by Calculated Risk on 12/18/2012 10:00:00 AM

Tuesday, December 18, 2012

Builder Confidence increases in December, Highest since April 2006

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 2 points in December to 47. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues Improving in December

Builder confidence in the market for newly built, single-family homes rose for an eighth consecutive month in December to a level of 47 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This marked a two-point gain from a slightly revised November reading, and the highest level the index has attained since April of 2006.

...

“While there is still much room for improvement, the consistent upward trend in builder confidence over the past year is indicative of the gradual recovery that has been taking place in housing markets nationwide and that we expect to continue in 2013,” noted NAHB Chief Economist David Crowe.

...

Two of the HMI’s three component indexes are now above the critical midpoint of 50. The component gauging current sales expectations rose two points to 51 in December, while the component gauging sales expectations in the next six months slipped one point, to 51. The component measuring traffic of prospective buyers increased one point, to 36.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November housing starts will be released tomorrow). This was at the consensus estimate of a reading of 47.

Housing: Inventory down 24% year-over-year in mid-December

by Calculated Risk on 12/18/2012 08:56:00 AM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays. That is why it helps to look at the year-over-year change in inventory.

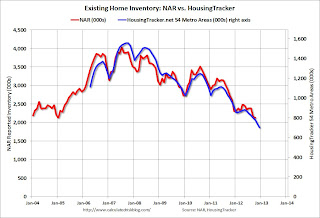

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 23.9% year-over-year and probably at the lowest level since the early '00s.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through mid-December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

HousingTracker reported that the mid-December listings, for the 54 metro areas, declined 23.9% from the same period last year.

My guess is inventory will bottom in January (both seasonally and for the current cycle). I think the recent increase in prices will entice a few more people to list their homes (some people will no longer have negative equity too and can finally sell). Also there may be a few more foreclosure listings in some judicial states.

Nick Timiraos at the WSJ writes: 2013: How Rising Prices Could Boost Housing Demand

Rising prices could eventually encourage more sellers to put their homes on the market, which would help boost demand even further. Glenn Kelman, chief executive of Redfin, says he is looking to increase the company’s workforce of 400 agents nationally by 50% by the end of January. “I’m going across the country meeting with managers, and the only topic we’re talking about is hiring,” he said.At the least the year-over-year declines should still start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer!

Monday, December 17, 2012

Tuesday: NAHB Home Builder Confidence

by Calculated Risk on 12/17/2012 10:09:00 PM

Two more articles on the possible "fiscal cliff" deal:

From the NY Times: President Delivers a New Offer on the Fiscal Crisis to Boehner

The White House plan would permanently extend Bush-era tax cuts on incomes below $400,000, essentially meaning that only the top tax bracket, 35 percent, would rise to 39.6 percent.From the WSJ: White House Revises Offer on Tax Rates in Deficit Talks

The president’s plan would cut spending by $1.22 trillion over 10 years, an official said, $800 billion of it in programmatic cuts, and $122 billion by adopting a new measure of inflation that slows the growth of government benefits, especially Social Security.

In President Barack Obama's latest budget proposal, the White House said it now would seek to raise tax rates on income above $400,000, a person familiar with the talks said. ...Tuesday economic releases:

In total, the plan would include $1.22 trillion in spending reductions, with $400 billion coming from changes to health-care programs, $200 billion from cuts to other mandatory spending programs, $100 billion in cuts coming from defense spending and another $100 billion coming from nondefense discretionary spending.

• At 10:00 AM ET, The December NAHB Housing Market Index (HMI) survey will be released. The consensus is for a reading of 47, up from 46 in November. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

Fiscal Cliff: Chained CPI

by Calculated Risk on 12/17/2012 07:32:00 PM

Ezra Klein at the WaPo WonkBlog wrote earlier today: A ‘fiscal cliff’ deal is near: Here are the details

Boehner offered to let tax rates rise for income over $1 million. The White House wanted to let tax rates rise for income over $250,000. The compromise will likely be somewhere in between. More revenue will come from limiting deductions, likely using some variant of the White House’s oft-proposed, oft-rejected idea for limiting itemized deductions to 28 percent. The total revenue raised by the two policies will likely be a bit north of $1 trillion. ...Chained CPI is a relatively new series (started in 2002), and measures inflation at a slightly lower rate than CPI or CPI-W - and over time this would add up both for Social Security payments and also for revenue (tax brackets would increase slower using chained CPI than using currently).

On the spending side, the Democrats’ headline concession will be accepting chained-CPI, which is to say, accepting a cut to Social Security benefits.

From the BLS: Frequently Asked Questions about the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The graph shows the year-over-year change in headline CPI, CPI-W, and chained CPI.

There isn't much difference on a year-over-year basis, but notice the blue line is mostly below the other two all the time. Those small differences add up over time as the following table shows.

This table shows the 10 year change in each measure (from Nov 2002 to Nov 2012) and the annualized change over that period. If we were using chained CPI instead of CPI-W over the last 10 years, Social Security benefits would be about 3.6% lower than they are now.

| 10 Year Increase | Annualized | |

|---|---|---|

| CPI (headline) | 27.0% | 2.42% |

| CPI-W (current) | 27.7% | 2.48% |

| CPI (chained) | 24.1% | 2.19% |

Lawler: Foreclosure Share Way Down, But Not All-Cash Share; Suggests Investor Purchases of Non-REO Properties Up Sharply

by Calculated Risk on 12/17/2012 04:26:00 PM

From economist Tom Lawler:

While most areas have experienced a significant decline in the foreclosure share (as well as the overall “distressed-sales” share of home sales this year, it’s sorta interesting to note that the all-cash share of homes purchases has not fallen, at least in areas where data on financing are available. E.g., here is a table showing the “all-cash” share of home purchases this November compared to last November in selected markets. All data are based on realtor association/MLS reports, save for the Southern California, which are Dataquick’s tabulations based on property/mortgage records. Also shown are the foreclosure and short-sales shares of home sales. Note that for Sothern California the foreclosure and short-sales shares are share of resales, while the all-cash share is the share of total sales. Note also that I don’t have the foreclosure and short sales shares for the Baltimore and DC metro areas, but only for the whole area covered by MRIS. However, the Baltimore and DC metro areas account for about 77% of total home sales through MRIS, so ...

While in most of these areas the foreclosure sales share of resales in November was down considerably from last November, as was the overall “distressed” sales shares, the all-cash-financed share of home sales was actually higher this November than last November in many areas, and in other areas it was little changed from a year ago.

Most analysts (and realtors) believe that investors make up a substantial share of all-cash purchases. Given that the all-cash share of purchases is flat to higher while the foreclosure share of purchases is down considerably, it appears as if investors have considerably increased their purchases of non-foreclosure properties over the last year.

| All Cash Share | Foreclosure Share | Short-Sales Share | ||||

|---|---|---|---|---|---|---|

| Nov-12 | Nov-11 | Nov-12 | Nov-11 | Nov-12 | Nov-11 | |

| Las Vegas | 52.7% | 48.2% | 10.7% | 46.0% | 41.2% | 26.8% |

| Phoenix | 43.2% | 45.4% | 12.9% | 29.8% | 23.2% | 29.6% |

| Sacramento | 37.1% | 27.4% | 11.5% | 34.3% | 36.1% | 29.8% |

| Orlando | 54.0% | 49.9% | 20.9% | 22.8% | 29.0% | 37.2% |

| Baltimore Metro | 23.8% | 23.8% | ||||

| DC Metro | 18.8% | 20.4% | ||||

| MRIS (Mid Atl) | 8.7% | 14.2% | 11.9% | 13.7% | ||

| Toledo | 40.9% | 38.2% | ||||

| Southern CA | 33.0% | 29.5% | 15.3% | 31.6% | 26.3% | 24.9% |