by Calculated Risk on 8/15/2013 05:05:00 PM

Thursday, August 15, 2013

First Look at 2014 Cost-Of-Living Adjustments and Maximum Contribution Base

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.0 percent over the last 12 months to an index level of 230.084 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was last year (2012), at 226.936, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2012 average. If the current level holds, COLA would be around 1.4% for next year (the current 230.084 divided by the Q3 2012 level of 226.936).

Even though CPI-W was up 2.0% year-over-year in July, the adjustment will probably be lower than 2.0%. Last year gasoline prices increased sharply in August and September - pushing up CPI-W for those months, and this year gasoline prices are down a little in August. So CPI-W will probably not increase as much this year in August as in Aug 2012.

This is early - we need the data for August and September - but my current guess is COLA will be a little lower than the 1.7% last year.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2012 yet, but wages probably increased again in 2012. If wages increased the same as last year, then the contribution base next year will be increased to around $117,000 from the current $113,700.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

FNC: House prices increased 3.7% year-over-year in June

by Calculated Risk on 8/15/2013 02:59:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Up 0.6% in June; Signs of Sustainable Recovery At Large

The latest FNC Residential Price Index™ (RPI) shows that the U.S. housing recovery continues to take hold with home prices nationwide rising a modest 0.6% in June. The index is reaching a two-year high after rising 16 straight months. The 16-month rising streak has lifted home prices by 7.6% since February 2012─the month in which the housing market bottomed out.Note: This increase is partially seasonal. This year prices were up 0.6% in June (from May). Last year, in June 2012, prices were up 0.9% - so this is slower seasonal price appreciation this year.

According to the FNC RPI, the pace of the price improvement in the ongoing recovery is much more modest than indicated by a number of other closely watched home price indices, with some of the largest differences seen in the San Francisco, Los Angeles, Atlanta, Miami, Chicago, Minneapolis, Seattle, and Washington D.C. markets. The difference may be due to these other indices being based on pairs of repeat sales, many of which are distressed properties in a prior sale. Other factors that may impact this divergence include the growing influence of new home sales, which are not included in repeat sales indices, and a disproportionate number of low value home sales relative to the housing stock. As an indicator of the underling home price trend, the FNC RPI excluded distressed sales and includes new home sales.

Housing market fundamentals continue to improve amid a moderately improving economy. Foreclosure sales have dropped to the 2007 levels before the collapse of the housing market—a strong indicator of strengthening conditions on the supply side. In June, foreclosure sales accounted for 13.5% of total home sales, down from 14.3% in May and 18.6% a year ago.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that June home prices increased from the previous month at a seasonally unadjusted rate of 0.6%. 1On a year-over-year basis, home prices were up a modest 3.7% from a year ago. FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes.

emphasis added

The year-over-year change slowed in June, with the 100-MSA composite up 3.7% compared to June 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals. Even with the recent increase, the FNC composite 100 index is still off 27.9% from the peak.

I expect all of the housing price indexes to start showing lower year-over-year prices gains as price increases slow.

Key Measures Show Low Inflation in July

by Calculated Risk on 8/15/2013 01:00:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here. Motor fuel increased at a 2% annualized rate in July, but will probably show a decrease in August.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (1.9% annualized rate) in July. The CPI less food and energy increased 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.8%, the CPI rose 2.0%, and the CPI less food and energy rose 1.7%. Core PCE is for June and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.7% annualized, and core CPI increased 1.9% annualized. Also core PCE for June increased 2.6% annualized.

Inflation is still mostly below the Fed's target.

NAHB: Builder Confidence increases in August to 59, Highest in almost 8 Years

by Calculated Risk on 8/15/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in August to 59. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Three Points in August

Builder confidence in the market for newly built, single-family homes rose three points to 59 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. This fourth consecutive monthly gain brings the index to its highest level in nearly eight years.

“Builder confidence continues to strengthen along with rising demand for a limited supply of new and existing homes in most local markets,” noted NAHB Chief Economist David Crowe. “However, this positive momentum is being slowed by the ongoing headwinds of tight credit and low supplies of finished lots and labor.”

...

Two of the HMI’s three components posted gains in August. The component gauging current sales conditions rose three points to 62, while the component gauging sales expectations in the next six months gained a single point to 68 and the component gauging traffic of prospective buyers held unchanged at 45.

All but one region saw a gain in its three-month moving average HMI score in August. The Midwest and West each posted six-point increases, to 60 and 57, respectively, while the South posted a four-point gain to 54 and the Northeast held unchanged at 39.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the August release for the HMI and the June data for starts (July housing starts will be released tomorrow). This was above the consensus estimate of a reading of 57.

Fed: Industrial Production unchanged in July

by Calculated Risk on 8/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in July after having gained 0.2 percent in June. In July, manufacturing production declined 0.1 percent. The output of mines advanced 2.1 percent, its fourth consecutive monthly increase, and the production of utilities fell 2.1 percent, its fourth consecutive monthly decrease. At 98.9 percent of its 2007 average, total industrial production in July was 1.4 percent above its year-earlier level. Capacity utilization for total industry edged down 0.1 percentage point to 77.6 percent in July, a rate 0.3 percentage point below its level of a year earlier and 2.6 percentage points below its long-run (1972-2012) average

emphasis added

Click on graph for larger image.

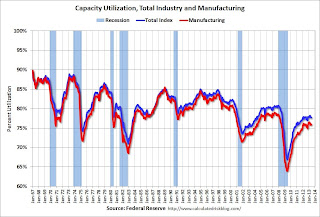

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in July at 98.9. This is 18.1% above the recession low, but still 1.9% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.3% increase in Industrial Production in July, and for Capacity Utilization to increase to 77.9%.