by Calculated Risk on 6/09/2013 11:24:00 AM

Sunday, June 09, 2013

Housing: Watch Inventory

I've been watching for sale inventory very closely this year. My guess is inventory probably bottomed early this year. Inventory in many areas is still very low, but when more inventory comes on the market, buyer urgency will wane - and price increases will slow.

Several real estate agents have told me that they think more inventory is about to come on the market in their selling areas based on their discussions with potential sellers. I wouldn't be surprised if inventory builds all year (usually inventory peaks in July or August). We also might see less demand from cash flow investors who have bid up the low end.

Note: I'm confident that prices have bottomed (post-bubble), but if more inventory comes on the market, we will probably see more seasonal price declines this winter than last winter.

Jim the Realtor thinks this home might be a "Canary in Coal Mine" for the $1+ million market in North County San Diego. He thinks this house would have sold quickly earlier this year, and he will be watching to see when it goes pending (it has only been only the market a few days):

Saturday, June 08, 2013

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 6/08/2013 06:25:00 PM

Yesterday on the employment report:

• May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The 6 to 14 weeks category declined to 1.7%, the lowest since May 2008, but this is still above the "normal" level of under 1.5%.

The long term unemployed is at 2.8% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

The BLS diffusion index for total private employment was at 59.8 in May, up from 55.6 in April.

The BLS diffusion index for total private employment was at 59.8 in May, up from 55.6 in April.For manufacturing, the diffusion index increased slightly to 45.7, up from 45.1 in April.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was fairly widespread in May. This is a good sign for the economy. However, for manufacturing, more companies were decreasing employment than adding jobs again in May.

Schedule for Week of June 9th

by Calculated Risk on 6/08/2013 11:01:00 AM

The key report this week will be May retail sales to be released on Thursday.

For manufacturing, the May Industrial Production survey will be released on Friday.

For prices, PPI for May will be released on Friday.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for May. The consensus is for an increase to 92.3 from 92.1 in April.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

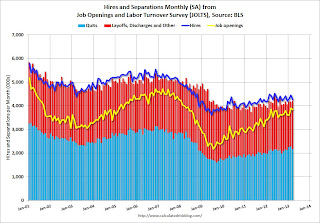

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 3.844 million, down from 3.899 million in February. The number of job openings (yellow) has generally been trending up, but openings are unchanged year-over-year compared to March 2012.

Quits were down in March, and quits are mostly unchanged year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 350 thousand from 346 thousand last week.

8:30 AM ET: Retail sales for May will be released.

8:30 AM ET: Retail sales for May will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 26.4% from the bottom, and now 10.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.5% in May, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.3% increase in inventories.

8:30 AM: Producer Price Index for May. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 84.5, unchanged from May.

Unofficial Problem Bank list declines to 760 Institutions

by Calculated Risk on 6/08/2013 08:46:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 7, 2013.

Changes and comments from surferdude808:

As CR posted yesterday, another bank controlled by Capitol Bancorp, LTD (Ticker: CBCRQ), 1st Commerce Bank, North Las Vegas, NV ($20 million) was closed intra-week. According to a report by SNL Securities, the FDIC used its authority that was received within the Federal Deposit Insurance Corporation Improvement Act of 1991 to close 1st Commerce Bank. Normally, the FDIC must wait for the chartering authority to close a bank. However, this authority allows the FDIC to close a bank to limit losses to the insurance fund when the chartering authority is delayed in terminating the charter. As reported, it has been more than a decade since a bank has been closed in this manner and this is only the fourth time the FDIC has exercised this authority since enactment of the legislation. Capitol Bancorp had been litigating the closure of 1st Commerce Bank and had obtained an injunction that was extended until June 10th, but the FDIC stepped around that action. While the FDIC accelerated the closing to limit losses to the insurance fund, 1st Commerce Bank has a failure cost estimate of $9.4 million, which is inordinately high at nearly 47 percent of the bank's assets.

The fate of the remaining seven banks controlled by Capital Bancorp is uncertain. So far, the four failed banks of Capitol Bancorp have cost the FDIC insurance e fund an estimated $44.2 million. The FDIC could assess the $44.2 million failure cost against the seven banks under cross guarantee authority. At March 31, 2013, the seven banks had cumulative equity of $51.8 million. Thus, an assertion of cross guarantee by the FDIC would likely lead to a closing of the seven banks. Some observers believe the FDIC has been generous in not asserting its cross guarantee authority. The geographic dispersion of the franchise, the unusual capital structure of the banks, or the lack of a single buyer could contribute to the piecemeal closings. The most vulnerable units appear to be Bank of Las Vegas, Henderson, NV ($247 million) and Sunrise Bank of Arizona ($206 million). We will continue to monitor the status of the remaining operating banks of Capitol Bancorp.

Meanwhile, the Unofficial Problem Bank List had a net reduction of one institution to 760 after two removals and one addition. Assets total $277.5 billion, which is the first weekly increase since the last week of January 2013. A year ago, the list held 923 institutions with assets of $355.7 billion.

The other removal from failure this week was Mountain National Bank, Sevierville, TN ($437 million Ticker: MNBT), which had a much more pedestrian estimated failure cost at 7.7 percent of assets. The addition was Colonial Bank, FSB, Vineland, NJ ($633 million Ticker: COBK).

Except for any potential follow through closings, we anticipate a quiet week for changes as the OCC will likely wait until June 21st to publish its actions through mid-May 2013.

Friday, June 07, 2013

Bank Failure #16 in 2013: Mountain National Bank, Sevierville, Tennessee

by Calculated Risk on 6/07/2013 06:54:00 PM

As of March 31, 2013, Mountain National Bank had approximately $437.3 million in total assets and $373.4 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $33.5 million. ... Mountain National Bank is the 16th FDIC-insured institution to fail in the nation this year, and the first in Tennessee.Friday is here.

Earlier on the employment report:

• May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs