by Calculated Risk on 12/21/2012 06:51:00 PM

Friday, December 21, 2012

Earlier: Chicago Fed National Activity Index improves, Kansas City Fed Mfg Survey shows contraction

A couple of reports from earlier this morning:

• The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Increased in November

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.10 in November from –0.64 in October. Two of the four broad categories of indicators that make up the index increased from October, but only the production and income category made a positive contribution to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.59 in October to –0.20 in November—its ninth consecutive reading below zero. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity increased, but growth was still below trend in November.

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.• From the Kansas City Fed: Tenth District Manufacturing Activity Declined Further

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Tenth District manufacturing activity declined further in December, though by a smaller amount than in October or November. Factories’ production expectations were somewhat more optimistic than last month, but a higher share of firms plan to decrease employment in coming months. Approximately half of all contacts cited fiscal policy uncertainty as having impacted their hiring decisions. Price indexes mostly increased, particularly for future raw materials, with the increase driven heavily by food prices.This showed contraction, but the index was slightly better than expected.

The month-over-month composite index was -2 in December, up slightly from -6 in November and -4 in October ... The employment index decreased from 22 to 13 after rebounding solidly last month.

...

“We saw factory activity decline for the third straight month, which many firms blamed on the uncertainty created by the fiscal cliff talks", said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]. "Contacts still plan modest output expansion in the first half of 2012, but they now expect their employment to fall, before recovering later in the year.”

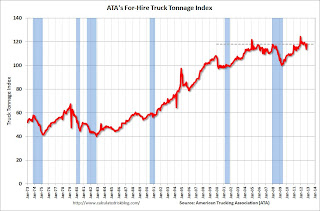

ATA Trucking Index rebounds in November

by Calculated Risk on 12/21/2012 02:52:00 PM

This is a minor indicator that I follow. Truck tonnage was negatively impacted by Hurricane Sandy in October, and bounced back in November.

From ATA: ATA Truck Tonnage Index Rebounds 3.7% in November

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 3.7% in November erasing October’s 3.7% drop. (The 3.7% decrease in October was revised from a 3.8% contraction ATA reported on November 20, 2012.) November’s gain was the first since July of this year. As a result, the SA index equaled 118.0 (2000=100) in November versus 113.8 in October. Compared with November 2011, the SA index was up 1%, after contracting 2.1% on a year-over-year basis in October. Year-to-date, compared with the same period last year, tonnage was up 2.8%.Note from ATA:

...

“Sandy impacted both October’s and November’s tonnage readings,” ATA Chief Economist Bob Costello said. “But it was still good to see tonnage snap back in November.” Costello said he expects a boost to flatbed tonnage from the rebuilding in the areas impacted by Sandy, but most of that won’t happen until the spring when the money starts flowing and the weather is conducive to building.

“Outside of Sandy, if the fiscal cliff isn’t fixed in time, expect a slowdown in tonnage early next year as paychecks shrink for all households,” Costello said. “Since trucks account for the vast majority of deliveries in the retail supply, any reduction in consumer spending will hurt.” Costello added that even if we don’t go off the fiscal cliff, he expects slower tonnage growth in 2013 than 2012 as better housing starts and auto sales will be offset by slower factory output and consumer spending.

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Overall the index has been mostly moving sideways this year due to the slowdown in manufacturing.

State Unemployment Rates decreased in 45 States in November

by Calculated Risk on 12/21/2012 11:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in November. Forty-five states and the District of Columbia recorded unemployment rate decreases and five states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 10.8 percent in November, followed by Rhode Island at 10.4 percent. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey and Connecticut are the laggards.

The states are ranked by the highest current unemployment rate. Only two states still have double digit unemployment rates: Nevada and Rhode Island. In early 2010, 18 states and D.C. had double digit unemployment rates.

Last month I wrote: "I expect the unemployment rate in California to fall below 10% very soon" and sure enough the unemployment rate in California fell to 9.8% in November, the lowest level since January 2009.

Even though Nevada still has the highest unemployment rate, the rate has declined in recent months, falling from 12.1% in August to 10.8% in November.

LPS: Mortgage delinquencies increased in November, "In Foreclosure" Declines

by Calculated Risk on 12/21/2012 10:55:00 AM

LPS released their First Look report for November today. LPS reported that the percent of loans delinquent increased in November compared to October, and declined about 9% year-over-year. Also the percent of loans in the foreclosure process declined further in November and are the lowest level since 2009.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.12% from 7.03% in October. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.51% from 3.61% in October.

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (434,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 18% or 388,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now declining.

LPS will release the complete mortgage monitor for November in early January.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Nov 2012 | Oct 2012 | Nov 2011 | |

| Delinquent | 7.12% | 7.03% | 7.83% |

| In Foreclosure | 3.51% | 3.61% | 4.20% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,999,000 | 1,957,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,584,000 | 1,543,000 | 1,767,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,767,000 | 1,800,000 | 2,155,000 |

| Total Properties | 5,350,000 | 5,300,000 | 6,172,000 |

Final December Consumer Sentiment declines to 72.9

by Calculated Risk on 12/21/2012 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for December declined to 72.9, down from the preliminary reading of 74.5, and was down from the November reading of 82.7.

This was below the consensus forecast of 75.0. The recent decline in sentiment is probably related to Congress and the so-called "fiscal cliff". This is similar to the sharp decline in 2011 when Congress threatened to force the US to default (not pay the bills).

I still think an agreement will be reached in early January - there is no drop dead date - but you never know.