by Calculated Risk on 8/07/2013 05:01:00 PM

Wednesday, August 07, 2013

Q2 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

The BEA released the underlying details for the Q2 advance GDP report this afternoon.

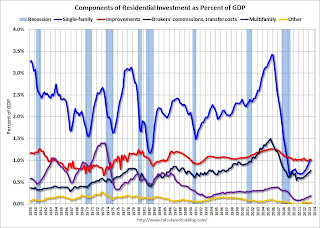

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Note: A change in the comprehensive revision was:

The presentation of the components of residential fixed investment was updated to reflect the expansion of the ownership transfer costs of residential fixed assets that are recognized as fixed investment. “Brokers’ commissions and other ownership transfer costs” is presented in place of “brokers’ commissions on sale of structures.”A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for nineteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again soon.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.Investment in home improvement was at a $171 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.0% of GDP), still above the level of investment in single family structures of $167 billion (SAAR) (also 1.0% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment in the next quarter or so.

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 56% from the recent peak (as a percent of GDP). There has been some increase in the Architecture Billings Index lately, so office investment might start to increase. However the office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 68%. With the hotel occupancy rate close to normal, it is possible that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

Another Dumb Idea: "Eminent domain" for Underwater Mortgages

by Calculated Risk on 8/07/2013 03:13:00 PM

I haven't written about the use of "eminent domain" to buy mortgages because it seemed like such a dumb idea I didn't expect it to go anywhere (the city is proposing to use eminent domain to help individual homeowners who are underwater - who may or may not be able to afford their mortgage - obviously not an intended use of eminent domain).

An appropriate public policy to help underwater homeowners would be cramdowns in bankruptcy (see Tanta's Just Say Yes To Cram Downs), but having cities use "eminent domain" is obviously not. I'll write more if this spreads ...

From Alejandro Lazo at the LA Times: Eminent domain proposal for mortgages gains traction in California

Cities in the Golden State are once again testing a controversial mortgage relief plan that could use local eminent domain powers to help residents stung by the last housing crisis. ...From Nick Timiraos at the WSJ: Freddie Mac Considers Legal Action to Block Eminent Domain Plan

... the idea is gaining traction again, with the city of Richmond, Calif., last week becoming the first to press forward. The hardscrabble Bay Area city announced that it had asked the holders of more than 620 underwater mortgages — on which the borrower owes more than the home is worth — to sell the loans to the city at a discount. The city would then write down the debt and refinance the loans for amounts in line with current home values.

If lenders refuse, the city could use eminent domain powers to force the transaction, a move widely expected to bring lawsuits from the financial industry.

“Our sense is that so-called voluntary loan sales would not be very voluntary. They are loan sales under pressure,” said William McDavid, general counsel of Freddie Mac, on a conference call with reporters Wednesday. “We would consider taking legal action” if it had the backing of its federal regulator, he said. ...

Eminent domain allows a government to forcibly acquire property that is then reused in a way considered good for the public—new housing, roads or shopping centers. Owners of the properties are entitled to compensation, often determined by a court.

Instead of acquiring houses, Richmond and other cities would buy the mortgages from investors at a price below the property’s current market value. They could cut the loan principal to around 97.75% of the property’s market value and then refinance the loan into a government-backed mortgage.

Event at 1 PM ET: President Obama answers questions on housing

by Calculated Risk on 8/07/2013 12:28:00 PM

President Barack Obama will answer questions about housing in an event hosted by Zillow CEO Spencer Rascoff.

The virtual event will be streamed on zillow.com/whitehouse and Whitehouse.gov.

Freddie Mac on Q2: $5.0 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 8/07/2013 09:36:00 AM

From Freddie Mac: Freddie Mac Reports Net Income of $5.0 billion for Second Quarter 2013

Second quarter 2013 net income was $5.0 billion, compared to $4.6 billion in the first quarter of 2013 – the seventh consecutive quarter of profitability and second largest in company history...

...

No additional Treasury draw required for the second quarter of 2013

Based on net worth of $7.4 billion, the company’s dividend obligation to Treasury will be $4.4 billion in September 2013. Including the September obligation, the company’s aggregate cash dividends paid to Treasury will total approximately $41 billion

Senior preferred stock outstanding and held by Treasury remained $72.3 billion, as dividend payments do not reduce prior Treasury draws

Click on graph for larger image.

Click on graph for larger image.On Real Estate Owned (REO), Freddie acquired 16,418 properties in Q2 2013, and disposed of 19,763 and the total REO fell to 44,623 at the end of Q2. This graph shows REO inventory for Freddie.

From Freddie's SEC 10-Q:

Since the beginning of 2008, on an aggregate basis, we have recorded provision for credit losses associated with single-family loans of approximately $74.2 billion, and have recorded an additional $3.8 billion in losses on loans purchased from PC trusts, net of recoveries. The majority of these losses are associated with loans originated in 2005 through 2008. While loans originated in 2005 through 2008 will give rise to additional credit losses that have not yet been incurred and, thus, have not yet been provisioned for, we believe that, as of June 30, 2013, we have reserved for or charged-off the majority of the total expected credit losses for these loans. Nevertheless, various factors, such as increases in unemployment rates or future declines in home prices, could require us to provide for losses on these loans beyond our current expectations.

Our loan loss reserves for single-family loans declined in each of the last six quarters, which in part reflects improvement in both borrower payment performance and lower severity ratios for both REO dispositions and short sale transactions due to the improvements in home prices in most areas during these periods. Our REO inventory also declined in each of the last six quarters primarily due to lower foreclosure activity as well as a significant number of borrowers completing short sales rather than foreclosures.

Our average REO disposition severity ratio improved to 31.2% for the second quarter of 2013 compared to 34.4% and 37.9% for the first quarter of 2013 and second quarter of 2012, respectively. We observed improvements in most areas during the first half of 2013, primarily due to increasing home prices. This ratio improved in each of the last six quarters, but remains high as compared to our experience in periods before 2008. Additionally, our REO disposition severity ratios have also been positively affected by changes made during 2012 to our process for determining the list price for our REO properties when we offer them for sale.

emphasis added

MBA: Mortgage Applications mostly unchanged in Latest Weekly Survey

by Calculated Risk on 8/07/2013 07:03:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 2, 2013. ...

The Refinance Index was unchanged from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.61 percent from 4.58 percent, with points increasing to 0.42 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

...

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.66 percent from 3.67 percent, with points increasing to 0.43 from 0.40 (including the origination fee) for 80 percent LTV loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates up over the last 3 months, refinance activity has fallen sharply, decreasing in 11 of the last 13 weeks.

This index is down 57% over the last 13 weeks.

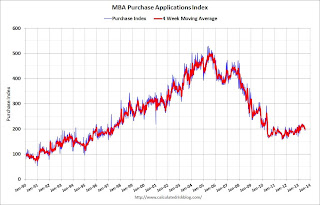

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last month), and the 4-week average of the purchase index is up about 7% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last month), and the 4-week average of the purchase index is up about 7% from a year ago.