by Calculated Risk on 1/13/2013 02:23:00 PM

Sunday, January 13, 2013

Gasoline Prices up Recently, Expected to be lower than in 2012

Another update on gasoline prices. From the EIA (Energy Information Administration):

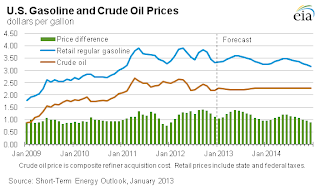

EIA expects that the Brent crude oil spot price, which averaged $112 per barrel in 2012, will fall to an average of $105 per barrel in 2013 and $99 per barrel in 2014. The projected discount of West Texas Intermediate (WTI) crude oil to Brent, which averaged $18 per barrel in 2012, falls to an average of $16 per barrel in 2013 and $8 per barrel in 2014, as planned new pipeline capacity lowers the cost of moving Mid-continent crude oil to the Gulf Coast refining centers.

EIA expects that falling crude prices will help national average regular gasoline retail prices fall from an average $3.63 per gallon in 2012 to annual averages of $3.44 per gallon and $3.34 per gallon in 2013 and 2014, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the EIA forecasts for crude and gasoline. There are some seasonal factors for gasoline with prices rising during the summer. This forecast is mostly just some small changes to current prices, and as we all know, there can be wild event driven swings for oil and gasoline prices.

Below is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices last year. Prices are up a little this year, but still near the recent low.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Jim the Realtor: "Price Pushing"

by Calculated Risk on 1/13/2013 10:33:00 AM

Jim the Realtor posted a short and interesting video.

Since the market is "hot" in Carmel Valley, San Diego, and there is very little inventory, some sellers are pushing up the price with the expected result - no takers.

As Jim notes: "I don't think you are going to buffalo today's buyers. I don't think they are going for. They have access to all the data. They know the comps. They know the one around the corner is priced [significantly less]."

"Price pushing" will probably contribute to some increase in inventory this year.

Saturday, January 12, 2013

No Trillion Dollar Platinum Coin

by Calculated Risk on 1/12/2013 09:59:00 PM

From Joe Weisenthal at Business Insider: White House Rules Out The Trillion Dollar Coin Option To Break The Debt Ceiling

”Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,” [Anthony Coley, a spokesman for the Treasury Department]I don't think of this as "hostage taking" since I remain confident that Congress will raise the debt ceiling (really just about paying the bills) and pay the bills on time - without any concessions from the White House. A better term would be "economic terrorism" since they are just trying to scare people.

...

From HuffPo:

"There are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default," said Press Secretary Jay Carney. "When Congressional Republicans played politics with this issue last time putting us at the edge of default, it was a blow to our economic recovery, causing our nation to be downgraded. The President and the American people won't tolerate Congressional Republicans holding the American economy hostage again simply so they can force disastrous cuts to Medicare and other programs the middle class depend on while protecting the wealthy. Congress needs to do its job."emphasis added

It would be better for America, the economy and all parties to raise the debt ceiling sooner rather than later.

The good news is, as Goldman Sachs chief economist Jan Hatzius wrote yesterday:

"By 2015, we expect the federal deficit to be down to $500bn, or just under 3% of GDP. If this forecast is correct, concerns about the federal deficit are likely to diminish over the next few years."That fits with my view for the next few years.

We should all agree: Pay the bills. Stop scaring people. Raise the debt ceiling today.

Unofficial Problem Bank list declines to 832 Institutions

by Calculated Risk on 1/12/2013 04:11:00 PM

The first bank failure of 2013:

Westside eclipsed by Sunwest

Sun burning savers

by Soylent Green is People

From the FDIC: Sunwest Bank, Irvine, California, Assumes All of the Deposits of Westside Community Bank, University Place, Washington

As of September 30, 2012, Westside Community Bank had approximately $97.7 million in total assets and $96.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.3 million. ... Westside Community Bank is the first FDIC-insured institution to fail in the nation this year, and the first in Washington.And the unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 11, 2012.

Changes and comments from surferdude808:

The FDIC cranked up a closing team to get the first full week in 2013 underway, otherwise it would have been a quiet week for the Unofficial Problem Bank List. Along with the failure, there was one action termination, which leaves the list count at 832 institutions with assets of $310.7 billion. A year ago, the list held 969 institutions with assets of $391.2 billion.Earlier:

The action termination was Southern First Bank, National Association, Greenville, SC ($779 million Ticker: SFST). The failure was Westside Community Bank, University Place, WA ($98 million), which was the 18th bank to close in Washington since the on-set of the crisis. Next week, we anticipate the OCC will release its actions through mid-December 2012.

• Schedule for Week of Jan 13th

• Summary for Week Ending Jan 11th

Schedule for Week of Jan 13th

by Calculated Risk on 1/12/2013 01:10:00 PM

Earlier:

• Summary for Week Ending Jan 11th

This will be a busy week for economic data. The key reports for this week will be the December retail sales report on Tuesday, and December housing starts on Thursday. On Monday, the focus will be on "a conversation with Fed Chairman Ben Bernanke".

Also the Consumer Price Index (CPI) and Producer Price Index (PPI) for December will be released this week.

For manufacturing, the Fed will release December Industrial Production on Wednesday, and the January NY Fed (Empire state) and Philly Fed surveys will be released this week.

8:45 AM ET: LPS will release their Mortgage Monitor report for November.

4:00 PM: Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium, "Chairman Bernanke visits the University of Michigan for a conversation with Ford School Dean Susan M. Collins on monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy". The even will be streamed live, and Bernanke will take questions on Twitter: #fordschoolbernanke

8:30 AM: Producer Price Index for December. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.

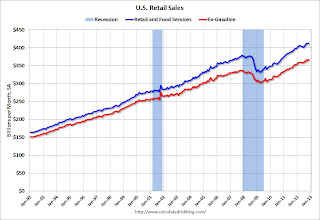

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through November. Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.2% in December, and to increase 0.3% ex-autos.

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 0.0, up from minus 8.1 in December (below zero is contraction).

8:30 AM: Corelogic will release their House Price Index for November 2012.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for December. The consensus is for no change in CPI in December and for core CPI to increase 0.1%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This shows industrial production since 1967 through November.

The consensus is for a 0.2% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.5%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in December. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 368 thousand from 371 thousand last week.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR). Single-family starts decreased to 565 thousand in November.

The consensus is for total housing starts to increase to 887 thousand (SAAR) in December, up from 861 thousand in November.

10:00 AM: Philly Fed Survey for January. The consensus is for a reading of 6.0, down from 8.1 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 75.0, up from 72.9.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2012