by Calculated Risk on 6/07/2013 04:57:00 PM

Friday, June 07, 2013

AAR: Rail Traffic increased in May

From the Association of American Railroads (AAR): AAR Reports Increased Rail Traffic for May, and Week Ending June 1

The Association of American Railroads (AAR) today reported that total U.S. rail traffic increased for the month of May 2013 as well as for the week ending June 1, 2013. May 2013 saw the first year-over-year monthly total carload increase in 16 months, and the 42nd straight monthly increase in intermodal traffic.

Intermodal traffic in May totaled 1,214,116 containers and trailers, up 3 percent (35,790 units) compared with May 2012. The weekly average of 242,823 units for May was the highest weekly intermodal average for any May in history. Carloads originated in May totaled 1,401,584, up 0.7 percent (9,551 carloads) compared with the same month last year.

...

“The economy is still not firing on all cylinders, and rail traffic in May reflects that,” said AAR Senior Vice President of Policy and Economics John Gray. “Pockets of rail traffic growth, such as autos, nonmetallic minerals, and commodities related to crude oil extraction are being countered by continued weakness in steel-related commodities, paper, and grain, among others.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

Total U.S. rail carloads rose 0.7% (9,551 carloads) in May 2013 over May 2012 to 1,401,584 carloads, their first year-over-year monthly increase in 16 months. U.S. rail carloads averaged 280,317 per week in May 2013, up from 277,181 in April 2013 and 278,407 in May 2012 ...Note that lumber was a little weaker than a year ago - a rare year-over-year decline.

Once again, petroleum and petroleum products led the way — their carloads on U.S. railroads were up 42% (20,837 carloads) in May 2013 over May 2012. ...

U.S. rail carloads of lumber and wood products fell 1.8% (288 carloads) in May 2013, just their second year-over-year decline since 2009.

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic is on track for a record year in 2013.

Year-to-date intermodal volume on U.S. railroads through May was 5,261,051 units, up 4.1% (207,236 units) over the same period in 2012.

Earlier on the employment report:

• May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

WSJ: Fed could slow QE later this year

by Calculated Risk on 6/07/2013 12:47:00 PM

Depending on how the economy performs over the summer, the Fed could slow QE bond purchases later this year. The most likely time to announce a change in purchases would be either at the September or December FOMC meeting (those meetings will be followed by a Bernanke press conference). My guess right now is the Fed will wait until the end of the year or early next year, mostly because I think fiscal policy will be a significant drag on economic activity over the next couple of quarters - and also because inflation is still below the Fed's target.

From Jon Hilsenrath at the WSJ: Fed on Track to Ease Up on Bond Buying Later This Year

Federal Reserve officials are likely to signal at their June policy meeting that they're on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn't disappoint.Two keys: "later this year" if "the economy doesn't disappoint".

The central bank faces a number of challenges. One is managing the signal that they send to the market with their next series of moves.It is clear they will not raise rates for a long time.

Officials in their public statements have been trying to make clear that they are going to proceed cautiously with the bond program and are still probably years away from raising short-term interest rates, which have been near zero since late 2008.

Officials will be updating their forecasts at the next policy meeting. One risk: Economic headwinds from tightening fiscal policy could continue longer than they expect.

Employment Report Comments and more Graphs

by Calculated Risk on 6/07/2013 10:30:00 AM

Total nonfarm employment is up 2.115 million over the 12 months, and up 946 thousand so far in 2013 (a 2.27 million annual pace).

Private employment is up 2.173 million over the last year, and up 972 thousand so far in 2013 (a 2.33 million annual pace).

Of course public payrolls are continuing to shrink (four years of declining public payrolls now). Public employment is down 58 thousand over the last year, and down 26 thousand so far in 2013 (a 62 thousand annual pace).

And on construction employment: Construction employment is up 189 thousand over the last year, and up 93 thousand so far in 2013 (a 223 thousand annual pace).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio increased to 76.0% in May, the highest since April 2009. The participation rate for this group also increased in May to 81.3%. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

In May, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was unchanged at 7.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decreased slightly in May to 7.904 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased slightly to 13.8% in May. This matches the lowest level for U-6 since December 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.357 million workers who have been unemployed for more than 26 weeks and still want a job. This was slightly from from 4.353 million in April. This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In May 2013, state and local governments added 11,000 jobs, and state and local employment is up 25 thousand so far in 2013.

I think most of the state and local government layoffs are over. Of course total public employment declined again as the Federal government layoffs are ongoing - and with many more layoffs expected due to the sequestration spending cuts.

In 2013, construction is a bright spot for employment, the drag from state and local cutbacks is mostly over - and Federal fiscal cutbacks are an ongoing drag. Pretty much as expected.

May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

by Calculated Risk on 6/07/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 175,000 in May, and the unemployment rate was essentially unchanged at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was slightly above expectations of 167,000 payroll jobs added. Employment for March and April combined was revised slightly lower.

...

The change in total nonfarm payroll employment for March was revised from +138,000 to +142,000, and the change for April was revised from +165,000 to +149,000. With these revisions, employment gains in March and April combined were 12,000 less than previously reported.

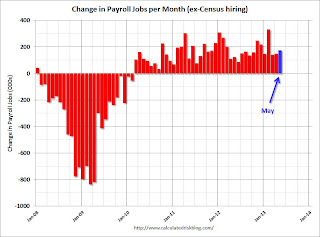

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate increased to 7.6% in May from 7.5% in April.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased to 63.4% in May (blue line) from 63.3% in April. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged at 58.6% in May (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was at expectations - of course expectations are fairly low. I'll have much more later ...

Thursday, June 06, 2013

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 6/06/2013 09:40:00 PM

First, LPS released their Mortgage Monitor report for April today. According to LPS, 6.21% of mortgages were delinquent in April, down from 6.59% in March

LPS reports that 3.17% of mortgages were in the foreclosure process, down from 4.20% in April 2012.

This gives a total of 9.38% delinquent or in foreclosure. It breaks down as:

• 1,717,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,394,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,588,000 loans in foreclosure process.

For a total of 4,699,000 loans delinquent or in foreclosure in April. This is down from 5,617,000 in April 2012.

The first graph from LPS shows percent of mortgage delinquent and in-foreclosure by month.

The percent of delinquent loans is still high (normal is in the 4% to 5% range), but the percent of delinquent loans is falling quickly.

The second graph shows the percent of loans in foreclosure in judicial and non-judicial foreclosure states.

[T]he disparity in foreclosure timelines between judicial and non-judicial states -- continues to grow. Still, as LPS Applied Analytics Senior Vice President Herb Blecher explained, the steady return to a relative degree of normality in the foreclosure sale rate has helped to bring down foreclosure inventories at the national level.There is much more in the mortgage monitor.

“The foreclosure sale rate in judicial states rose nearly 17 percent from March to April,” Blecher said. “This is the highest that rate has been since the moratoria and process reviews in the fall of 2010 led to a near-complete halt in the process in both judicial and non-judicial states. Non-judicial rates were relatively quick to bounce back, but judicial states experienced a much slower, though steady, increase. This has helped drive an overall decline in foreclosure inventory at the national level, which is now at 3.2 percent -- its lowest point in four years.

“The situation is far from resolved,” Blecher stressed. “Foreclosure inventories in judicial states are still more than three times the size of those in non-judicial states, and national inventories are still more than seven times pre-crisis levels. Additionally, recently announced moratoria will need to be monitored to determine the impact on timelines, as well as the rate of the improvement trend.”

Friday economic releases:

• At 8:30 AM, the BLS will release the Employment Report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May; the economy added 165,000 non-farm payroll jobs in April. The consensus is for the unemployment rate to be unchanged at 7.5% in May.

• At 3:00 PM, Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $14.0 billion in April.