by Calculated Risk on 11/11/2012 08:21:00 PM

Sunday, November 11, 2012

Monday: Veterans Day

Monday:

• Bond markets and banks will be closed in observance of Veterans Day. The stock market will be open.

• 4:00 AM ET: Eurozone Finance Ministers Meeting

On Greece, from the Financial Times: Greece battles to avert €5bn default

Greece is battling to raise funds to avoid defaulting on a €5bn debt repayment this week ...From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 1 and DOW futures are slightly down.

The country’s debt management office has announced plans to cover the full amount through a treasury bill auction on Tuesday, but Greek banks expected to buy the issue can only raise about €3.5bn of collateral acceptable to the European Central Bank ...

Senior EU officials, however, said they remain doubtful a deal can be struck at Monday’s meeting of finance ministers in Brussels ...

excerpt with permission

Oil prices are down slightly with WTI futures at $85.96 per barrel and Brent at $109.03 per barrel. Gasoline prices have been falling.

Weekend:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Two more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

AAR: Rail Traffic "mixed" in October

by Calculated Risk on 11/11/2012 04:54:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for October

The Association of American Railroads (AAR) today reports U.S. rail traffic continues to show mixed results in monthly rail data, and that impacts from Hurricane Sandy can be seen in decreased traffic for week 44.

“The fundamentals of U.S. rail traffic remained roughly the same in October as in recent months: weakness in coal, remarkable growth in petroleum and petroleum products, a slight slowing of growth in intermodal and autos, and mixed results for everything else,” said AAR Senior Vice President John T. Gray.

Intermodal traffic in October saw an increase for the 35th straight month, totaling 1,233,475 containers and trailers, up 1.5 percent (18,710 units) compared with October of 2011. Carloads originated in October totaled 1,422,654 carloads, down 6.1 percent (92,601 carloads) compared with the same month last year. Carloads excluding coal were up 1.9 percent for the month, or 15,609 carloads, compared with the same month last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Total U.S. rail carload traffic fell 6.1% (92,601 carloads) to 1,422,654 in October 2012 from October 2011 on a non-seasonally adjusted basis (see charts below). That’s the largest year-over-year carload percentage decline since November 2009.The second graph is for intermodal traffic (using intermodal or shipping containers):

As was the case last month too, coal alone more than accounted for the total carload decline in October. Coal carloads were down 16.0% (108,210 carloads) in October 2012 from October 2011.

...

Hurricane Sandy negatively affected rail traffic in the last week of October in the East. As is always the case when bad weather affects rail traffic, some of the lost traffic will be made up, some will not, and it is not possible to precisely determine how much falls into each category.

Graphs reprinted with permission.

Graphs reprinted with permission.On Intermodal traffic:

U.S. rail intermodal traffic rose 1.5% (18,710 containers and trailers) in October 2012 over October 2011 to 1,233,475 units. That’s the 35th straight year-over-year monthly increase, though it was the smallest percentage gain in 14 months.This is more evidence of sluggish growth.

Yesterday:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Sacramento October House Sales: Conventional Sales up 55% year-over-year

by Calculated Risk on 11/11/2012 11:14:00 AM

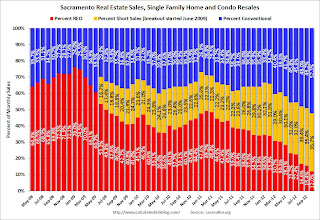

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In October 2012, 47.7% of all resales (single family homes and condos) were distressed sales. This was down from 50.8% last month, and down from 64.1% in October 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 12.0%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.7%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were almost three times as many short sales as REO sales in October. The gap between short sales and REO sales is increasing.

Total sales were up 7% from October 2011, and conventional sales were up 55% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 60.4% from last October, although listings were up 4% in October compared to the previous month.

Cash buyers accounted for 36.9% of all sales (frequently investors), and median prices were up 4.1% from last October.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

Chicago Fed Letter: "Detecting early signs of financial instability"

by Calculated Risk on 11/11/2012 09:09:00 AM

Here is another possible tool for predicting financial stress. From Scott Brave, senior business economist, and R. Andrew Butters, graduate student, Kellogg School of Management, Northwestern University: Detecting early signs of financial instability. A few excerpts:

Following the financial crisis, policymakers and researchers have sought to identify new indicators that may be useful in gauging the relationship between the financial and nonfinancial sectors of the economy in the hope of detecting early signs of financial instability. The ratio of private credit to gross domestic product (GDP) has received a lot of attention in this regard.1 This leverage ratio serves as an early warning indicator of financial instability, insofar as it captures instances where the nonfinancial sector’s financial obligations form an outsized share of the broader economy’s resources.

In this Chicago Fed Letter, we propose an alternative early warning indicator to the private-credit-to-GDP ratio. Our measure is constructed as a subindex made up of two nonfinancial leverage measures used in the Chicago Fed’s National Financial Conditions Index (NFCI). We show that this subindex has performed well as a leading indicator for historical periods of financial stress and their accompanying recessions in the United States; we also demonstrate that it has been more accurate than the private-credit-to-GDP ratio in predicting both at longer forecast horizons.

Click on graph for larger image.

Click on graph for larger image.The solid black line is the nonfinancial leverage subindex of the Chicago Fed’s National Financial Conditions Index, and the solid blue line is the ratio of private credit to gross domestic product (GDP) detrended as explained in note 4. For ease of comparison, both measures have been scaled to have a mean of zero and a standard deviation of one over the period 1973–2012.And their conclusion:

The horizontal (time) axis is measured in weeks. We assign the quarterly private-credit-to-GDP ratio to the last week of each quarter to be able to plot it on the same figure panel as the weekly nonfinancial leverage subindex. The shaded regions in panel A correspond with historical periods of financial stress based on the analysis in Brave and Butters (2012).

The dashed black line is the two-year-ahead prediction threshold for a financial crisis (panel A) ... calculated for the nonfinancial leverage subindex, as explained in the text.

Our nonfinancial leverage indicator signals both the onset and duration of financial crises and their accompanying recessions more reliably at longer lead times than the private-credit-to-GDP ratio.This might be useful some time in the future. The Chicago Fed will include this as part of the NFCI release.

Beginning with the November 15, 2012, NFCI release, we will include the nonfinancial leverage subindex in the publicly available materials for the NFCI at www.chicagofed.org/nfci.

Saturday, November 10, 2012

Unofficial Problem Bank list declines to 860 Institutions

by Calculated Risk on 11/10/2012 05:11:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 9, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Only one action termination this week for the Unofficial Problem Bank List. The Federal Reserve terminated the Written Agreement against Community First Bank, Boscobel, WI ($217 million). After the change, the list holds 860 institutions with assets of $328.2 billion. A year ago, the list held 981 institutions with assets of $405.9 billion.Earlier:

Next week, activity should pick-up as the OCC will publish it actions through mid-October and perhaps the FDIC will execute a few closings to get ahead of the Thanksgiving Day holiday.

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th