by Calculated Risk on 6/11/2013 01:43:00 PM

Tuesday, June 11, 2013

DataQuick: SoCal May Home Sales Highest in 7 Years

From DataQuick: Southland May Home Sales Highest in 7 Years; Median Price Hits 5-Year High

A total of 23,034 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 7.6 percent from 21,415 sales in April, and up 3.8 percent from 22,192 sales in May 2012, according to San Diego-based DataQuick.Distressed sales are down in SoCal, and foreclosures are back to 2007 levels (although short sales are much higher). Overall sales in SoCal were the highest for May since 2006.

Last month’s sales were the highest for the month of May since 30,303 Southland homes sold in May 2006, but they were still 10.1 percent below the May average of 25,617 sales since 1988, when DataQuick’s statistics begin. Over the last seven years Southland home sales have been below average for any particular month.

...

“We’re deep into uncharted territory: Amazingly low mortgage rates, a razor-thin inventory of homes for sale, and the release of years’ worth of pent-up demand. Plus there’s a seemingly endless stream of investors and non-investors who pay cash and thereby avoid the loan-qualification process. How this all plays out is educated guesswork at this point. Understandably, speculation continues over whether another housing bubble is forming,” said John Walsh, DataQuick president.

“History suggests that’s a tough call early on. What seems obvious is that if prices keep rising fast they’ll cause many more people to list their homes for sale, and that increase in supply should at least slow the rate of price appreciation,” he said.

...

Last month foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 10.8 percent of the Southland resale market. That was down from 12.4 percent the month before and down from 26.9 percent a year earlier. Last month’s foreclosure resale rate was the lowest since it was 10.0 percent in August 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was the same as the month before and down from 24.3 percent a year earlier.

...

Buyers paying with cash accounted for 31.9 percent of last month's home sales, compared with 34.4 percent the month before and 32.1 percent a year earlier. The peak was 36.9 percent this February, and since 1988 the monthly average is 16.1 percent.

On Walsh's "bubble" comment - I wouldn't call this a "bubble", and I agree with Walsh's comment that supply will probably start to increase and that should slow the price increases.

BLS: Job Openings decreased slightly in April

by Calculated Risk on 6/11/2013 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.8 million job openings on the last business day of April, little changed from 3.9 million in March, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.2 percent) also were little changed in April. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was up over the 12 months ending in April for total nonfarm and total private but was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in April to 3.757 million, down from 3.875 million in March. The number of job openings (yellow) has generally been trending up, and openings are up 7% year-over-year compared to April 2012.

Quits were up in April, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

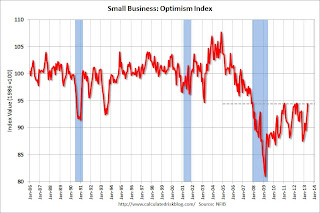

NFIB: Small Business Optimism Index increases in May

by Calculated Risk on 6/11/2013 08:32:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Confidence Edges Up, Reaches May 2012 Level

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May. ...In a little sign of good news, only 16% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Job creation plans rose 6 points to a net 6 percent planning to increase total employment, outcome nice improvement after the 4 point decline in March.

...

Owners were asked to identify their top business problem: 24 percent cited taxes, 23 percent cited regulations and red tape, 16 percent cited weak sales and 2 percent reported financing/access to credit.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.4 in May from 92.1 in April. This is still low, but near the post-recession high.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, June 10, 2013

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 6/10/2013 08:38:00 PM

A little good news from the California State Controller: State Finances in May 2013

May was a good month for the State’s fiscal coffers, with revenues coming in well ahead of the estimates contained in the Governor’s revised budget re-leased last month. All three of the state’s principal revenue sources exceeded expectations and total General Fund revenues surpassed projections by close to $800 million or 12.4%. ...Tuesday economic releases:

The better-than-expected revenue performance last month reflects the underlying improvement of California's economy with a moderate but generally widespread resuscitation in the job market, a resurgence in housing, and solid advances in the technology sector. However, we caution against reading too much into May's numbers since this month typically accounts for only 7% of the total year's receipts. June's figures will be much more telling since that is a time when the state typically receives a large influx of tax receipts.

• At 7:30 AM, the NFIB Small Business Optimism Index for May. The consensus is for an increase to 92.3 from 92.1 in April.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for April from the BLS. Jobs openings decreased in March to 3.844 million, down from 3.899 million in February. Job openings were unchanged year-over-year compared to March 2012.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.2% increase in inventories.

Existing Home Inventory is up 15.5% year-to-date on June 10th

by Calculated Risk on 6/10/2013 04:58:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 15.5%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.4% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.