by Calculated Risk on 12/14/2012 09:15:00 AM

Friday, December 14, 2012

Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October. In November, manufacturing output increased 1.1 percent after having decreased 1.0 percent in October; in addition to the storm-related rebound, a sizable rise in the production of motor vehicles and parts boosted factory output in November. The output of utilities advanced 1.0 percent, and production at mines rose 0.8 percent. At 97.5 percent of its 2007 average, total industrial production in November was 2.5 percent above its year-earlier level. Capacity utilization for total industry increased 0.7 percentage point to 78.4 percent, a rate 1.9 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

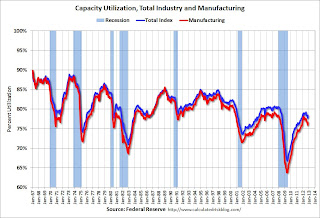

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

BLS: CPI declines 0.3% in November, Core CPI increases 0.1%

by Calculated Risk on 12/14/2012 08:40:00 AM

From the BLS: Consumer Price Index - November 2012

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment. The gasoline index fell 7.4 percent in November; this decrease more than offset increases in other indexes, resulting in the decline in the seasonally adjusted all items index.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% decrease for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in November after a 0.2 percent increase in October. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, slightly lower than the October figure of 2.0 percent. The food index has risen 1.8 percent over the last 12 months, and the energy index has risen 0.3 percent.

The decrease in CPI was mostly due to the recent decline in gasoline prices. On a year-over-year basis, CPI is up 1.8 percent, and core CPI is up 1.9 percent. Both below the Fed's target.

Thursday, December 13, 2012

Friday: CPI, Industrial Production

by Calculated Risk on 12/13/2012 08:27:00 PM

A couple of articles for light evening reading:

From Derek Thompson at the Atlantic: The Best Idea for the Debt Ceiling? Abolish It Forever. It really should be called the "default ceiling". I've been arguing for years - since Reagan demanded a clean bill from Congress in the '80s - that the default ceiling is just for political grandstanding.

From Suzy Khimm at the Wonkblog: New language, same findings: Tax hikes on the rich won’t cripple the economy. Here is the updated Congressional Research Service report. The data speaks.

Note: I still expect some sort of compromise to be reached on the "fiscal cliff", probably in early January.

Thursday economic releases:

• At 8:30 AM ET, the Consumer Price Index for November will be released. The consensus is for CPI to decrease 0.2% in November and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production in November, and for Capacity Utilization to increase to 78.0%.

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

CoStar: Commercial Real Estate prices decrease slightly in October, Up 6% Year-over-year

by Calculated Risk on 12/13/2012 05:30:00 PM

From CoStar: Commercial Property Prices Show Little Movement in October Amid Economic Uncertainty

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—saw very little change in the month of October 2012, dipping -0.1% and -0.8%, respectively, although both improved over quarter and year-ago levels. Recent pricing fluctuations likely signify a more cautious attitude among investors stemming from uncertainty over U.S. fiscal policy heading into 2013.

...

The number of distressed property trades in October fell to 14.8%, the lowest level witnessed since the first quarter of 2009. This reduction in distressed deal volume should result in higher, more consistent pricing, and lead to enhanced market liquidity, giving lenders more confidence to finance deals.

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 35.0% from the bottom (showing the demand for higher end properties) and up 6.1% year-over-year. However the Equal-Weighted index is only up 10.0% from the bottom, and up 5.9% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Sacramento November House Sales: Conventional Sales up 46% year-over-year

by Calculated Risk on 12/13/2012 02:44:00 PM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In November 2012, 47.6% of all resales (single family homes and condos) were distressed sales. This was down slightly from 47.7% last month, and down from 64.1% in November 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 11.5%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 36.1%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were more than three times as many short sales as REO sales in November (the highest recorded). The gap between short sales and REO sales is increasing.

Total sales were up slightly from November 2011, and conventional sales were up 46% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 56.7% from last November, although listings were up 2% in November compared to October.

Cash buyers accounted for 37.1% of all sales (frequently investors), and median prices were up sharply year-over-year (the mix has changed).

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.