by Calculated Risk on 4/07/2014 12:12:00 PM

Monday, April 07, 2014

Employment Diffusion Indexes

Here is something I like to look at every month.

These diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment was at 58.5 in March, down from 59.1 in February.

For manufacturing, the diffusion index decreased to 50.0, down from 51.9 in March.

Job growth was fairly widespread for private employment in March.

Mortgage Monitor: Delinquencies are below 6% for the first time since 2008, "Little Sign of Easing" in Credit Standards

by Calculated Risk on 4/07/2014 08:29:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for February today. According to LPS, 5.97% of mortgages were delinquent in February, down from 6.27% in January. BKFS reports that 2.22% of mortgages were in the foreclosure process, down from 3.38% in February 2013.

This gives a total of 8.17% delinquent or in foreclosure. It breaks down as:

• 1,749,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,242,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,115,000 loans in foreclosure process.

For a total of 4,106,000 loans delinquent or in foreclosure in February. This is down from 5,104,000 in February 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years. BKFS reports: "Delinquencies are below 6% for the first time since ‘08; foreclosures down 34% in the last year"

The second graph from BKFS shows the credit score distribution for all mortgage originations. From Herb Blecher, senior vice president of Black Knight’s Data and Analytics division:

The second graph from BKFS shows the credit score distribution for all mortgage originations. From Herb Blecher, senior vice president of Black Knight’s Data and Analytics division:

“Credit standards have shown little sign of easing -- only about 30 percent of 2013 loans went to borrowers with credit scores below 720 -- which indicates that significant opportunity to expand mortgage origination activity is available, if risk appetites allow."There is much more in the mortgage monitor.

emphasis added

Sunday, April 06, 2014

Sunday Night Futures

by Calculated Risk on 4/06/2014 09:46:00 PM

Monday:

• Early: The Black Knight February Mortgage Monitor report. This is a monthly report of mortgage delinquencies and other mortgage data.

• At 3:00 PM, Consumer Credit for February from the Federal Reserve.

Weekend:

• Schedule for Week of April 6th

• WSJ Employment Graph ignores Demographics, Needs Correction

• Research: Labor Force Participation Rate

• Labor Force Participation Rate Update

• Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are up slightly (fair value).

Oil prices are mixed with WTI futures at $100.85 per barrel and Brent at $106.01 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.55 per gallon (up sharply over the last two months and about the same level as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation

by Calculated Risk on 4/06/2014 06:42:00 PM

An interesting topic is why there has been a steady decline in the labor force participation rate for prime-working age men (ages 25 to 54).

In the previous post I wrote: "The participation rate for [prime-working age] men decreased from the high 90s decades ago, to 88.5% in March. This is just above the lowest level recorded for prime working age men. This declining participation is a long term trend, and the result of inherited wealth - OK, just joking - the reasons for this decline in working age men participation are varied and need more research, however some analysts incorrectly blame this trend solely on more social benefits."

First here is a repeat of the of the graph I posted earlier today:

Click on graph for larger image.

Click on graph for larger image.

This graph shows the changes in the participation rates for men and women and combined since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and then flattened out.

The decline in the participation rate for prime-working age men is a long term trend.

The second graph shows just prime-working age men (Note the change in scale from the previous graph to better show the trend).

The second graph shows just prime-working age men (Note the change in scale from the previous graph to better show the trend).

The dashed line is the trend from 1960 through 2007 (trend line does not include the recent recession - economic weakness has pushed down the participation rate below trend recently).

So why the long term decline? Here are some possible reasons:

1) Cultural changes. As a larger percentage of women entered the labor force (pink line in first graph), this allowed men some more options, such as: a) take some time off between jobs, b) go back to school to improve skills or be able to change careers, c) be a "Mr. Mom". There used to be stigma for men not working - or ego problems with women being the prime "bread winner" - but over time that stigma has lessened. Even though the percentage of prime-working age women in the labor force is now declining slowly, I think the cultural changes are still the main driver for the decline in the participation rate for men.

2) Demographics. It is possible that the changing ethnicity of the prime working-age population is contributing to the decline in the participation rate for prime-working age men. This is unclear from the top level data (We'd need data by ethnicity, sex, and age group).

3) Underground Economy. It is also possible that the underground economy (cash economy) is growing, and some of these men are actually working "off the books" for cash.

4) Increased benefits for disability and illness. Note: Everyone opposes fraud, but that is probably only a small problem. Overall most Americans would consider it good news that people with serious illnesses or disabilities receive benefits - even if that has contributed a little to the decline in the participation rate.

5) Inheritance and lower estate taxes. Although the impact has probably been small, the decline in the participation rate for working-age men has tracked the decline in the inheritance tax over the last 50 years. I'm guessing there are more working-age men not working today because they are living off their inheritance.

I'm sure there are other possible reasons too. It is important to understand - that for whatever reason - this decline in participation for prime working-age men is one of the drivers of the overall decline in participation (the two main drivers are a large cohort moving into retirement, and more young people staying in school).

Labor Force Participation Rate Update

by Calculated Risk on 4/06/2014 12:12:00 PM

A key point: A significant decline in the participation rate had been expected, and probably half or more of the recent decline in the participation rate was due to changing demographics (and long term trends), as opposed to economic weakness.

A few key long terms trends include:

• A decline in participation for those in the 16 to 24 age groups. This is mostly due to higher enrollment rate in school (see the graph at Get the Lead Out Update). This is great news for the future and is possibly related to removing lead from the environment (see from Brad Plumer at the WaPo: Study: Getting rid of lead does wonders for school performance)

• There is a general long term trend of declining participation for those in the key working years (25 to 54). See the second graph below.

• There has been an increase in participation among older age groups. This is probably a combination of financial need (not good news) and many workers staying healthy or engaged in less strenuous jobs.

Of course, even though the participation rate is increasing for older age groups, there are more people moving into those groups so the overall participation rate falls.

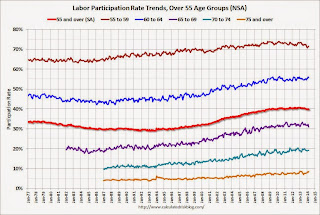

As an example, the participation rate for those in the "55 to 59" group has increased from 68.4% twenty years ago, to 71.6% now. And the participation rate for those in the "60 to 64" age group has increased from 44.7% to 55.9% over the same period. However, even though the participation rate for each age group has been increasing, when people move from the "55 to 59" age group to the "60 to 64" group, their participation rate falls (from 71.6% to 55.9%). And right now a large cohort is moving into these older age groups, and that is pushing down the overall participation rate.

Here is an update to a few graphs I've posted before.

Click on graph for larger image.

Click on graph for larger image.

Here is a repeat of the graph I posted Friday showing the participation rate and employment-to-population ratio.

The Labor Force Participation Rate increased to 63.2% in March (blue line). This is down slightly from 63.3% in March 2013.

This is the percentage of the working age population (16 and over, Civilian noninstitutional population1) in the labor force.

Here is a look at some of the long term trends (updating graphs through March 2014):

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and then flattened out. The participation rate for women in March was 74.2%.

Note that the trend for prime working age women was down BEFORE the recession. This might be because of changing values, economic situations, or demographics (as an example, the cultural norms for some recent immigrant groups is for the women to work at home).

The participation rate for men decreased from the high 90s decades ago, to 88.5% in March. This is just above the lowest level recorded for prime working age men. This declining participation is a long term trend, and the result of inherited wealth - OK, just joking - the reasons for this decline in working age men participation are varied and need more research, however some analysts incorrectly blame this trend solely on more social benefits.

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.

There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red). This is directly related to more education.

• The participation rate for the 'over 55' age group was been rising since the mid '90s (purple), and has started to decline recently. Now that the leading edge of the baby boomers are over 65, the 'over 55' participation will decline.

• The participation rate for the '20 to 24' age group fell recently too (more education before joining the labor force). This appears to have stabilized.

The last graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The last graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is generally trending up for all older age groups.

The '55 and over' participation rate is starting to decline as the oldest baby boomers move into even older age groups.

1 From the BLS: "Civilian noninstitutional population (Current Population Survey) Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces."