by Calculated Risk on 11/08/2012 11:25:00 AM

Thursday, November 08, 2012

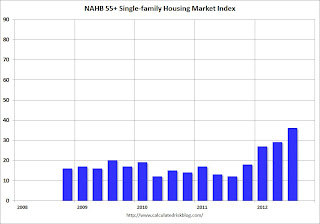

NAHB: Builder Confidence in the 55+ Housing Market Increases in Q3

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low.

From the NAHB:

Builder Confidence in the 55+ Housing Market Continues to Improve in the Third Quarter

Builder confidence in the 55+ housing market for single-family homes showed significant improvement in the third quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders' (NAHB) latest 55+ Housing Market Index (HMI) released today. The index more than tripled year over year from a level of 12 to 36, which is the highest third-quarter reading since the inception of the index in 2008.

...

The 55+ multifamily condo HMI had a significant increase of 13 points to 23, which is the highest third-quarter reading since the inception of the index in 2008; however, condos remain the weakest segment of the 55+ housing market. All 55+ multifamily HMI components increased considerably compared to a year ago as present sales rose 13 points to 22, expected sales for the next six months jumped 19 points to 29 and traffic of prospective buyers climbed 11 points to 22.

...

"Like other segments of the housing industry, the market for 55+ housing is continuing on a steady upward path, driven by improving conditions in additional markets around some parts of the country" said NAHB Chief Economist David Crowe "While we expect the upward trend to continue as the recovery broadens, the speed of the recovery is being constrained by factors as tight mortgage credit, making it difficult for potential 55+ customers to sell their current homes, and shortages of inputs to construction such as buildable lots that are beginning to emerge in some market areas."

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2012. All of the readings are very low for this index, but there has been a fairly sharp increase over the last year.

This is going to be a key demographic for household formation over the next couple of decades - if the baby boomers can sell their current homes!

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.So demographics should be favorable for the 55+ market - if these people can sell their current homes.

Trade Deficit declined in September to $41.5 Billion

by Calculated Risk on 11/08/2012 09:25:00 AM

The Department of Commerce reported:

[T]otal September exports of $187.0 billion and imports of $228.5 billion resulted in a goods and services deficit of $41.5 billion, down from $43.8 billion in August, revised. September exports were $5.6 billion more than August exports of $181.4 billion. September imports were $3.4 billion more than August imports of $225.2 billion.The trade deficit was smaller than the consensus forecast of $45.4 billion.

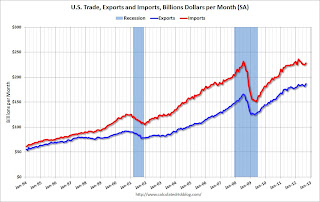

The first graph shows the monthly U.S. exports and imports in dollars through September 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in September. Exports are at a new high.

Exports are 13% above the pre-recession peak and up 3.5% compared to September 2011; imports are 1% below the pre-recession peak, and up about 1.5% compared to September 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $98.88 in September, up from $94.36 per barrel in August. The trade deficit with China increased to $29.1 billion in September, up from $28.0 billion in September 2011. Most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $7.6 billion in August, up from $6.4 billion in August 2011.

This suggests a small upward revision to Q3 GDP.

Weekly Initial Unemployment Claims decline to 355,000

by Calculated Risk on 11/08/2012 08:39:00 AM

The DOL reports:

In the week ending November 3, the advance figure for seasonally adjusted initial claims was 355,000, a decrease of 8,000 from the previous week's unrevised figure of 363,000. The 4-week moving average was 370,500, an increase of 3,250 from the previous week's unrevised average of 367,250.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,500. This is about 7,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom.

SPECIAL NOTE: Due to Hurricane Sandy, we will probably see an increase in initial unemployment claims over the next few weeks. The decline this week is probably because some people in a few states - like New York and New Jersey - were not able to file claims immediately.

Wednesday, November 07, 2012

Thursday: Initial Unemployment Claims, Trade Deficit

by Calculated Risk on 11/07/2012 08:43:00 PM

I'll write something soon on the "fiscal slope". It is NOT a "cliff" ... and I suspect something will be worked out (the compromise will very likely include higher tax rates on high income individuals - so the agreement will probably have to happen after January 1st so some politicians can claim they didn't vote to increase taxes). No worries. Jan 1st is not a drop dead date.

Note: Jim Hamilton suggests breaking "the problem into smaller pieces", and Macro Man says the 'fiscal cliff may have to be downgraded to "road hump"'.

From Reuters: Greek government defies protests to approve more austerity

Greece's government voted by a razor thin margin on Thursday to approve an austerity package needed to unlock vital aid and avert bankruptcy ...The beatings will continue until morale improves.

The bill covering the bulk of 13.5 billion euros' ($17.2 billion) worth of belt-tightening measures is a precursor to the 2013 budget law, which the government is expected to push through on Sunday.

If it does, it is expected to unlock a 31.5 billion euro aid tranche from the International Monetary Fund and European Union that Greece needs to shore up its banks and pay off loans.

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 363 thousand.

• Also at 8:30 AM, the Trade Balance report for September will be released by the Census Bureau. The consensus is for the U.S. trade deficit to increase to $45.4 billion in August, up from from $44.2 billion in August. Export activity to Europe will be closely watched due to economic weakness.

Once more question for the November economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

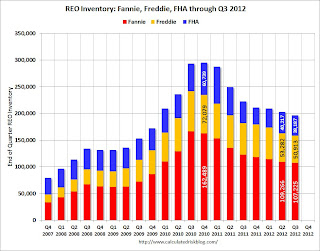

Fannie, Freddie, FHA REO inventory declines in Q3

by Calculated Risk on 11/07/2012 06:56:00 PM

First, from Fannie Mae: Fannie Mae Reports Net Income of $1.8 Billion for Third Quarter 2012

Fannie Mae (FNMA/OTC) today reported net income of $1.8 billion in the third quarter of 2012, compared with a net loss of $5.1 billion in the third quarter of 2011. For the first nine months of 2012, the company has reported $9.7 billion in net income. Lower credit-related expenses resulting from an increase in actual and expected home prices, higher sales prices on the company’s real-estate owned (“REO”) properties, and a decline in fair value losses contributed to the continued improvement in the company’s financial results.Here are some more details from the Fannie Mae's SEC filing 10-Q:

The company reported comprehensive income of $2.6 billion in the third quarter of 2012. The company is able to pay its third-quarter dividend of $2.9 billion to the Department of the Treasury without any draw under its senior preferred stock purchase agreement.

“We are seeing signs of sustained improvement in housing and our actions to support the housing recovery have generated strong financial results in 2012,” said Timothy J. Mayopoulos, president and chief executive officer.

Credit losses decreased in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011 primarily due to: (1) improved actual home prices and sales prices of our REO properties resulting from strong demand in markets with limited REO supply; and (2) lower volume of REO acquisitions due to the slow pace of foreclosures. The decrease in credit losses was partially offset by a decrease in amounts collected by us as a result of repurchase requests in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011. We expect our credit losses to remain high in 2012 relative to pre−housing crisis levels. We expect delays in foreclosures to continue for the remainder of 2012, which delays our realization of credit losses.Fannie sees rising prices and strong demand for REOs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and the FHA. This was the seventh straight quarterly decline in the "F's" REO inventory, and total "F" REO was down 12% from a year ago.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. (I'll have more on those categories soon).