by Calculated Risk on 1/14/2013 08:45:00 AM

Monday, January 14, 2013

LPS: Mortgage Delinquency Rates increased slightly in November

LPS released their Mortgage Monitor report for November today. According to LPS, 7.12% of mortgages were delinquent in November, up from 7.03% in October, and down from 7.83% in November 2011.

LPS reports that 3.51% of mortgages were in the foreclosure process, down from 3.61% in October, and down from 4.20% in November 2011.

This gives a total of 10.63% delinquent or in foreclosure. It breaks down as:

• 1,999,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,584,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,767,000 loans in foreclosure process.

For a total of 5,350,000 loans delinquent or in foreclosure in November. This is up slightly from 5,300,000 in October, and down from 6,172,000 in November 2011.

This following graph from LPS shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

Even though delinquencies were up slightly in November, it was mostly seasonal. However there was a large increase in delinquencies in the areas impacted by Hurricane Sandy, From LPS:

The November data also showed that the impact of Hurricane Sandy continued in ZIP codes hit hardest by the storm. While national delinquencies are moving in line with seasonal trends – that is, tending to rise slightly through the remainder of the calendar year – mortgage delinquencies increased sharply in those areas affected by Sandy. Whereas the national delinquency rate has increased 3.7 percent since August of this year, delinquencies in Sandy-impacted ZIPs have risen at more than threefold that pace – climbing 15.4 percent in Conn., 15.2 percent in N.J. and 14.8 percent in N.Y.

The second graph from LPS shows foreclosure starts were off sharply. From LPS:

The second graph from LPS shows foreclosure starts were off sharply. From LPS: The November Mortgage Monitor report released by Lender Processing Services shows the national foreclosure inventory dropped to 3.51 percent in November, representing an almost 10 percent decline from September 2012, when newly instituted National Mortgage Settlement requirements began to influence the pace of first-time foreclosure starts. As noted in last month’s Mortgage Monitor release, LPS expects foreclosure starts to rebound as mortgage servicers incorporate the new procedural requirements into their operations in the coming months.There is much more in the mortgage monitor.

Sunday, January 13, 2013

Sunday Night Futures

by Calculated Risk on 1/13/2013 09:23:00 PM

Monday:

• At 8:45 AM ET, LPS will release their Mortgage Monitor report for November.

• At 4:00 PM Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium. Here is the topic: "Chairman Bernanke visits the University of Michigan for a conversation with Ford School Dean Susan M. Collins on monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy". The event will be streamed live, and Bernanke will take questions on Twitter: #fordschoolbernanke

Weekend:

• Schedule for Week of Jan 13th

• Summary for Week Ending Jan 11th

The Asian markets are mixed tonight; the Shanghai Composite index is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 3 and DOW futures are up 25 (fair value).

Oil prices have moved sideways recently WTI futures at $94.03 per barrel and Brent at $110.83 per barrel. Gasoline prices are down slightly over the last couple of days.

Gasoline Prices up Recently, Expected to be lower than in 2012

by Calculated Risk on 1/13/2013 02:23:00 PM

Another update on gasoline prices. From the EIA (Energy Information Administration):

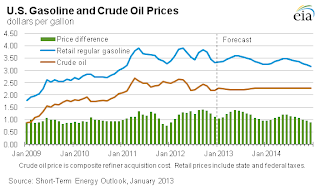

EIA expects that the Brent crude oil spot price, which averaged $112 per barrel in 2012, will fall to an average of $105 per barrel in 2013 and $99 per barrel in 2014. The projected discount of West Texas Intermediate (WTI) crude oil to Brent, which averaged $18 per barrel in 2012, falls to an average of $16 per barrel in 2013 and $8 per barrel in 2014, as planned new pipeline capacity lowers the cost of moving Mid-continent crude oil to the Gulf Coast refining centers.

EIA expects that falling crude prices will help national average regular gasoline retail prices fall from an average $3.63 per gallon in 2012 to annual averages of $3.44 per gallon and $3.34 per gallon in 2013 and 2014, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the EIA forecasts for crude and gasoline. There are some seasonal factors for gasoline with prices rising during the summer. This forecast is mostly just some small changes to current prices, and as we all know, there can be wild event driven swings for oil and gasoline prices.

Below is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices last year. Prices are up a little this year, but still near the recent low.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Jim the Realtor: "Price Pushing"

by Calculated Risk on 1/13/2013 10:33:00 AM

Jim the Realtor posted a short and interesting video.

Since the market is "hot" in Carmel Valley, San Diego, and there is very little inventory, some sellers are pushing up the price with the expected result - no takers.

As Jim notes: "I don't think you are going to buffalo today's buyers. I don't think they are going for. They have access to all the data. They know the comps. They know the one around the corner is priced [significantly less]."

"Price pushing" will probably contribute to some increase in inventory this year.

Saturday, January 12, 2013

No Trillion Dollar Platinum Coin

by Calculated Risk on 1/12/2013 09:59:00 PM

From Joe Weisenthal at Business Insider: White House Rules Out The Trillion Dollar Coin Option To Break The Debt Ceiling

”Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,” [Anthony Coley, a spokesman for the Treasury Department]I don't think of this as "hostage taking" since I remain confident that Congress will raise the debt ceiling (really just about paying the bills) and pay the bills on time - without any concessions from the White House. A better term would be "economic terrorism" since they are just trying to scare people.

...

From HuffPo:

"There are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default," said Press Secretary Jay Carney. "When Congressional Republicans played politics with this issue last time putting us at the edge of default, it was a blow to our economic recovery, causing our nation to be downgraded. The President and the American people won't tolerate Congressional Republicans holding the American economy hostage again simply so they can force disastrous cuts to Medicare and other programs the middle class depend on while protecting the wealthy. Congress needs to do its job."emphasis added

It would be better for America, the economy and all parties to raise the debt ceiling sooner rather than later.

The good news is, as Goldman Sachs chief economist Jan Hatzius wrote yesterday:

"By 2015, we expect the federal deficit to be down to $500bn, or just under 3% of GDP. If this forecast is correct, concerns about the federal deficit are likely to diminish over the next few years."That fits with my view for the next few years.

We should all agree: Pay the bills. Stop scaring people. Raise the debt ceiling today.