by Calculated Risk on 1/04/2013 06:20:00 PM

Friday, January 04, 2013

AAR: Rail Traffic "mixed" in December

From the Association of American Railroads (AAR): AAR Reports Mixed Annual and Monthly Traffic for December

The Association of American Railroads (AAR) today reported mixed 2012 rail traffic compared with 2011. U.S. rail intermodal volume totaled 12.3 million containers and trailers in 2012, up 3.2 percent or 374,918 units, over 2011. Carloads totaled 14.7 million in 2012, down 3.1 percent or 476,322 carloads, from 2011. Intermodal volume in 2012 was the second highest on record, down 0.1 percent or 14,885 containers and trailers, from the record high totals of 2006.

...

“Coal and grain typically account for around half of U.S. rail carloads, so when they’re down, chances are good that overall rail carloads are down too, as we saw in 2012,” said AAR Senior Vice President John T. Gray. “That said, a number of key rail carload categories showed solid improvement in 2012, including categories like autos and lumber that are most highly correlated with economic growth. Meanwhile, intermodal just missed setting a new volume record in 2012.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,086,990 carloads in December 2012, down 4.2% (48,071 carloads) from December 2011 and an average of 271,748 carloads per week. Except for a tiny increase in January, year-over-year total U.S. rail carloads fell each month in 2012 compared with the same month in 2011 ...Note that building related commodities were up.

In December 2012, as in every prior month in 2012, year-over-year U.S. rail carloads would have increased if not for a decline in coal carloadings. Coal carloads totaled 446,233 in December 2012, down 13.3% (68,372 carloads) from December 2011.

Grain carloads totaled 72,422 in December 2012, down 13.9% (11,708 carloads) from December 2011. December 2012’s average weekly grain carloads of 18,106 were the lowest for any December on record.

...

Other commodities showing carload increases on U.S. railroads in December 2012 compared with December 2011 include motor vehicles and parts (up 7,252 carloads, or 13.9%) and crushed stone, gravel, and sand (up 5,419 carloads, or 9.1%. Carloads of stone, clay and glass products were up 1,902, or 7.8%, in December 2012, while carloads of lumber and wood products were 1,673, or 16.3%, higher for the month.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is near peak levels (black line).

U.S. rail intermodal traffic totaled 888,002 containers and trailers in December 2012, up 1.7% (14,690 intermodal units) over December 2011 and an average of 222,001 per week ... For all of 2012, U.S. rail intermodal volume totaled 12,267,336 containers and trailers, up 3.2% (374,918 units) over 2011 and just 0.1% (14,885 units) off 2006’s record. A new record almost certainly would have been set in 2012 if not for the strike by harbor clerks at the Ports of Los Angeles and Long Beach beginning in late November, and/or Hurricane Sandy, which severely disrupted rail and port operations on the East Coast beginning in late October.Intermodal will probably set a new record in 2013.

Earlier on employment:

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

• Employment Report Comments and more Graphs

• Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 1/04/2013 02:31:00 PM

Here are the earlier employment posts (with graphs):

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

• Employment Report Comments and more Graphs

• Employment graph gallery

And a few more graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is at 3.1% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 63.2 in December, up from 56.6 in November. For manufacturing, the diffusion index increased to 59.3, up from 51.2 in November.

This is a little more technical. The BLS diffusion index for total private employment was at 63.2 in December, up from 56.6 in November. For manufacturing, the diffusion index increased to 59.3, up from 51.2 in November. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Even though the headline number was similar for November and December, it appears job growth was spread across more industries in December, and that is good news.

Employment Report Comments and more Graphs

by Calculated Risk on 1/04/2013 11:52:00 AM

Here is a table of the change in payroll employment on an annual basis (before benchmark revisions - the revision through March 2012 will be released next month and will show more jobs added based on the preliminary estimate):

| Annual Change Payroll Employment (000s)

| |||

|---|---|---|---|

| Private | Public | Total | |

| 2006 | 1,859 | 209 | 2,068 |

| 2007 | 812 | 288 | 1,100 |

| 2008 | -3,782 | 179 | -3,603 |

| 2009 | -4,984 | -76 | -5,060 |

| 2010 | 1,248 | -221 | 1,027 |

| 2011 | 2,105 | -265 | 1,840 |

| 2012 | 1,903 | -68 | 1,835 |

Employment growth in 2012 was mostly in line with expectations. A little good news - it appears we are near the end of the state and local government layoffs (see last graph), but the Federal government layoffs are ongoing. Look at the table - four consecutive years of public sector job losses is unprecedented since the Depression.

The first graph below shows the employment-population ratio for the 25 to 54 age group. This has been moving sideways lately, and that shows the labor market is still weak. Also seasonal retail hiring slowed sharply in December (3rd graph) - but overall seasonal hiring suggests a decent holiday retail season.

Hopefully employment growth will pick up some in 2013, although austerity probably means another year of sluggish growth. Here are a several more graphs...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio increased in December to 75.9% from 75.7% in November. This has generally been trending up - although the improvement stalled in 2012 - and the ratio is still very low.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a slow pace in December.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.This really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 88.3 thousand workers (NSA) net in December. The combined level for October, November is the highest since 2006. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers were initially optimistic about the holiday season, but sales might have slowed in December. There is a decent correlation between retail hiring and retail sales, see: Retail: Seasonal Hiring vs. Retail Sales, and the retail season was probably decent.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 7.9 million, changed little in December. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in December to 7.92 million from 8.14 million in November.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 14.4% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.77 million workers who have been unemployed for more than 26 weeks and still want a job. This was down slightly from 4.78 million in November, and is at the lowest level since June 2009. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing. Overall government employment has seen an unprecedented decline over the last 3+ years (not seen since the Depression).

ISM Non-Manufacturing Index increases in December

by Calculated Risk on 1/04/2013 10:00:00 AM

Note: I'll have more on the employment report soon.

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 36th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56.1 percent in December, 1.4 percentage points higher than the 54.7 percent registered in November. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 60.3 percent, which is 0.9 percentage point lower than the 61.2 percent reported in November, reflecting growth for the 41st consecutive month. The New Orders Index increased by 1.2 percentage points to 59.3 percent. The Employment Index increased by 6 percentage points to 56.3 percent, indicating growth in employment for the fifth consecutive month at a significantly faster rate. The Prices Index decreased 0.4 percentage point to 56.6 percent, indicating prices increased at a slightly slower rate in December when compared to November. According to the NMI™, 13 non-manufacturing industries reported growth in December. Respondents' comments remain mixed and are mostly positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in December than in November. The internals were strong with the employment index and new order up.

December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

by Calculated Risk on 1/04/2013 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 155,000 in December, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised from +146,000 to +161,000.

Click on graph for larger image.

Click on graph for larger image.The headline number was at expectations of 157,000. Employment for October was revised down slightly, and November payroll growth was revised up.

The second graph shows the unemployment rate.

The unemployment rate was unchanged at 7.8% (The November unemployment rate was revised up from 7.7% as part of the annual household report revision).

The unemployment rate is from the household report and the household report showed only a small increase in employment.

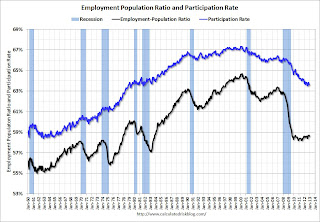

The unemployment rate is from the household report and the household report showed only a small increase in employment.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.6% in December (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio decreased to 58.6% in December (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another sluggish growth employment report. I'll have much more later ...