by Calculated Risk on 6/12/2013 02:06:00 PM

Wednesday, June 12, 2013

Sacramento: Conventional Sales in May highest in Years, Inventory increases year-over-year

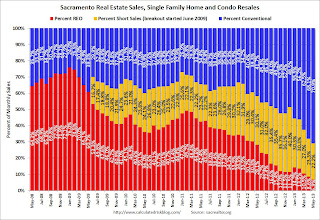

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For some time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In May 2013, 29.1% of all resales (single family homes) were distressed sales. This was down from 31.9% last month, and down from 58.3% in May 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 6.9%, and the percentage of short sales decreased to 22.2%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently, and there were more than three times as many short sales as REO sales in May.

Active Listing Inventory for single family homes increased 5.3% year-over-year in May. This is the first year-over-year increase in inventory in two years and suggests inventory might have bottomed in Sacramento.

Cash buyers accounted for 33.6% of all sales, down from 37.2% last month (frequently investors).

Total sales were down 14% from May 2012, but conventional sales were up 45% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

Possibly the most important number in the release this month was the year-over-year increase in active inventory. This suggests price increases will slow in Sacramento, and I expect to see a similar pattern in other areas.

CoreLogic: Negative Equity Decreases in Q1 2013, 9.7 Million Properties still with Negative Equity

by Calculated Risk on 6/12/2013 10:20:00 AM

From CoreLogic: 9.7 Million Residential Properties with a Mortgage Still in Negative Equity

CoreLogic ... today released new analysis showing approximately 850,000 more residential properties returned to a state of positive equity during the first quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 39 million. The analysis shows that 9.7 million, or 19.8 percent of all residential properties with a mortgage, were still in negative equity at the end of the first quarter of 2013 with a total value of $580 billion. This figure is down from 10.5 million*, or 21.7 percent of all residential properties with a mortgage, at the end of the fourth quarter of 2012.

... At the end of the first quarter of 2013, 2.1 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“The impressive home price gains of 2012 and the beginning of 2013 have had a big impact on the distribution of residential home equity,” said Dr. Mark Fleming, chief economist for CoreLogic. “During the past year, 1.7 million borrowers have regained positive equity. We expect the pent-up supply that falling negative equity releases will moderate price gains in many of the fast-appreciating markets this spring.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 45.4 percent, followed by Florida (38.1 percent), Michigan (32 percent), Arizona (31.3 percent) and Georgia (30.5 percent). These top five states combined account for 32.8 percent of negative equity in the U.S."

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.

MBA: Mortgage Applications Increase, Mortgage Rates highest since March 2012

by Calculated Risk on 6/12/2013 08:11:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

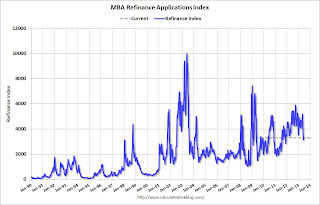

The Refinance Index increased 5 percent from the previous week. Despite the increase in the refinance index last week, the level is still 11 percent lower than two weeks prior and 36 percent lower than the recent peak at the beginning of May. The seasonally adjusted Purchase Index increased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.15 percent, the highest rate since March 2012, from 4.07 percent, with points increasing to 0.48 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4%, refinance activity has fallen sharply over the last 5 weeks even with the slight increase last week.

This index is down 36% over the last five weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, June 11, 2013

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/11/2013 09:31:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 32% from the peak, and is still declining. The number of salesperson's licenses has fallen to June 2004 levels.

However brokers' licenses are only off 8% and have only fallen to late 2006 levels - and appear to have stopped falling

Click on graph for larger image.

Click on graph for larger image.

If we look at examinations (and new licensees issued), there are more people obtaining licenses than a year ago. However - since the number of salesperson's licenses are still declining - there are still more people letting their licensees expire.

So far there is no sign of a new bubble in real estate agents!

Comment: Senator Elizabeth Warren and Short Sale Fraud

by Calculated Risk on 6/11/2013 06:53:00 PM

I like Elizabeth Warren, but I was shocked to see this commentary from her: Commentary: FHFA’s Senseless Arm’s-Length Policy on Short Sales (ht jb). Warren argued for having the FHA allow short sales to family members and friends so the owner can stay in the home.

Apparently Ms. Warren isn't familiar with short sale fraud. I've covered this extensively, from Tanta in 2007: Let the Short Sale Scams Begin, from the FBI in 2009: FBI: U.S. Mortgage Fraud "Rampant" and "Escalating" (see short sale fraud), from John Gittelsohn at Bloomberg in 2010: Banks Face Short-Sale Fraud as Home `Flopping' Spreads, from Jim the Realtor in 2010: Jim the Realtor on Short Sales: "Rampant Fraud and Deceit" and Short Sales: Arm’s Length Transactions and many more ...

Lenders have always been afraid of short sales because of fraud. Short sales increased after lenders put many fraud protections in place - such as having all parties sign that there is no undisclosed consideration, that the transaction are arms-length (not to related party) and more. This hasn't stopped all short sale fraud, but it has helped.

Warren writes:

Short sales can make good sense, and private lenders have gone along with them in many cases. But the FHFA – the regulator overseeing the bailed-out housing giants Fannie Mae and Freddie Mac and the financing of about half the country’s outstanding mortgages – has blocked the way.Uh, one of the reasons private lenders have "gone along with" short sales is because they require that the sales be "arms-length". The FHFA has the same requirement - for good reason.

In some of those short sales, friends, families, or nonprofit organizations are willing to buy the home at fair market value, then work out a rental or re-sale to the family living in it. The mortgage company gets the same amount as in a sale to strangers, but the homeowner has a last-chance to save the family home.

Warren seems to think that the lender will get the same amount either way ... not likely. She writes:

The FHFA claims that its policy prevents sweetheart insider deals that benefit the homeowners at the expense of Fannie and Freddie. But that makes no sense when the house is sold at market value or when people affiliated with the homeowner put in the highest bid to save the home. In those cases, the identity of the bidder makes no meaningful difference because Fannie and Freddie’s bottom line stays the same.Warren doesn't understand that short sales don't go to the highest bidder. The first chance to negotiate with the bank goes to someone the homeowner (or agent) picks. Since the homeowner has no financial interest in the property, this creates an agency problem, and opens the door to fraud (I've suggested having the lender hire the agent). The "arms-length" protection is an important tool to prevent fraud.

If friends and family want to help, they could contact the bank about modification and offer to pay down some of the debt, but eliminating the "arms-length" rule would just mean more fraud.