by Calculated Risk on 1/04/2013 10:00:00 AM

Friday, January 04, 2013

ISM Non-Manufacturing Index increases in December

Note: I'll have more on the employment report soon.

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 36th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56.1 percent in December, 1.4 percentage points higher than the 54.7 percent registered in November. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 60.3 percent, which is 0.9 percentage point lower than the 61.2 percent reported in November, reflecting growth for the 41st consecutive month. The New Orders Index increased by 1.2 percentage points to 59.3 percent. The Employment Index increased by 6 percentage points to 56.3 percent, indicating growth in employment for the fifth consecutive month at a significantly faster rate. The Prices Index decreased 0.4 percentage point to 56.6 percent, indicating prices increased at a slightly slower rate in December when compared to November. According to the NMI™, 13 non-manufacturing industries reported growth in December. Respondents' comments remain mixed and are mostly positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in December than in November. The internals were strong with the employment index and new order up.

December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

by Calculated Risk on 1/04/2013 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 155,000 in December, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised from +146,000 to +161,000.

Click on graph for larger image.

Click on graph for larger image.The headline number was at expectations of 157,000. Employment for October was revised down slightly, and November payroll growth was revised up.

The second graph shows the unemployment rate.

The unemployment rate was unchanged at 7.8% (The November unemployment rate was revised up from 7.7% as part of the annual household report revision).

The unemployment rate is from the household report and the household report showed only a small increase in employment.

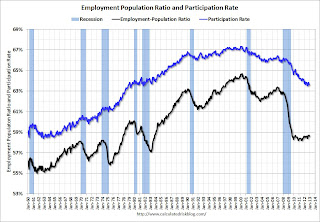

The unemployment rate is from the household report and the household report showed only a small increase in employment.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.6% in December (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio decreased to 58.6% in December (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another sluggish growth employment report. I'll have much more later ...

Thursday, January 03, 2013

Friday: Employment Report

by Calculated Risk on 1/03/2013 09:20:00 PM

The key report of the week will be released Friday morning: the December Employment Report. The consensus (see below) increased today based on the better than expected ADP employment report. Here is a summary of recent data:

• The ADP employment report showed an increase of 215,000 private sector payroll jobs in December. This was above expectations. Historically the ADP report hasn't been very useful in predicting the BLS report for any one month, although the methodology changed three months ago and may be more useful in predicting the BLS report. In general this suggests employment growth was above expectations.

• The ISM manufacturing employment index increased in December to 52.7%, up from 48.4% in November.

• Initial weekly unemployment claims averaged about 362,000 in December. This was the low for the year. A positive for employment.

For the BLS reference week (includes the 12th of the month), initial claims were at 362,000; the lowest for a reference week this year.

• The small business index from Intuit showed 15,000 payroll jobs added, down from 25,000 in November.

• And on the unemployment rate from Gallup:

Gallup's seasonally unadjusted unemployment rate for the U.S. workforce was 7.7% for the month of December, statistically unchanged from 7.8% at the end of November. Gallup's seasonally adjusted unemployment rate is 7.9%, a 0.4-point decline over November.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution. So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate, but this does suggest little change in December from 7.7% in November.

This data suggests a stronger employment report for December than for November, and perhaps over 200 thousand jobs added.

Friday economic releases:

• At 8:30 AM, the Employment Report for December will be released. The consensus is for an increase of 157,000 non-farm payroll jobs in December; there were 146,000 jobs added in November. The consensus is for the unemployment rate to increase to 7.8% in December, up from 7.7% in November.

• At 10:00 AM, ISM non-Manufacturing Index for December. The consensus is for a decrease to 54.5 from 54.7 in November. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.3% increase in orders.

• At 3:00 PM, Speech by Fed Vice Chair Janet Yellen, "Systemic Risk", At the American Economic Association/American Finance Association Joint Luncheon, San Diego, California

U.S. Light Vehicle Sales at 15.3 million annual rate in December

by Calculated Risk on 1/03/2013 04:00:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.

This was above the consensus forecast of 15.1 million SAAR (seasonally adjusted annual rate). Note: Some of the increase in November was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October, and sales might have been boosted slightly in December from some storm related bounce back.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 15.31 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

Sales in 2012 were just over 14.4 million, up from 12.7 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Sales were up over 13% in 2012, and auto sales have been a key contributor to the economy over the last three years. Sales will probably increase in 2013, but not at a double digit rate.

FOMC Minutes: "Several" members expect QE3 to end in 2013

by Calculated Risk on 1/03/2013 02:00:00 PM

It appears several members expect QE3 to end in 2013. Also, all but one member was in favor of economic thresholds for raising the Fed Funds rate.

From the Fed: Minutes of the Federal Open Market Committee, Meeting of December 11-12, 2012. Excerpt:

In their discussion of monetary policy for the period ahead, all members but one judged that continued provision of monetary accommodation was warranted in order to support further progress toward the Committee's goals of maximum employment and price stability. The Committee judged that such accommodation should be provided in part by continuing to purchase MBS at a pace of $40 billion per month and by purchasing longer-term Treasury securities, initially at a pace of $45 billion per month, following the completion of the maturity extension program at the end of the year. The Committee also maintained its existing policy of reinvesting principal payments from its holdings of agency debt and agency MBS into agency MBS and decided that, starting in January, it will resume rolling over maturing Treasury securities at auction. While almost all members thought that the asset purchase program begun in September had been effective and supportive of growth, they also generally saw that the benefits of ongoing purchases were uncertain and that the potential costs could rise as the size of the balance sheet increased. Various members stressed the importance of a continuing assessment of labor market developments and reviews of the program's efficacy and costs at upcoming FOMC meetings. In considering the outlook for the labor market and the broader economy, a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases. Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet. One member viewed any additional purchases as unwarranted.

With regard to its forward guidance about the federal funds rate, the Committee decided to indicate in the statement language that it expects the highly accommodative stance of monetary policy to remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In addition, all but one member agreed to replace the date-based guidance with economic thresholds indicating that the exceptionally low range for the federal funds rate would remain appropriate at least as long as the unemployment rate remains above 6½ percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee thought it would be helpful to indicate in the statement that it viewed the economic thresholds as consistent with its earlier, date-based guidance. The new language noted that the Committee would also consider other information when determining how long to maintain the highly accommodative stance of monetary policy, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. One member dissented from the policy decision, opposing the new economic threshold language in the forward guidance, as well as the additional asset purchases and continued intervention in the MBS market.

emphasis added