by Calculated Risk on 1/15/2013 12:38:00 PM

Tuesday, January 15, 2013

After the Debt Ceiling is increased ...

As I noted earlier this year, there are three short term fiscal deadlines this year: 1) the Debt Ceiling, 2) the "sequester", and 3) the “continuing resolution". I'm convinced the debt ceiling will be increased, and something will be worked out on the "sequester", but there is strong possibility the “continuing resolution" will lead to a government shutdown.

Here are some comments from Alec Phillips at Goldman Sachs this morning:

A government shutdown -- modest effects but increasingly likely: Congress opted in September 2012 to extend spending authority for six months, until March 27, 2013. This has been done frequently in recent years when lawmakers cannot agree on full-year spending levels. If spending authority is not extended further, the Obama administration will lose its authority to carry out activities funded by appropriations and will be forced to shut down non-essential government operations. This is not as bad as it sounds, for a few reasons: first, only 40% of federal spending relies on congressional appropriations; the remainder is unaffected by a failure to extend spending authority. Second, about two-thirds of that 40% is deemed "essential" and continues even without a renewal of spending authority. This includes defense functions and services "essential to protect life and property." The upshot is that a one-week shutdown of these activities would reduce federal spending by $8bn to $12bn (annualized). Since a shutdown that begins on March 27 would straddle the end of Q1 and the start of Q2, the effect on quarterly growth is hard to estimate but might be around 0.1pp in each quarter.As Phillips notes, this will not be catastrophic (like not paying the bills), but it will be disruptive. A "government shutdown" is just a stunt since most of the government expenditures will continue.

Note: Much of the data I rely on is from the Bureau of Labor Statistics (BLS), Census Bureau, and the Bureau of Economy Analysis (BEA) and other agencies that will probably be impacted. This includes the monthly employment report, housing starts, new home sales and much more. This data is very useful, and I think the value far outweighs the cost.

Here is a repeat of what I wrote earlier: Question #1 for 2013: US Fiscal Policy

[T]here are still several fiscal issues remaining for this year. The "sequester" (automatic spending cuts) still needs to be resolved, the "debt ceiling" needs to be raised, and a “continuing resolution” needs to be passed or the government will be shut down.

The so-called "debt ceiling" is really just about paying the bills. Here are a few things to know:

1) The House will raise the debt ceiling before the deadline, and the US will pay the bills.

2) The House majority has no leverage on the "debt ceiling"; as I've noted before, the House majority holds a losing hand and everyone knows it. The sooner they fold (and raise the debt ceiling) the better for everyone. As we saw in 2011, there are real world consequences for waiting until the last minute.

3) Those thinking there are no consequences for missing the deadline, I suggest reading the new (January 7th) Debt Limit Analysis by analysts at the Bipartisan Policy Center. From a political perspective, missing the deadline will, in the words of Republican Senator Mitch McConnell, make the "Republican brand toxic". It would be political suicide, so it will not happen.

Hopefully the House will fold their losing hand soon. If they are planning on taking the country to the brink, and betting voters will forget like after 2011, I think that is another losing bet.

Although the negotiations on the "sequester" will be tough, I suspect something will be worked out (remember the goal is to limit the amount of austerity in 2013). The issue that might blow up is the “continuing resolution", and that might mean a partial shut down of the government. This wouldn't be catastrophic (like the "debt ceiling"), but it would still cause problems for the economy and is a key downside risk.

And a final prediction: If we just stay on the current path - and the "debt ceiling" is raised, and a reasonable agreement is reached on the "sequester", and the “continuing resolution" is passed - I think the deficit will decline faster than most people expect over the next few years. Eventually the deficit will start to increase again due to rising health care costs (this needs further attention), but that isn't a short term emergency.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next three years based on current policy (Jan Hatzius at Goldman Sachs estimates the deficit will 3% of GDP in 2015). Note: With 7.8% unemployment, there is a strong argument for less deficit reduction in the short term, but that doesn't seem to be getting any traction.

As David Wessel at the WSJ recently noted: Putting the Brakes on Cutting the Deficit

In the depths of the most recent recession, the fiscal year that ended Sept. 30, 2009, the deficit was 10.1% of gross domestic product, the value of all the goods and services produced. Since then, the deficit has declined to 9% of GDP in 2010, 8.7% in 2011 and 7.0% in fiscal 2012. Private analysts predict the deficit will be between 5.5% and 6.0% of GDP in fiscal 2013 ...Over the next few years the deficit will probably be steadily decreasing as a percent of GDP. We don't want to reduce the deficit much faster than this path, because that will be too much of a drag on the economy.

However, later this decade, the deficit will probably start to increase again, mostly due to rising health care expenditures. Health care spending is a long term issue and needs to be addressed to put the long term debt on a sustainable path long term.

The key points are: the cyclical deficit will slowly decline, and there is a long term issue, mostly related to health care costs that we need to start to address in the next few years.

Final note: I'm convinced the house will fold soon on "paying the bills" (the sooner the better for everyone), but we might see a government shutdown at the end of March.

CoreLogic: House Prices up 7.4% Year-over-year in November, Largest increase since 2006

by Calculated Risk on 1/15/2013 09:55:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Rises 7.4 Percent Year Over Year in November

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 7.4 percent in November 2012 compared to November 2011. This change represents the biggest increase since May 2006 and the ninth consecutive increase in home prices nationally on a year-over-year basis. On a month-over-month basis, including distressed sales, home prices increased by 0.3 percent in November 2012 compared to October 2012. The HPI analysis shows that all but six states are experiencing year-over-year price gains.

...

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 6.7 percent in November 2012 compared to November 2011. On a month-over-month basis excluding distressed sales, home prices increased 0.9 percent in November 2012 compared to October 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that December 2012 home prices, including distressed sales, are expected to rise by 7.9 percent on a year-over-year basis from December 2011 and fall by 0.5 percent on a month-over-month basis from November 2012 reflecting a seasonal winter slowdown.

...

“As we close out 2012 the pending index suggests prices will remain strong," said Mark Fleming, chief economist for CoreLogic. “Given the recently released QM rules issued by the CFPB are not expected to significantly restrict credit availability relative to today, the gains made in 2012 will likely be sustained into 2013.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in November, and is up 7.4% over the last year.

The index is off 26.8% from the peak - and is up 9.6% from the post-bubble low set in February 2012 (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in November - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Retail Sales increased 0.5% in December

by Calculated Risk on 1/15/2013 08:44:00 AM

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $415.7 billion, an increase of 0.5 percent from the previous month and 4.7 percent above December 2011. ... The October to November 2012 percent change was revised from +0.3 percent to +0.4 percent.

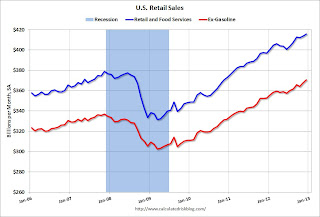

Click on graph for larger image.

Click on graph for larger image.Sales for November were revised up to a 0.4% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 25.4% from the bottom, and now 9.7% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes).

The second graph shows the same data, but just since 2006 (to show the recent changes). Retail sales ex-autos increased 0.3%.

Excluding gasoline, retail sales are up 22.5% from the bottom, and now 10.0% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.7% for all retail sales).

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

Monday, January 14, 2013

Tuesday: Retail Sales, PPI, Empire State Mfg Survey

by Calculated Risk on 1/14/2013 09:03:00 PM

From the NY Times: Obama Says G.O.P. Won’t Get ‘Ransom’ to Lift Debt Limit

“They will not collect a ransom in exchange for not crashing the American economy,” Mr. Obama vowed in the East Room, a week before his second inauguration. “The financial well-being of the American people is not leverage to be used. The full faith and credit of the United States of America is not a bargaining chip.”CR note: The "debt limit" is not about spending - it is about paying the bills.

The key in the short term is to NOT reduce the deficit too quickly (the fiscal agreement will probably add a 1.5% drag to the economy in 2013). The key in the long term is put the debt on a sustainable path. These are not contradictory, and right now we are on a path to reduce the deficit to about 3% of GDP in 2015. That is about the right pace following the financial crisis. That gives policymakers time to address the long run issues.

Tuesday economic releases:

• At 8:30 AM ET, Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales. The consensus is for retail sales to increase 0.2% in December, and to increase 0.3% ex-autos..

• Also at 8:30 AM, the BLS will release the Producer Price Index for December. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for January will be released. The consensus is for a reading of 0.0, up from minus 8.1 in December (below zero is contraction).

• Also at 8:30 AM, Corelogic will release their House Price Index for November 2012.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report will be released.

Bernanke to Congress: Do your job, Pay the Bills

by Calculated Risk on 1/14/2013 05:35:00 PM

Fed Chairman Ben Bernanke was very clear. The "debt ceiling" is about paying the bills, not about new spending. He urged congress to do their job, raise the debt ceiling, and pay the bills. His preference was to abolish the "debt ceiling" since it is redundant.

From the WSJ: Bernanke Calls on Congress to Raise Debt Ceiling

"It’s very, very important that Congress take the necessary action to raise the debt ceiling to avoid the situation where the government doesn’t pay its bills,” said Mr. Bernanke ... “Raising the debt ceiling gives the government the ability to pay its existing bills–it doesn’t create new spending,” he said.At another point, Bernanke said the "debt ceiling" has "symbolic value", but he prefers eliminating it. He was very clear that Congress should do their job and raise the debt ceiling.

Bernanke also expressed concern about the long run sustainability of the debt (over decades), but that we also shouldn't cut the deficit too quickly and impact the "fragile recovery". He thought the fiscal cliff deal would subtract about 1.5% from GDP this year.

CR Note: As I've noted before, the "debt ceiling" sounds virtuous, but it is really just about paying the bills. Not paying the bills is reckless and irresponsible.

By stalling, Congress is scaring people and is probably already negatively impacting the economy. Congress should do their job. Today. I remain confident Congress will authorize paying the bills, but this delaying is embarrassing.