by Calculated Risk on 1/24/2013 08:47:00 PM

Thursday, January 24, 2013

Friday: New Home Sales

First, from Michelle Meyer at Merrill Lynch: Tale of the missing homes

One of the key developments for the housing market in 2012 was a significant decline in inventory. The number of existing homes on the market for sale plunged 22% from the end of 2011, reaching the lowest level since January 2001. At the current sales pace, it now only takes 4.4 months to clear the stock of homes for sale. This is the slowest pace since the heart of the housing bubble in mid-2005. The reduction in supply has underpinned home prices and created a need for construction yet again.CR note: Watching inventory - while not much more exciting than watching grass grow - will be key this year. My guess is inventory has bottomed, but even if there are further declines, the year-over-year declines will be much less in 2013 than in 2012.

The decline in supply can be explained by a few factors. Most significantly, the sharp decline in homebuilding translated to minimal growth in the housing stock. From 2009 to 2011, housing starts only slightly exceeded the pace of demolitions. The sluggish pace of new construction, of course, has a more direct impact on new inventory than it does on existing supply. Nonetheless, over time, it means fewer homes available for sale and hence slower turnover.

The latter – the decline in turnover – is the main reason for lean inventory of existing properties. This is a function of 1) falling home prices, which discouraged sellers; 2) tight credit, which reduced the number of move-up buyers; 3) negative equity that led to lock-in. As home prices increase and credit standards ease, some of this "pent-up" inventory will be unleashed. That said, if it is truly turnover – which means selling a property to buy a different one – it will also result in a gain in home sales. Months supply can therefore remain low.

Another source of inventory is from distressed properties – both current and previous. There is still a large pipeline of mortgages in foreclosure or seriously delinquent that needs to be processed. We think this will be gradual given the delays from states with a judicial foreclosure process. We can also see inventory from previously delinquent mortgages that had been purchased by investors. Many institutional investors bought distressed properties in bulk with the intention of renting them for a few years until prices appreciated. As prices rise, investors will look to take capital gains.

We advise some caution when interpreting the inventory data as there are big seasonal swings. Inventory typically falls at the end of the year and picks up again in Q1 in anticipation of the spring selling season. Extracting the seasonal factors from inventory shows that the biggest adjustments occur in December, when inventory is low, and August when inventory is high. We therefore expect a gain in inventory over Q1. This may very well be matched with a modest gain in sales in the spring, therefore making it a temporary rise in inventory.

Friday economic releases:

• At 10:00 AM ET, New Home Sales for December from the Census Bureau. The consensus is for an increase in sales to 388 thousand Seasonally Adjusted Annual Rate (SAAR) in December. This will put annual sales at around 367,000, an increase of around 20% from 2011.

DOT: Vehicle Miles Driven increased 0.8% in November

by Calculated Risk on 1/24/2013 04:11:00 PM

The Department of Transportation (DOT) reported:

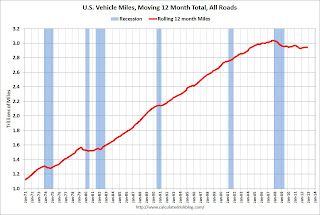

Travel on all roads and streets changed by +0.8% (1.9 billion vehicle miles) for November 2012 as compared with November 2011. Travel for the month is estimated to be 238.8 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.6% (16.7 billion vehicle miles). The Cumulative estimate for the year is 2,702.9 billion vehicle miles of travel.

Traffic in the Northeast was down 0.9%, but there were gains in every other region. The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 60 months - 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in November compared to November 2011. In November 2012, gasoline averaged of $3.52 per gallon according to the EIA. Last year, prices in November averaged $3.44 per gallon.

Gasoline prices were up in November compared to November 2011. In November 2012, gasoline averaged of $3.52 per gallon according to the EIA. Last year, prices in November averaged $3.44 per gallon. However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Forecast: Solid Auto Sales in January

by Calculated Risk on 1/24/2013 02:32:00 PM

From Edmunds.com: January Auto Sales Suggest the Good Times Will Keep Rolling in 2013, says Edmunds.com

Edmunds.com ... forecasts that 1,045,587 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.3 million light vehicles. The projected sales will be ... a 14.5 percent increase from January 2012.It looks like auto sales are starting 2013 fairly strong.

“January’s numbers show that vehicle sales stayed strong, even after the holiday ads faded away and the replacement sales following Hurricane Sandy started to dry up,” says Edmunds.com Senior Analyst Jessica Caldwell. “These results certainly reinforce the exuberance and optimism that filled the air last week at the North American International Auto Show in Detroit.”

The following table shows annual light vehicle sales, and the change from the previous year. Light vehicle sales have seen double digit growth for three consecutive years, but the growth rate will probably slow in 2013.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

Kansas City Fed: Regional Manufacturing Contracted Modestly in January

by Calculated Risk on 1/24/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Contracted Modestly

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity contracted modestly again in January, but factories’ production expectations remained relatively optimistic for the months ahead.This follows contraction in the Richmond Fed survey earlier this week:

“Regional factory activity has now edged down for four straight months, as fiscal policy uncertainty continues to weigh on firms’ plans, said Wilkerson. On the positive side, expectations for new orders rose quite a bit in January, but hiring and capital spending plans were only modestly positive.”

The month-over-month composite index was -2 in January, largely unchanged from readings of -1 in December and -3 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity declined at most durable goods-producing plants, while nondurable producers noted a slight increase overall. Most other month-over-month indexes were below zero but higher than in December. The production index inched higher from -5 to -3, and the shipments, new orders, and order backlog indexes also rose somewhat but stayed in negative territory. In contrast, the employment index fell from -1 to -8, its lowest level since mid-2009, and the new orders for exports index also declined.

emphasis added

In January, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost seventeen points to settle at −12 from December's reading of 5. Among the index's components, shipments fell seventeen points to −11, the gauge for new orders moved down twenty-seven points to end at −17, and the jobs index slipped two points to −5.The NY Fed (Empire state) and Philly Fed surveys showed contraction last week.

However, the Markit Flash PMI was positive for January: Strongest manufacturing expansion since March 2011

The expansion of the U.S. manufacturing sector gained further momentum at the start of 2013, with the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) rising to 56.1 in January. Up from 54.0 in December, the ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, signalled.The Markit Flash PMI is the opposite of the regional surveys. Go figure.

Manufacturing employment also rose strongly during January, with new jobs being created at the fastest rate for nine months. Firms generally linked job creation to fuller order books.

Weekly Initial Unemployment Claims decline to 330,000

by Calculated Risk on 1/24/2013 08:40:00 AM

The DOL reports:

In the week ending January 19, the advance figure for seasonally adjusted initial claims was 330,000, a decrease of 5,000 from the previous week's unrevised figure of 335,000. The 4-week moving average was 351,750, a decrease of 8,250 from the previous week's revised average of 360,000.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 351,750.

This is the lowest level for the 4-week average since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

Weekly claims were below the 360,000 consensus forecast.