by Calculated Risk on 8/16/2013 03:35:00 PM

Friday, August 16, 2013

Lawler: Early Look at Existing Home Sales in July

From housing economist Tom Lawler:

Based on local realtor association/board/MLS reports I have seen across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.33 million in July, up 4.9% from June’s disappointing pace.

Local data indicate that existing home sales on an unadjusted basis almost certainly showed substantially faster YOY growth in July than in June. Some acceleration was to be expected, as there were more business days this July than last July, while there were fewer business days this June than last June. However, most regional home sales reports showed YOY growth rates well in excess of any “business-day” effects.

On the inventory front, the vast bulk of realtor reports showed a monthly gain in listings. Other “listings trackers” also point to a monthly increase in the number of homes for sale. While NAR inventory estimates don’t always match reported changes in listings, I estimate that the NAR’s estimate of the inventory of existing home sales in July will be 2.26 million, up 3.2% from June and down 5.8% from last July.

It is worth noting that a faster home sales pace in July does not mean that the jump in mortgage rates has had little or no effect on home sales. Existing home sales are closed sales, and many folks who settled in July locked in rates a few months ago. In addition, there is evidence that when interest rates first started moving higher – just not by a boatload – there was an increase in contracted sales reflecting home buyers’ fears of rates rising further. And, some closings may have been accelerated to beat rate-lock expirations.

CR Note: The NAR is scheduled to report July existing home sales on Wednesday, August 21st.

Based on Tom's estimates of a 5.33 million sales rate, and inventory at around 2.26 million for July, and months-of-supply around 5.1 (down from 5.2 months in June). This would still be a very low level of inventory - probably the lowest for July since 2002 or so - also a 5.8% year-over-year decline in inventory would be the smallest year-over-year decline since early 2011 (when inventory started to decline sharply). Note: In June, inventory was down 7.6% compared to June 2012. These smaller year-over-year declines suggest inventory bottomed earlier this year.

Note: Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 3 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer (the "consensus" for July is 5.13 million) .

Note: The consensus average miss was 170 thousand with a standard deviation of 190 thousand. Lawler's average miss was 70 thousand with a standard deviation of 50 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | --- |

| 1NAR initially reported before revisions. | |||

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 8/16/2013 11:33:00 AM

In addition to housing starts for July, the Census Bureau also released the Q2 "Started and Completed by Purpose of Construction" report this morning.

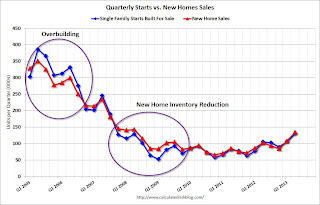

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 131,000 single family starts, built for sale, in Q2 2013, and that was below the 135,000 new homes sold for the same quarter, so inventory decreased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 25% compared to Q2 2012. This is still very low, and only back to about Q2 2008 levels.

Owner built starts were up slightly year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' had increased significantly, but the year-over-year growth has slowed.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales was just above the record low at 129,000 in Q2 2013.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Preliminary August Consumer Sentiment decreases to 80.0

by Calculated Risk on 8/16/2013 09:55:00 AM

Click on graph for larger image.

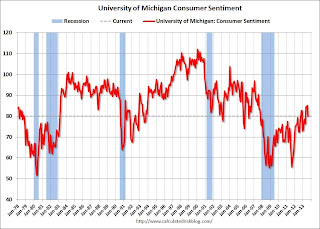

The preliminary Reuters / University of Michigan consumer sentiment index for August decreased to 80.0 from the final July reading of 85.1.

This was below the consensus forecast of 85.5. This is a noisy series, however sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Housing Starts increased in July to 896,000 SAAR

by Calculated Risk on 8/16/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 896,000. This is 5.9 percent above the revised June estimate of 846,000 and is 20.9 percent above the July 2012 rate of 741,000.

Single-family housing starts in July were at a rate of 591,000; this is 2.2 percent below the revised June figure of 604,000. The July rate for units in buildings with five units or more was 290,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 943,000. This is 2.7 percent above the revised June rate of 918,000 and is 12.4 percent above the July 2012 estimate of 839,000.

Single-family authorizations in July were at a rate of 613,000; this is 1.9 percent below the revised June figure of 625,000. Authorizations of units in buildings with five units or more were at a rate of 303,000 in July.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July (Multi-family is volatile month-to-month).

Single-family starts (blue) decreased slightly to 591,000 SAAR in July (Note: June was revised up from 591 thousand to 604 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was slightly below expectations of 904 thousand starts in July, but Permits were strong. Total starts in July were up 21% from July 2012; single family starts were only up 15.4% year-over-year. I'll have more later ...

Thursday, August 15, 2013

Friday: Housing Starts

by Calculated Risk on 8/15/2013 09:06:00 PM

Oh my! From Nick Timiraos and Jeannette Neumann at the WSJ: Richmond’s Seizure Plan Complicated by Size of Mortgages

The city of Richmond, Calif., is seeking to acquire mortgages as large as $1.1 million under its plan to invoke powers of eminent domain to purchase and restructure underwater mortgages.It isn't true that a loss has occurred on a loan just because the value of the collateral declines. Frequently a loan will be for more than any collateral securing the loan (this happens frequently with car loans and I could give many other examples). This doesn't mean a loss has "already occurred" - in fact most of these loans are paid in full with no loss.

...

“The city will pay fair value for every loan,” said [John Vlahoplus, the chief strategy officer for MRP]. “Any loss on a loan has already occurred because of the fall in home prices.”

Friday:

• At 8:30 AM, the Census Bureau will release Housing Starts for July. The consensus is for total housing starts to increase to 904 thousand (SAAR) in July.

• At 9:55 AM: the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 85.5, up from 85.1 in July.