by Calculated Risk on 8/19/2013 08:45:00 PM

Monday, August 19, 2013

Inventory, Inventory, Inventory

The NAR is scheduled to report July existing home sales on Wednesday. The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. However economist Tom Lawler is estimating the NAR will report a July sales rate of 5.33 million. So it is likely that the NAR will report above consensus sales.

However I wouldn't read too much into an above consensus report. I suspect some people pushed to close in July before their mortgage rate "lock" expired, and my very early guess is existing home sales will decline in August.

Of course what really matters in the NAR report is inventory and months-of-supply. It is mostly visible inventory that impacts prices, and it appears inventory bottomed earlier this year.

Watching inventory during the bubble helped me call the top of the housing market. And watching inventory decline helped me call the bottom for prices (see Feb 2012: The Housing Bottom is Here), and now inventory is suggesting price increases will slow. Below is a table of the year-over-year change in inventory since January 2012. Notice that the year-over-year change will probably turn positive soon. Inventory is still very low, but this will be a key change to watch.

| Year-over-year Change in Inventory | |

|---|---|

| YoY % Change | |

| Jan-12 | -19.9% |

| Feb-12 | -20.3% |

| Mar-12 | -23.4% |

| Apr-12 | -21.9% |

| May-12 | -21.1% |

| Jun-12 | -25.0% |

| Jul-12 | -23.8% |

| Aug-12 | -20.5% |

| Sep-12 | -25.2% |

| Oct-12 | -23.0% |

| Nov-12 | -24.0% |

| Dec-12 | -21.1% |

| Jan-13 | -24.0% |

| Feb-13 | -20.8% |

| Mar-13 | -16.8% |

| Apr-13 | -14.0% |

| May-13 | -13.0% |

| Jun-13 | -7.6% |

| Jul-13 | |

Tuesday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July will be released. This is a composite index of other data.

Weekly Update: Existing Home Inventory is up 21.7% year-to-date on Aug 19th

by Calculated Risk on 8/19/2013 05:20:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

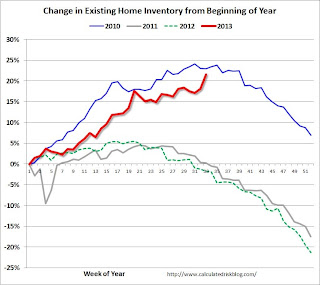

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.7%, and there might be some further increases over the next few weeks. It is important to remember that inventory is still very low, and is down 5.7% from the same week last year according to Housing Tracker.

This strongly suggests inventory bottomed early this year. I expect inventory to be up year-over-year very soon (maybe in September), and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory also means price increases will slow.

Research: Drop in Jobless Claims suggests pickup in Wage Growth

by Calculated Risk on 8/19/2013 01:10:00 PM

Fast FT has an excerpt from a Deutsche Bank research note: US jobless claims hold signs for the second half

So far, rises in wages and salaries have barely been able to outpace the combined effect of inflation and the higher payroll tax introduced at the start of the year.The following graph is from the research note. This shows that the year-over-year change in weekly unemployment claims (inverted) typically leads wage growth. However, I think wage growth will remain sluggish with the high unemployment rate.

Deutsche expects that could change:

If the recent four-week average (332,000) on claims is sustained over the entirety of the third quarter, this should be consistent with an acceleration in wages and salary income toward 5.7% by yearend—which would significantly outpace the drag from inflation and the payroll taxexcerpt with permission

BLS: State unemployment rates were "little changed" in July

by Calculated Risk on 8/19/2013 10:16:00 AM

From the BLS: Jobless rates up in 28 states, down in 8 in July; payroll jobs up in 32 states, down in 17

Regional and state unemployment rates were little changed in July. Twenty-eight states and the District of Columbia had unemployment rate increases, 8 states had decreases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in July, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

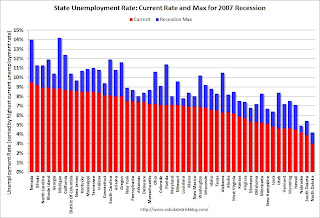

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only two states: Nevada and Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only two states have an unemployment rate above 9% (purple), seventeen states above 8% (light blue), and 28 states above 7% (blue).

Sunday, August 18, 2013

San Francisco: Apartments converting back to condos

by Calculated Risk on 8/18/2013 07:57:00 PM

From Carolyn Said at the San Francisco Chronicle: Bay Area rental pendulum swings to condos

Some condominium complexes opened at the worst possible time - in the depths of the real estate downturn when home buyers were few and far between. They coped by becoming for-rent apartment buildings instead. But now, as the housing recovery accelerates, several East Bay and South Bay developments are switching back to for-sale condos.The conversion of these condo projects to apartments was an interesting story during the housing bust (and a way to take excess "for sale" inventory off the market) - and now they are converting back to condos (taking advantage of the lack of "for sale" inventory). This is similar to a story by Cale Ottens at the LA Times last week: Condo conversions inch up in Los Angeles.

...

For instance, the 125-unit Broadway Grand in Oakland, developed by Signature Properties, first opened as a condo complex, sold 17 units, and then switched to rentals as the market tanked ... Last year it went condo again, and now has sold all but 11 of its units.

Similarly, the Skyline in San Jose with 121 units is now switching to condos after opening as rentals during the downturn. In Emeryville, the 424-unit Bridgewater is switching from rentals to condos. The current phase II, which started in June with 174 homes ranging from $185,000 to $450,000, is finding a receptive audience, said Alan Mark, president of the Mark Co., which is marketing the complex.