by Calculated Risk on 6/10/2013 01:34:00 PM

Monday, June 10, 2013

Las Vegas Real Estate in May: Year-over-year Inventory decline slows sharply

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR says local housing market, prices heating up

GLVAR said the total number of existing local homes, condominiums and townhomes sold in May was 3,884. That’s up from 3,789 in April, but down from 4,134 total sales in May 2012. ...There are several key trends that we've been following:

...

In May, 31.8 percent of all existing local home sales were short sales, down from 32.5 percent in April. Another 10.3 percent of all May sales were bank-owned properties, up from 10.0 percent of all sales in April. The remaining 57.9 percent of all sales were the traditional type, which was up from 57.5 percent in April.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in May, with 13,814 single-family homes listed for sale at the end of the month. That’s down 0.5 percent from 13,881 single-family homes listed for sale at the end of April..

As for available homes listed for sale without any sort of pending or contingent offer by the end of May, GLVAR reported 3,297 single-family homes listed without any sort of offer. That’s up 4.3 percent from 3,161 such homes listed in April, but still down 13.2 percent from one year ago.

...

In May, GLVAR reported that 57.9 percent of all existing local homes sold were purchased with cash. That’s down from 59.3 percent in April and just off the peak of 59.5 percent set in February.

emphasis added

1) Overall sales are down year-over-year, but ...

2) Conventional sales are up sharply. In May 2012, only 32.7% of all sales were conventional. This year, in May 2013, 57.9% were conventional. That is an increase in conventional sales of about 66% (of course this is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (about 3 to 1).

4) and probably most interesting right now is that the decline in non-contingent inventory (year-over-year) has slowed sharply. Non-contingent inventory is only down 13.2% year-over-year compared to a year-over-year inventory decrease of 66.3% reported in May 2012. Last month, GLVAR reported a year-over-year decline of 24.1%. It appears the year-over-year inventory decline will be in single digits in June!

This suggests inventory is near a bottom in Las Vegas (A major theme for housing in 2013).

Quick Comment: Recession Calls and Markets

by Calculated Risk on 6/10/2013 12:32:00 PM

Just an update: Back in March I wrote: Business Cycles and Markets . In that post, I pointed out that IF an investor could predict recessions and recoveries (even without being precise), they could significantly outperform the market.

I also pointed out that calling recessions and recoveries is NOT easy. A recent example would be ECRI's recent series of incorrect recession calls. If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 40% increase in the market!

For an investor, one bad business cycle call like that would wipe out most of the advantages from trying to time cycles.

Of course I disagreed with ECRI's recent recession call (I disagreed with their incorrect recession call in 2011 too - I wasn't even on recession watch then and I'm not on recession watch now).

One of my goals with this blog is to try to call the next recession, but I don't think that will happen for some time. Right now I'm optimistic on the economy, especially once most of the fiscal drag is behind us. Of course I might miss the next cycle - no one has a crystal ball.

Q1 2013: Mortgage Equity Withdrawal Strongly Negative

by Calculated Risk on 6/10/2013 09:29:00 AM

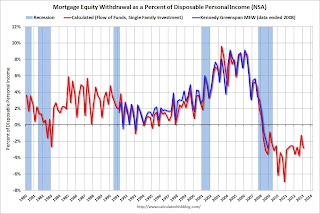

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q1 2013, the Net Equity Extraction was minus $85 billion, or a negative 2.8% of Disposable Personal Income (DPI).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined further in Q1. Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again in the next year or two.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Sunday, June 09, 2013

Sunday Night Futures

by Calculated Risk on 6/09/2013 09:50:00 PM

An interesting article from Nick Timiraos at the WSJ: Housing's Up, but Is Foundation Sound?

The housing-market recovery is here but there's a growing debate among bulls and bears over how long it will last ...I don't expect 2 million units per year at the end of the decade, but I do think the housing recovery will continue.

...

Population growth will require 14 million additional housing units this decade, around three-quarters of them single-family homes, according to Zelman & Associates, a research and advisory firm. Analysts at Zelman estimate that only 5.7 million of those units will be built by 2015, meaning the U.S. would need to add two million homes a year over the last four years of the decade—spurring a big boost of construction that would ripple through the economy.

"There's just not enough shelter," says Ivy Zelman, the firm's chief executive.

...

Joshua Rosner, managing director of Graham Fisher & Co., draws attention to several forces that had helped housing—and the economy—expand over the past few decades but whose end will now hinder growth.

Mr. Rosner first highlights the end of the "democratization" of credit. On the way up, lenders extended loans on better terms to more borrowers during a period in which interest rates were also declining. ... Housing and consumption enjoyed a one-time boost as baby boomers moved from one-income to two-income households during the inflation spells of the 1970s and as those consumers entered their peak consumption years in the 1980s. Those forces fueled homeownership, renovations and second-home buying.

Now, those tailwinds are becoming headwinds, Mr. Rosner says. The democratization of credit ended during the bust, and a new period of much tighter credit standards has replaced it.

Weekend:

• Schedule for Week of June 9th

The Asian markets are green tonight with the Nikkei up 2.9%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 16 (fair value).

Oil prices have moved up a little recently with WTI futures at $96.14 per barrel and Brent at $104.65 per barrel.

Gasoline Prices down slightly Nationally, Higher in Midwest due to Refinery Issues

by Calculated Risk on 6/09/2013 03:33:00 PM

From Reuters: U.S. Midwest gasoline price spike expected to linger

Gasoline prices at the pump in several U.S. Midwestern states have spiked close to record highs this week and were expected to stay near those levels for several weeks due to unexpected outages at key regional refineries ... price spikes have moved east from Midwestern states such as North Dakota, Minnesota and Nebraska, where some cities experienced record high prices a few weeks ago, but the reason is the same -- refineries are undergoing maintenance work.And from Reuters: Steady average gas price belies local ups and downs-survey

The average price for a gallon of gasoline slipped 1.81 cents to $3.6385 on June 7, according to the Lundberg Survey of about 2,500 gas stations across the country. ...Oil prices were up this week, with WTI up to $96.03 per barrel, and Brent at $104.56.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.45 per gallon. That is almost 20 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level, we should expect national gasoline prices to fall below $3.50 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |