by Calculated Risk on 7/09/2013 06:24:00 PM

Tuesday, July 09, 2013

Fed's Williams: "A Defense of Moderation in Monetary Policy"

From San Francisco Fed President John Williams: A Defense of Moderation in Monetary Policy. From the abstract:

This paper examines the implications of uncertainty about the effects of monetary policy for optimal monetary policy with an application to the current situation. Using a stylized macroeconomic model, I derive optimal policies under uncertainty for both conventional and unconventional monetary policies. According to an estimated version of this model, the U.S. economy is currently suffering from a large and persistent adverse demand shock. Optimal monetary policy absent uncertainty would quickly restore real GDP close to its potential level and allow the inflation rate to rise temporarily above the longer-run target. By contrast, the optimal policy under uncertainty is more muted in its response. As a result, output and inflation return to target levels only gradually. This analysis highlights three important insights for monetary policy under uncertainty. First, even in the presence of considerable uncertainty about the effects of monetary policy, the optimal policy nevertheless responds strongly to shocks: uncertainty does not imply inaction. Second, one cannot simply look at point forecasts and judge whether policy is optimal. Indeed, once one recognizes uncertainty, some moderation in monetary policy may well be optimal. Third, in the context of multiple policy instruments, the optimal strategy is to rely on the instrument associated with the least uncertainty and use alternative, more uncertain instruments only when the least uncertain instrument is employed to its fullest extent possible.Currently inflation is below the Fed's target (and is forecast to remain below the target), and unemployment is significantly above target (and forecast to remain above target). In general the current situation and forecasts would suggest more accommodation.

emphasis added

Williams argues because of uncertainty that current policy might be optimal. Note: Williams is an influential Fed president and has been supportive of QE. Maybe ... but high unemployment is a serious problem now (and also keeps down wages for almost everyone), and I'd think monetary and fiscal policymakers would be discussing this daily. With the current Congress, fiscal policy aimed at reducing unemployment is off the table, so all we have is monetary policy. And now Williams is defending "moderation" ...

Zillow: 30-Year Fixed Mortgage Rates Surge to Highest Level in 2 Years

by Calculated Risk on 7/09/2013 03:54:00 PM

The Freddie Mac Weekly Primary Mortgage Market Survey® will be released on Thursday (the series I usually follow), but since everyone is curious about mortgage rates, here is a release from Zillow today: 30-Year Fixed Mortgage Rates Surge to Highest Level in 2 Years

Mortgage rates for 30-year fixed mortgages rose this week, with the current rate borrowers were quoted on Zillow Mortgage Marketplace at 4.41 percent, up from 4.17 percent at this same time last week.The ten year Treasury yield closed at 2.71% on Friday, but has fallen to 2.63% today.

The 30-year fixed mortgage rate hovered between 4.2 and 4.3 percent early last week and spiked at 4.6 percent on Friday before declining near the current rate early this week. The last time rates exceeded 4.4 percent was July 26, 2011.

“Rates surged on Friday after a stronger-than-expected jobs report and upward revisions to prior months’ unemployment levels,” said Erin Lantz, director of Zillow Mortgage Marketplace. “This week, rate movement will depend on whether Wednesday’s release of the Federal Open Market Committee meeting minutes and Fed Chairman Ben Bernanke’s speech reinforce or depress market expectations of a September start of easing federal stimulus.”

BLS: Job Openings little changed in May

by Calculated Risk on 7/09/2013 11:21:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.8 million job openings on the last business day of May, little changed from April, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.2 percent) also were little changed in May. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ...The number of quits (not seasonally adjusted) was little changed over the 12 months ending in May for total nonfarm, total private, government, and in all four regions.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 3.828 million, up from 3.800 million in April. The number of job openings (yellow) has generally been trending up, but openings are only up 1% year-over-year compared to May 2012.

Quits were up in May, and quits are up about 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

Reis: Apartment Vacancy Rate unchanged at 4.3% in Q2 2013

by Calculated Risk on 7/09/2013 09:50:00 AM

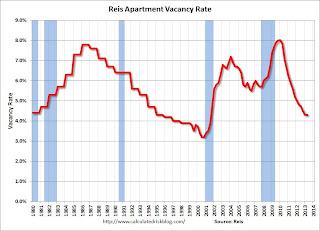

Reis reported that the apartment vacancy rate was unchanged in Q2. The vacancy rate was at 4.8% in Q2 2012 (a year ago) and peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy was unchanged during first quarter at 4.3%. While the rate of vacancy compression has been slowing in recent quarters, this marks the first time that the quarterly vacancy rate has not fallen since the first quarter of 2010. Over the last four quarters national vacancies have declined by 50 basis points, a bit slower than last quarter's year‐over‐year decline in vacancy of 70 basis points. This dynamic is somewhat to be expected ‐ as the market gets tighter and tighter, it becomes increasingly difficult for vacancy to continue falling at a high rate as vacant units, or at least palatable vacant units, disappear from the market.

The aforementioned stalling in vacancy decline is more a function of increasingly supply than decreasing demand. On the demand side, the sector absorbed 31,973 units in the second quarter, about on par with absorption from one year ago during 2Q2012 and down slightly from the 39,319 units that were absorbed during the first quarter of 2013. Year‐to‐date, the sector has absorbed more units in 2013 than were absorbed through this point in 2012. However, new construction is finally starting to pick up a bit. Completions during the second quarter were 26,584 units, an increase relative to last quarter's 16,578 units and slightly below the 29,523 units that were delivered during the fourth quarter of 2012. This appears to be the front end of the relatively large wave of new supply that is estimated to come online over the next few years.

Asking and effective rents grew by 0.6% and 0.7%, respectively, during the second quarter. This is a slight increase relative to the first quarter when asking and effective rents grew by 0.5% and 0.6%, respectively. However, during the last few quarters rent growth has slowed relative to the mini‐spike that was observed during mid‐2012

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

New supply is finally coming on the market and the vacancy rate has stopped falling (at least for one quarter).

Apartment vacancy data courtesy of Reis.

NFIB: Small Business Optimism Index declines in June

by Calculated Risk on 7/09/2013 08:19:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Drops in June, Ends 2 Months of Increases

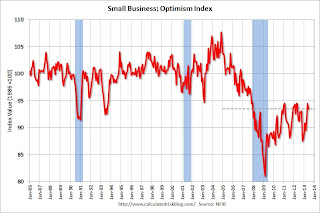

Small-business optimism remained in tepid territory in June, as NFIB’s monthly economic Index dropped just under a point (0.9) and landed at 93.5 ...In a little sign of good news, only 18% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Job creation plans rose 2 points to a net 7% planning to increase total employment, better, but still a weak reading.

...

Five percent of the owners reported that all their credit needs were not met, unchanged and the lowest reading since February 2008.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 93.5 in June from 94.4 in May. This is still low, but just below the post-recession high.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.