by Calculated Risk on 7/15/2013 01:01:00 PM

Monday, July 15, 2013

Report: Home Listed For Sales up 4.3% in June from May, Down 7.3% year-over-year

From Nick Timiraos at the WSJ: Housing Listings Multiply in June

The number of homes listed for sale increased by 4.3% in June to 1.9 million homes, the highest level in the last year, according to data released Monday by Realtor.com. ... Listings typically climb heading into the spring and summer, when housing activity hits a seasonal peak. But inventories appear to be posting larger-than-usual gains in many markets right now as they rise from their lowest levels in at least a decade. ...Note: Here is the realtor.com site (not updated with June data yet at posting time).

Nationally, the number of homes listed for sale stood 7.3% below their levels of one year earlier. The year-over-year decline stood at 18.6% in February, by contrast.

...

The question now is whether higher inventory will lead to higher sales volumes, and whether it will also slow the pace of home-price gains.

emphasis added

Last month, the NAR reported inventory was down 10.1% from May 2012. That was the smallest year-over-year (YoY) decrease since 2011, and it appears the YoY decrease will be in single digits for June (the NAR reports June sales and inventory next Monday). Tom Lawler's initial estimate is that the NAR will report a 6.3% YoY decline in inventory in June.

My guess is the YoY change for inventory will probably turn positive in September and that inventory bottomed in early 2013.

FNC: House prices increased 4.0% year-over-year in May

by Calculated Risk on 7/15/2013 10:22:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: Home Prices Continue to Rise Steadily; Up 0.5% in May

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to steadily improve, climbing another 0.5% in May in conjunction with continued improvement in housing market fundamentals. Notably, the FNC RPI shows that the pace at which home prices are rising is rather modest, averaging 0.4% per month in the last six months. Similarly, the rate of annual price appreciation appears to be much slower and sustainable than reported by a number of other closely watched price indices.Note: This increase is partially seasonal. This year prices were up 0.5% in May (from April). Last year, in May 2012, prices were up 1.0% - so this is slower seasonal price appreciation this year.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that May home prices rose from the previous month at a seasonally unadjusted rate of 0.5%. The two narrower indices (30-MSA and 10-MSA composites) recoded a 0.4% increase. On a year-over-year basis, home prices were up a modest 4.0% from a year ago.

The year-over-year change slowed in May, with the 100-MSA composite up 4.0% compared to May 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.3% from the peak.

Retail Sales increased 0.4% in June

by Calculated Risk on 7/15/2013 08:43:00 AM

On a monthly basis, retail sales increased 0.4% from May to June (seasonally adjusted), and sales were up 5.7% from June 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $422.8 billion, an increase of 0.4 percent from the previous month, and 5.7 percent above June 2012.

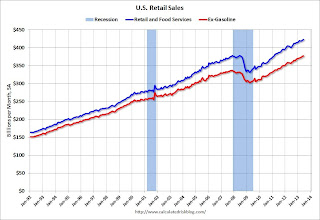

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.5% from the bottom, and now 11.8% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased slightly. Retail sales ex-gasoline increased 0.3%.

Excluding gasoline, retail sales are up 24.6% from the bottom, and now 12.2% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.9% on a YoY basis (5.7% for all retail sales).

This was below the consensus forecast of 0.8% increase in retail sales.

Sunday, July 14, 2013

Monday: Retail Sales, Empire State Mfg Survey

by Calculated Risk on 7/14/2013 10:06:00 PM

Via MarketWatch: "China's Q2 GDP rises 7.5% from year earlier". I strongly recommend listening to the Alphaville interview with Michael Pettis to understand why China is slowing down, and what will likely happen. Here is the podcast and some notes. My suggestion: Pay attention to Pettis - he has been very accurate on China.

From the WSJ: China Slump Ripples Globally

Growth in China, the world's second-biggest economy after the U.S., has been slowing since 2007's peak, but that slowdown has accelerated recently. This year, according to the government's target and economists' estimates, China is likely to see its weakest growth since 1990, around 7.5%.From the NY Times: Pitfalls Abound in China’s Push From Farm to City

...

China is trying to pull off a tricky rebalancing. It hopes to reshape its economy to be less reliant on construction and heavy industry, and more reliant on consumer spending. ...

To boost domestic consumption, the government has raised minimum wages to put more money in people's pockets and loosened controls on interest rates to give household savers better returns. It has tilted tax and land incentives toward industries that cater to consumption, such as food and autos, and away from heavy industries suffering from overcapacity, such as steel making and ship building.

Qiyan, previously a village of 200 households, was designated a town, and its lower reaches were leveled and rebuilt with towers to house 6,000 people. Those living in the surrounding hills were encouraged to live in the valley — and not in big cities like Xi’an. The process is known as chengzhenhua, moving into towns, and has become one of the most-debated topics in China. The idea is to limit the number of megacities by keeping farmers closer to the land they farmed instead of moving them to giant cities. The problem is jobs, or the lack of them, in these areas.Monday:

During a visit in February, townspeople sat in their front yards, huddled around open fires. Their homes were brand-new, with indoor heating and modern appliances, just as Mr. Li’s plan envisions, but it all runs on an unaffordable luxury: electricity. Hence the fires to keep warm.

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for retail sales to increase 0.8% in June, and to increase 0.5% ex-autos.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for July. The consensus is for a reading of 5.0, down from 7.8 in June (above zero is expansion).

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for no change in inventories.

Weekend:

• Schedule for Week of July 14th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are mostly unchanged (fair value).

Oil prices have increased recently with WTI futures at $105.60 per barrel and Brent at $108.66 per barrel.

Oil and Gasoline Prices Increase, Spread between Brent and WTI Narrows

by Calculated Risk on 7/14/2013 02:06:00 PM

From Gary Richards at Mercury News: Gas prices expected to rise soon

Gas prices are back on the rise and could increase by 10 to 15 cents a gallon over the next couple of weeks, analysts say.So the national average finally dipped below $3.50 per gallon, but gasoline prices have started increasing again.

The biggest culprit behind the anticipated surge is the price of crude oil, which approached $106 a barrel Friday. That's up from $97 on July 1. Each $1 increase typically turns into a 2.5-cent hike at the gas station. The average in California is hovering around $4 a gallon, up a few cents over the past week. But the national average reached $3.55 on Friday, seven cents more than a week earlier.

Unfortunately we are seeing more refinery problems and gasoline futures are up sharply. From the WSJ: Gasoline Futures Hit Four-Month High After Refinery Glitches

Gasoline futures shot to the highest level in nearly four months Friday, after a series of refinery glitches spurred concerns about the ready availability of fuel supplies.Oil prices were up this week, with WTI at $105.95 per barrel up from $93.69 three weeks ago, and Brent at $108.81, up from $100.91 three weeks ago.

...

Motiva Enterprises LLC on Wednesday shut a production unit at its Port Arthur refinery in Texas. ...

Separately, Phillips reported a production shutdown at its refinery in Ponca City, Okla., after a power outage. The refinery had resumed normal operations by Friday afternoon, a company spokesman said.

Refinery problems often boost gasoline-futures prices as traders rush to the futures market to cover potential shortfalls. If sustained, they can translate to higher prices at the pump.

WTI prices "surged" more than Brent, and the spread between WTI and Brent prices has almost closed. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Now the difference is under 3% (and less than $3 per barrel).

Click on graph for larger image.

Click on graph for larger image.Here is an update to the graph that shows the divergence between Brent and Cushing starting in 2011.

Until the gap disappears completely, we still need to use Brent crude prices to forecast U.S. gasoline prices.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.56 per gallon. That is close to the current level according to Gasbuddy.com, so even if we see a spike in gasoline prices - if crude oil prices stay at this level, and the refinery problems are resolved - gasoline will probably return to the current level.

The following graph is from gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |