by Calculated Risk on 1/17/2013 03:31:00 PM

Thursday, January 17, 2013

Some Comments on Housing Starts

A few key points:

• Housing starts increased 28.1% in 2012 (initial estimate). This is a solid year-over-year increase, and residential investment is now making a positive contribution to GDP growth.

• Even after increasing 28% in 2012, the 780 thousand housing starts this year were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). This was also the fourth lowest year for single family starts since 1959.

• Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

• Residential investment and housing starts are usually the best leading indicator for economy. Note: Housing is usually a better leading indicator for the US economy than manufacturing, see: Josh Lehner's The Handoff – Manufacuturing to Housing. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

The following table shows annual starts (total and single family) since 2005:

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.0 | 28.1% | 535.5 | 24.4% |

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, but the increase in completions has just started. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey Shows Contraction in January

by Calculated Risk on 1/17/2013 01:44:00 PM

Catching up ... earlier from the Philly Fed: January Manufacturing Survey

Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a revised reading of 4.6 in December to ‐5.8 this month.Earlier this week, the Empire State manufacturing survey also indicated contraction in January.

Labor market conditions at reporting firms deteriorated this month. The employment index, at ‐5.2, fell from ‐0.2 in December. ...

The survey’s future indicators suggest that firms expect recent declines to be temporary. The future general activity index increased from a revised reading of 23.7 to 29.2, its second consecutive monthly increase.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys decreased in January, and is back below zero. This suggests another weak reading for the ISM manufacturing index.

CoreLogic: Negative Equity Decreases in Q3 2012

by Calculated Risk on 1/17/2013 11:01:00 AM

From CoreLogic: CORELOGIC® Reports 1.4 Million Borrowers Returned to "Positive Equity" Year to Date through the end of the Third Quarter 2012

CoreLogic ... today released new analysis showing approximately 100,000 more borrowers reached a state of positive equity during the third quarter of 2012, adding to the more than 1.3 million borrowers that moved into positive equity through the second quarter of 2012. This brings the total number of borrowers who moved from negative equity to positive equity September YTD to 1.4 million. 10.7 million, or 22 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2012. This is down from 10.8 million properties, or 22.3 percent, at the end of the second quarter of 2012. An additional 2.3 million borrowers had less than 5 percent equity in their home, referred to as near-negative equity, at the end of the third quarter.

Together, negative equity and near-negative equity mortgages accounted for 26.8 percent of all residential properties with a mortgage nationwide in the third quarter of 2012, down from 27 percent at the end of the second quarter in 2012. Nationally, negative equity decreased from $689 billion at the end of the second quarter in 2012 to $658 billion at the end of the third quarter, a decrease of $31 billion. This decrease was driven in large part by an improvement in house price levels.This dollar amount represents the total value of all homes currently underwater nationally.

“Through the third quarter, the number of underwater borrowers declined significantly,” said Mark Fleming, chief economist for CoreLogic. “The substantive gain in house prices made in 2012, partly due to tight inventory caused by negative equity’s lock-out effect, has paradoxically alleviated some of the pain.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 56.9 percent, followed by Florida (42.1 percent), Arizona (38.6 percent), Georgia (35.6 percent) and Michigan (32 percent). These top five states combined account for 34 percent of the total amount of negative equity in the U.S."

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.

The second graph shows the distribution of home equity. Close to 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But some borrowers are close.More from CoreLogic: "As of Q3 2012, there were 1.8 million borrowers who were only 5 percent underwater, who if home prices continue increasing over the next year, could return to a positive equity position."

This is more improvement, but there are still 10.7 million residential properties with negative equity.

Weekly Initial Unemployment Claims decline to 335,000

by Calculated Risk on 1/17/2013 09:25:00 AM

The DOL reports:

In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000.

The previous week was revised up from 371,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 359,250.

This was the lowest level for weekly claims since January 2008, and the 4-week average is near the low since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

Weekly claims were below the 368,000 consensus forecast.

Earlier:

• Housing Starts increase sharply to 954 thousand SAAR in December

Housing Starts increase sharply to 954 thousand SAAR in December

by Calculated Risk on 1/17/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 954,000. This is 12.1 percent above the revised November estimate of 851,000 and is 36.9 percent above the December 2011 rate of 697,000.

Single-family housing starts in December were at a rate of 616,000; this is 8.1 percent above the revised November figure of 570,000. The December rate for units in buildings with five units or more was 330,000.

An estimated 780,000 housing units were started in 2012. This is 28.1 percent above the 2011 figure of 608,800.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 903,000. This is 0.3 percent above the revised November rate of 900,000 and is 28.8 percent above the December 2011 estimate of 701,000.

Single-family authorizations in December were at a rate of 578,000; this is 1.8 percent above the revised November figure of 568,000. Authorizations of units in buildings with five units or more were at a rate of 301,000 in December.

Click on graph for larger image.

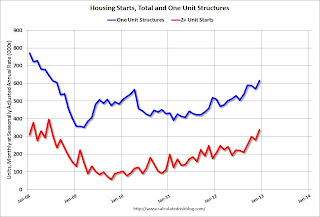

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply from November.

Single-family starts (blue) increased to 616,000 thousand in December.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR).

Total starts has doubled from the bottom start rate, and single family starts are up about 75 percent from the low

This was well above expectations of 887 thousand starts in December. Starts in December were up 36.9% from December 2011, and starts are up 28.1% from the 2011 level. I'll have more soon ...