingly” weak pace of sales last quarter.

On the inventory front, I estimate (based on realtor/MLS reports, as well as reports from entities tracking listings) that the inventory of existing homes for sale as measured by the NAR increased by 4.0% from February to March to 2.080 million, which would be up 7.8% from last March’s level.

Finally, my “best guess” based on realtor reports is that the NAR’s estimate of the median existing SF home sales price in March will be up 8.7% from last March.

CR Note: The NAR is scheduled to report March existing home sales on Tuesday, April 22nd. Based on Lawler's estimates, months-of-supply increased to around 5.4 months in March - the highest level since mid-2012.

DataQuick on SoCal: March Home Sales down 14% Year-over-year, Conventional (Equity) Sales increase

by Calculated Risk on 4/15/2014 02:59:00 PM

From DataQuick: Southland Home Sales Stuck at 6-year Low; Median Price Rises to 6-Year High

Southern California home sales quickened last month compared with February, as they normally do, but remained far below average and at the lowest level for a March in six years. ... A total of 17,638 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 25.7 percent from 14,027 sales in February, and down 14.3 percent from 20,581 sales in March last year, according to San Diego-based DataQuick.Generally both distressed sales and investor buying is declining - and this is dragging down overall sales (plus inventory is still very low). And even though total sales are down year-over-year, normal equity transactions are up 9% year-over-year.

...

Sales during the month of March have ranged from a low of 12,808 in 2008 to a high of 37,030 in 2004. Last month’s sales were 26.9 percent below the average number of sales – 24,115 – for March since 1988. Sales haven’t been above average for any month in more than seven years.

“Southland home buying got off to a very slow start this year, with last month’s sales coming in at the second-lowest level for a March in nearly two decades. We see multiple reasons for this: The inventory of homes for sale remains thin in many markets. Investor purchases have fallen. The jump in home prices and mortgage rates over the past year has priced some people out of the market, while other would-be buyers struggle with credit hurdles. Also, some potential move-up buyers are holding back while they weigh whether to abandon a phenomenally low interest rate on their current mortgage in order to buy a different home,” said DataQuick analyst Andrew LePage.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.4 percent of the Southland resale market in March. That was down from a revised 6.7 percent the prior month and down from 13.8 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 7.7 percent of Southland resales last month. That was down from a revised 9.3 percent the prior month and down from 18.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 27.4 percent of the homes sold last month, down from 28.9 percent in February and down from 31.2 percent a year earlier.

emphasis added

It is important to recognize that declining existing home sales is NOT a negative indicator for the housing recovery. The reason for the decline in overall existing home sales is fewer distressed sales and less investor buying. Those are positive trends!

Key Inflation Measures Shows Slight Increase, but still Low in March

by Calculated Risk on 4/15/2014 11:15:00 AM

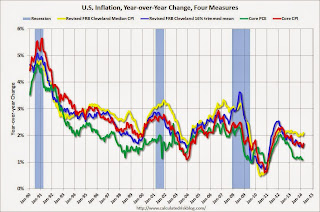

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also increased 0.2% (2.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in March. The CPI less food and energy increased 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.7%. Core PCE is for February and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI increased 2.5% annualized.

These measures suggest inflation remains below the Fed's target.

NAHB: Builder Confidence increased slightly in April to 47

by Calculated Risk on 4/15/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 47 in April, up from 46 in March. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Holds Steady in April

Builder confidence in the market for newly built, single-family homes rose one point to 47 in April from a downwardly revised March reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

...

“Job growth is proceeding at a solid pace, mortgage interest rates remain historically low and home prices are affordable,” said NAHB Chief Economist David Crowe. “While these factors point to a gradual improvement in housing demand, headwinds that are holding up a more robust recovery include ongoing tight credit conditions for home buyers and the fact that builders in many markets are facing a limited availability of lots and labor.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions in April held steady at 51 while the component gauging traffic of prospective buyers was also unchanged at 32. The component measuring expectations for future sales rose four points to 57.

The HMI three-month moving average was down in all four regions. The West fell nine points to 51 and the Midwest posted a four-point decline to 49 while the Northeast and South each dropped two points to 33 and 47, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the third consecutive reading below 50.