by Calculated Risk on 4/08/2014 08:29:00 AM

Tuesday, April 08, 2014

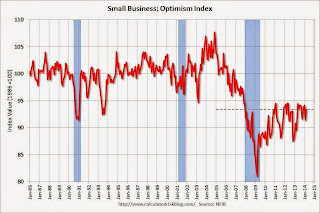

NFIB: Small Business Optimism Index increases in March

From the National Federation of Independent Business (NFIB): Small Business Rollercoaster Continues

The latest Small Business Optimism Index rose 2 points to 93.4, mostly reversing the February decline ... NFIB owners increased employment by an average of 0.18 workers per firm in March (seasonally adjusted), an improvement over February’s 0.11 reading and the sixth positive month in a row.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.4 in March from 91.4 in February.

Monday, April 07, 2014

Tuesday: Small Business Confidence, Job Openings

by Calculated Risk on 4/07/2014 09:32:00 PM

At the end of each day, I always check the Alphaville Closer.

A couple of interesting links:

• Introducing the new St Louis FRED blog (CR Note: Added FRED blog to right sidebar)

• And from Business Insider: Wall Street's Brightest Minds Reveal THE MOST IMPORTANT CHARTS IN THE WORLD

Tuesday:

• 7:30 AM ET, NFIB Small Business Optimism Index for March.

• 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. The number of job openings (yellow) were up 7.6% year-over-year compared to January 2013, and Quits decreased in January and were up about 3% year-over-year.

CBO: Federal Deficit through March $187 billion less this year than it was in fiscal year 2013

by Calculated Risk on 4/07/2014 06:56:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for March 2014

The federal government ran a budget deficit of $413 billion for the first six months of fiscal year 2014, CBO estimates—$187 billion less than the shortfall recorded in the same span last year. Revenues were about 10 percent higher; and outlays, about 4 percent lower. ...And for March 2014:

The federal government incurred a deficit of $36 billion in March 2014, CBO estimates—$71 billion less than the $107 billion deficit incurred in March 2013. Because March 1 fell on a weekend in 2014, certain payments that ordinarily would have been made in March this year were made in February. Without those shifts in the timing of payments, and prepayments of deposit insurance premiums that lowered collections in fiscal year 2013, the deficit in March 2014 would have been $34 billion smaller than it was in the same month last year.The consensus was the deficit for March would be around $133 billion, and it appears the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

emphasis added

Of course there will be a solid surplus in April.

Weekly Update: Housing Tracker Existing Home Inventory up 7.7% year-over-year on April 7th

by Calculated Risk on 4/07/2014 04:14:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY.

Inventory in 2014 (Red) is now 7.7% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Lawler: Phoenix "listings are way up and sales are way down"

by Calculated Risk on 4/07/2014 02:59:00 PM

From housing economist Tom Lawler:

ARMLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 6,712 in March, down 17.7% from last March’s pace. Lender-owned properties were 6.9% of last month’s sales, down from 11.6% last March, while last month’s short-sales share was 5.1%, down from 15.1% a year ago. All-cash transactions were 33.1% of last month’s sales, down from 41.5% last March. Active listings in March totaled 29,939, up 0.9% from February and up 44.4% from a year ago. The median home sales price last month was $187,000, up 11.6% from last March. Last month’s sales were the lowest for a March since 2008.

| Residential Home Sales, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Mar-11 | Mar-12 | Mar-13 | Mar-14 | |

| Number of Sales by Type | ||||

| Lender owned | 4,589 | 1,872 | 948 | 462 |

| Short sales | 1,889 | 2,275 | 1,233 | 339 |

| "Non-distressed" sales | 3,455 | 4,722 | 5,972 | 5,911 |

| Total sales | 9,933 | 8,869 | 8,153 | 6,712 |

| Share of Sales by Type (and All-Cash Share) | ||||

| Lender owned | 46.2% | 21.1% | 11.6% | 6.9% |

| Short sales | 19.0% | 25.7% | 15.1% | 5.1% |

| Non-distressed | 34.8% | 53.2% | 73.2% | 88.1% |

| All-cash | 49.8% | 47.6% | 41.5% | 33.1% |

Click on graph for larger image.

Click on graph for larger image.This graph from Tom Lawler shows the active inventory in the Phoenix area. As Tom noted, listings are way up - but also way below the "bust" years.