by Calculated Risk on 11/14/2012 04:07:00 PM

Wednesday, November 14, 2012

WSJ: FHA Close to Exhausting Reserves

As we discussed last week, the FHA Fiscal Year 2012 Actuarial Review is due this week. Nick Timiraos at the WSJ has a preview: Housing Agency Close to Exhausting Reserves

The Federal Housing Administration is expected to report later this week that it could exhaust its reserves because of rising mortgage delinquencies ... That could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.As Timiraos notes, the FHA's market share was small during the peak of the bubble (luckily) and most of the really horrible loans were made by Wall Street related mortgage lenders. However, Timiraos doesn't mention that many of the loans that the FHA insured at the peak were so-called Downpayment Assistance Programs (DAPs). These DAPs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). The FHA attempted to stop this practice - the IRS called it a "scam" - but thanks to Congress, the DAPs led to billions of losses for the FHA.

... The New Deal-era agency, which doesn't actually make loans but instead insures lenders against losses, has played a critical role stabilizing the housing market by backing mortgages of borrowers who make down payments of as little as 3.5%—loans that most private lenders won't originate without a government guarantee. ... Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from one year ago. That represents around 9.6% of its $1.08 trillion in mortgages guarantees.

The FHA's annual audit estimates how much money the agency would need to pay off all claims on projected losses, against how much it has in reserves. Last year, that buffer stood at $1.2 billion ...

The decision over whether the FHA will need money from Treasury won't be made until next February, when the White House typically releases its annual budget. Because the FHA has what is known as "permanent and indefinite" budget authority, it wouldn't need to ask Congress for funds; it would automatically receive money from the U.S. Treasury.

Most of the agency's losses now stem from loans made as the housing bust deepened. Around 25% of mortgages guaranteed in 2007 and 2008 are seriously delinquent, compared with around 5% of those insured in 2010.

Of course, as Timiraos mentioned, the FHA also saw a sharp increase in demand in the 2007 through 2009 period as private lenders disappeared and Fannie and Freddie tightened standards - and those loans have performed poorly. Now the bill is coming due ...

FOMC Minutes: "Participants generally favored" Thresholds

by Calculated Risk on 11/14/2012 02:00:00 PM

It seems very likely that the Fed will adopt a threshold rule for the Feds Fund Rate based on inflation and unemployment, and remove the forward guidance sentence from the statement at the December 11th and 12th meeting. Note: The forward guidance includes the sentence: "currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015".

From the Fed: Minutes of the Federal Open Market Committee, October 23–24, 2012. Excerpt:

A staff presentation focused on the potential effects of using specific threshold values of inflation and the unemployment rate to provide forward guidance regarding the timing of the initial increase in the federal funds rate. The presentation reviewed simulations from a staff macroeconomic model to illustrate the implications for policy and the economy of announcing various threshold values that would need to be attained before the Federal Open Market Committee (FOMC) would consider increasing its target for the federal funds rate. Meeting participants discussed whether such thresholds might usefully replace or perhaps augment the date-based guidance that had been provided in the policy statements since August 2011. Participants generally favored the use of economic variables, in place of or in conjunction with a calendar date, in the Committee's forward guidance, but they offered different views on whether quantitative or qualitative thresholds would be most effective. Many participants were of the view that adopting quantitative thresholds could, under the right conditions, help the Committee more clearly communicate its thinking about how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook. Accordingly, thresholds could increase the probability that market reactions to economic developments would move longer-term interest rates in a manner consistent with the Committee's view regarding the likely future path of short-term rates. A number of other participants judged that communicating a careful qualitative description of the indicators influencing the Committee's thinking about current and future monetary policy, or providing more information about the Committee's policy reaction function, would be more informative than either quantitative thresholds or date-based forward guidance. Several participants were concerned that quantitative thresholds could confuse the public by giving the impression that the FOMC focuses on a small number of economic variables in setting monetary policy, when the Committee in fact uses a wide range of information. Some other participants worried that the public might mistakenly interpret quantitative thresholds as equivalent to the Committee's longer-run objectives or as triggers that, when reached, would prompt an immediate rate increase; but it was noted that the Chairman's postmeeting press conference and other venues could be used to explain the distinction between thresholds and these other concepts.There are still many details to work out, but it appears likely the Fed will adopt thresholds based on the unemployment rate and inflation. It sounds like the thresholds will be for the Fed Funds rate, and not QE3.

Participants generally agreed that the Committee would need to resolve a number of practical issues before deciding whether to adopt quantitative thresholds to communicate its thinking about the timing of the initial increase in the federal funds rate. These issues included whether to specify such thresholds in terms of realized or projected values of inflation and the unemployment rate and, in either case, what values for those thresholds would best balance the Committee's objectives of promoting maximum employment and price stability. Another open question was whether to supplement thresholds expressed in terms of the unemployment rate and inflation with additional indicators of economic and financial conditions that might signal a need either to raise the federal funds rate before a threshold is crossed or to delay until well afterward. A final question was whether the statement should also provide forward guidance about the likely path of the federal funds rate after the initial increase. It was noted that such guidance could have significant effects on financial conditions and the economy. At the conclusion of the discussion, the Chairman asked the staff to provide additional background material, taking into account the range of participants' views.

emphasis added

Report: Housing Inventory declines 17% year-over-year in October

by Calculated Risk on 11/14/2012 11:11:00 AM

From Realtor.com: October 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops remained at historic lows, with 1.76 million units for sale in October 2012, down -17.00% compared to a year ago.For sale inventories declined on a year-over-year basis in 141 of the 146 markets tracked by Realtor.com. Forty four cities saw year-over-year declines greater than 20%.

The median age of inventory was down -11.81% compared to one year ago.

On a month-over-month basis, inventory declined in 127 of 146 markets.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in October.

Retail Sales declined 0.3% in October

by Calculated Risk on 11/14/2012 08:30:00 AM

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $411.6 billion, a decrease of 0.3 percent from the previous month, but 3.8 percent above October 2011. ... The August to September 2012 percent change was revised from 1.1 percent to 1.3 percent.

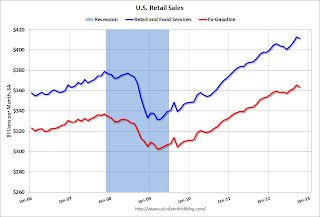

Click on graph for larger image.

Click on graph for larger image.Sales for September were revised up to a 1.3% increase (from 1.1% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.2% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.Excluding gasoline, retail sales are up 20.2% from the bottom, and now 8.0% above the pre-recession peak (not inflation adjusted).

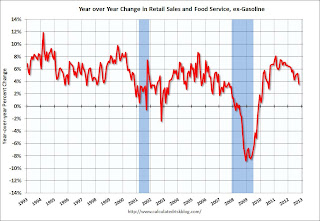

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.5% on a YoY basis (3.8% for all retail sales).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

MBA: Mortgage Applications rebound after Hurricane Sandy, Mortgage Rates fall to Record Low

by Calculated Risk on 11/14/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 13 percent from the previous week, ending a five-week decline. The seasonally adjusted Purchase Index increased 11 percent from one week earlier.Some of this decline in activity was related to Hurricane Sandy.

“Following the decrease in applications two weeks ago due to the effects of superstorm Sandy, mortgage applications in many East Coast states rebounded strongly this week,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Application volume in New Jersey more than doubled over the week, while volume in Connecticut and New York increased more than 60 percent. In addition to the rebound in the states impacted by the storm, the 30 year fixed mortgage rate reached a new record low in the survey.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.52 percent from 3.61 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This record low rate for 30 year fixed mortgages beats the previous survey low of 3.53 percent for the week ending September 28, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The increase this week was mostly just a rebound from the sharp decline the previous week due to Hurricane Sandy.