by Calculated Risk on 6/20/2013 01:35:00 PM

Thursday, June 20, 2013

Philly Fed Manufacturing Survey indicates Expansion in June

Catching up ... from the Philly Fed: June Manufacturing Survey

Manufacturing firms responding to the monthly Business Outlook Survey indicated that regional manufacturing activity increased this month. Most of the survey’s broadest current indicators were positive this month, suggesting an improvement in business conditions. The survey's indicators of future activity continue to suggest that firms expect growth over the next six months.Earlier in the week, the Empire State manufacturing survey also indicated expansion in June.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from ‑5.2 in May to 12.5, its highest reading since April 2011.

Labor market conditions showed continued weakness, however, with indexes suggesting lower employment among the reporting manufacturers. Although it increased 3 points to ‑5.4, the employment index remained negative for the third consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

The average of the Empire State and Philly Fed surveys turned positive in June, and this suggests a rebound in the ISM report for June. The June ISM report will be released Monday, July 1, 2013.

Comment on Existing Home Sales: Inventory near Bottom

by Calculated Risk on 6/20/2013 11:49:00 AM

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased 3.3% in May from April, and is only down 10.1% from May 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of May since 2002, but this is also the smallest year-over-year decline since July 2011. The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 12.9% from May 2012, but conventional sales are probably up over 20% from May 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 18 percent of May sales, unchanged from April, but matching the lowest share since monthly tracking began in October 2008; they were 25 percent in May 2012.Although this survey isn't perfect, if total sales were up 12.9% from May 2012, and distressed sales declined from 25% of total sales (25% of 5.18 million) to 18% (18% of 4.59 million in May 2012), this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

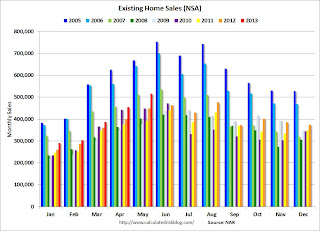

All-cash sales were at 33 percent of transactions in May, up from 32 percent in April and 28 percent in May 2012. Individual investors, who account for many cash sales, purchased 18 percent of homes in May; they were 19 percent in April and 17 percent in May 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in May: 5.18 million SAAR, 5.1 months of supply

Existing Home Sales in May: 5.18 million SAAR, 5.1 months of supply

by Calculated Risk on 6/20/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in May with Strong Price Increases

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 4.2 percent to a seasonally adjusted annual rate of 5.18 million in May from 4.97 million in April, and is 12.9 percent above the 4.59 million-unit pace in May 2012.

Total housing inventory at the end of May rose 3.3 percent to 2.22 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace, down from 5.2 months in April. Listed inventory is 10.1 percent below a year ago, when there was a 6.5-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2013 (5.18 million SAAR) were 4.2% higher than last month, and were 12.9% above the May 2012 rate. This is the highest sales rate since November 2009 (housing tax credit).

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.22 million in May up from 2.15 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.22 million in May up from 2.15 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 10.1% year-over-year in May compared to May 2012. This is the 27th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 10.1% year-over-year in May compared to May 2012. This is the 27th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply decreased to 5.1 months in May.

This was just above expectations of sales of 5.0 million. For existing home sales, the key number is inventory - and inventory is still down year-over-year, although the declines are slowing. This was another solid report. I'll have more later ...

Weekly Initial Unemployment Claims increase to 354,000

by Calculated Risk on 6/20/2013 08:35:00 AM

The DOL reports:

In the week ending June 15, the advance figure for seasonally adjusted initial claims was 354,000, an increase of 18,000 from the previous week's revised figure of 336,000. The 4-week moving average was 348,250, an increase of 2,500 from the previous week's revised average of 345,750.The previous week was revised up from 334,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 348,250.

The 4-week average has mostly moved sideways over the last few months. Claims were above the 340,000 consensus forecast.

Wednesday, June 19, 2013

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 6/19/2013 07:57:00 PM

Another take on the FOMC statement and Bernanke press conference from Goldman Sachs' economists Jan Hatzius and Sven Jari Stehn:

The FOMC was more hawkish than we had expected. First, Chairman Bernanke suggested that tapering would start “later” this year and might conclude in mid-2014 assuming a 7% unemployment rate at that point. Second, the committee moved down its unemployment rate forecasts by about 0.2 percentage points throughout the forecast horizon. Third, the committee noted that downside risks had “diminished” since last fall ... Fourth, although inflation projections moved down, the chairman was somewhat dismissive of the recent inflation drop, attributing much of it to special factors. Fifth, the chairman was a bit more reluctant to push back on the increase in short-term rate expectations than we had expected, although he did state explicitly that the 6.5% unemployment threshold might eventually move down.Thursday economic releases:

Our takeaway is that the risk to our forecast of QE tapering starting in December has increased. However, our own GDP forecast for the second half of 2013 is more than ½ percentage point below the committee’s, and our labor market forecasts are also less optimistic.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 340 thousand from 334 thousand last week.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for June. The index was at 52.3 in May.

• At 10:00 AM, the Existing Home Sales report for April from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in April were at a 4.97 million SAAR. Economist Tom Lawler is estimating the NAR will report a May sales rate of 5.2 million. A key will be inventory (especially the year-over-year change) and the months-of-supply.

• Also at 10:00 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of -0.5, up from -5.2 last month (above zero indicates expansion).