by Calculated Risk on 8/10/2013 01:05:00 PM

Saturday, August 10, 2013

Schedule for Week of August 11th

This will be a busy week for economic data. A key report will be July retail sales to be released on Tuesday. Also there are two key housing reports that will be released later in the week; housing starts on Friday, and the homebuilder confidence survey on Thursday.

For manufacturing, the July Industrial Production survey, and the August NY Fed (Empire State) and Philly Fed surveys will be released this week.

For prices, PPI will be released on Wednesday, and CPI on Thursday.

2:00 PM ET: Monthly Treasury Statement for July. The CBO has projected a deficit of $96 billion in July 2013, down $10 billion from July 2012 after accounting for "quirks of the calendar".

7:30 AM ET: NFIB Small Business Optimism Index for July.

8:30 AM ET: Retail sales for July will be released.

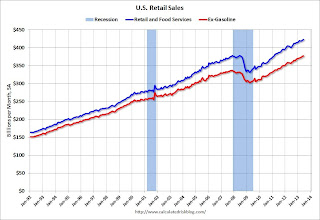

8:30 AM ET: Retail sales for July will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 27.5% from the bottom, and now 11.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.4% in July, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Producer Price Index for July. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

11:00 AM: The Q2 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 333 thousand last week.

8:30 AM: Consumer Price Index for July. The consensus is for a 0.2% increase in CPI in July and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 10.0, up from 9.5 in July (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

10:00 AM ET: The August NAHB homebuilder survey. The consensus is for a reading of 57, the same as in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 15.8, down from 19.8 last month (above zero indicates expansion).

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 836 thousand (SAAR) in June. Single family starts were at 591 thousand SAAR in June.

The consensus is for total housing starts to increase to 904 thousand (SAAR) in July.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 85.5, up from 85.1 in July.

Unofficial Problem Bank list declines to 723 Institutions

by Calculated Risk on 8/10/2013 08:34:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 9, 2013.

Changes and comments from surferdude808:

Not that many changes were made to the Unofficial Problem Bank List this week as anticipated. In all, there were three removals that lower the institution count to 723 with assets of $255.0 billion. Assets declined this week by $4.1 billion with $3.1 billion of the decline coming from updating assets through the second quarter. A year ago, the list held 900 institutions with assets of $348.6 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

Removals include the failed Bank of Wausau, Wausau, WI ($49 million). The Federal Reserve terminated the action against Belt Valley Bank, Belt, MT ($62 million) and The First National Bank of Shelby, Shelby, NC ($716 million) departed through an unassisted merger.

This week Capitol Bancorp, Ltd was in the news as they "lashed out at the FDIC" in an August 2nd filing with the bankruptcy court for not granting cross-guaranty waivers that supposedly prevented the sale of some units before they failed according to a report published by SNL Securities (A Capitol offense? BHC blasts FDIC for 'undermining' sale efforts, 'unnecessary' seizures). Perhaps the resolution of the remaining units is nearing an end.

Next week we anticipate the OCC will release its action through mid July 2013.

Friday, August 09, 2013

Merle Hazard: "Great Unwind" with commentary from several economists

by Calculated Risk on 8/09/2013 08:29:00 PM

A new song from Merle Hazard called the "The Great Unwind". This was debuted on PBS this week and several economists have commented on the song:

Yesterday from PBS: Art Laffer, John Taylor, Simon Johnson Respond to the Fed's 'Great Unwind' Problem

From John Taylor:

I've been writing about the costs of unwinding unconventional monetary policy since the Fed started its massive bond buying four years ago. Now, just in time for the actual unwinding, we have the online debut of Merle Hazard's funny and informative "The Great Unwind," a country and western song about the Fed's current predicament. Like Merle's earlier numbers -- such as "Inflation or Deflation" and "Bailout" -- his new song tells you a lot about monetary policy. Full disclosure: I'm a real fan of Merle Hazard as I said in this promotional video Merle Hazard Meets John Taylor for "Inflation or Deflation."And today: Is the Fed's 'Great Unwind' a Nonevent or the Chickens Finally Coming Home to Roost? (with comments from Ken Rogoff, Justin Wolfers, James Galbraith, and Greg Mankiw) From Rogoff:

Another great performance from Merle Hazard. However, I would worry more about the long-term effects of lingering unemployment and growing income inequality than the risks of quantitative easing (QE). ... the real risk is that there will be a sharp rise in interest rates making it very expensive to roll over growing issuance of short-term debt. As long as that doesn't happen, the "great unwind" will be a non-event.From Wolfers:

Country music star Merle's Hazard's latest turns to a far more important theme than the usual fare of unrequited love, dead dogs, old trucks and 'merica, worrying instead about how the Fed will unwind it's balance sheet. Is Ben Bernanke a monetary outlaw or the trusted sheriff who'll restore order? I'm betting on the latter, but either way, I tip my (ten-gallon) hat to the strumming balladeer and dismal scientist.From CR: Rogoff argues that the concern is "a sharp rise in interest rates" - I'd say the concern is an eventual sharp increase in inflation that forces the Fed to unwind quicker than planned. I'm not that worried though - I'm more in the "non-event" / "restore order" group - but it does require a Fed Chairman with good judgment and an understanding of what is happening. Enjoy!

Bank Failure #18 in 2013: Bank of Wausau, Wausau, Wisconsin

by Calculated Risk on 8/09/2013 06:14:00 PM

From the FDIC: Nicolet National Bank, Green Bay, Wisconsin, Assumes All of the Deposits of Bank of Wausau, Wausau, Wisconsin

As of June 30, 2013, Bank of Wausau had approximately $43.6 million in total assets and $40.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $13.5 million. ... Bank of Wausau is the 18th FDIC-insured institution to fail in the nation this year, and the second in Wisconsin.It is Friday!

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/09/2013 03:49:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in July.

From CR: Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down significantly year-over-year.

Also there has been a sharp decline in foreclosure sales in all of these cities.

And now short sales are declining year-over-year too! This is a recent change - short sales had been increasing year-over-year, but it looks like both categories of distressed sales are now declining.

The All Cash Share is mostly staying steady. The all cash share will probably decline when investors pull back in markets like Las Vegas and Phoenix (already declining).

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | Jul-13 | Jul-12 | |

| Las Vegas | 28.0% | 40.0% | 8.0% | 20.7% | 36.0% | 60.7% | 54.5% | 54.8% |

| Reno | 21.0% | 38.0% | 7.0% | 15.0% | 28.0% | 53.0% | ||

| Phoenix | 11.5% | 29.5% | 9.4% | 14.6% | 20.8% | 44.1% | 35.8% | 44.9% |

| Charlotte | 9.5% | 13.8% | ||||||

| Tucson | 29.1% | 33.3% | ||||||

| Toledo | 35.0% | 36.5% | ||||||

| Omaha | 15.9% | 15.6% | ||||||

| Memphis* | 16.7% | 26.9% | ||||||

| *share of existing home sales, based on property records | ||||||||